Question

Lily graduated from UCSD in 2015. Right now she has an excellent job with a take-home income (after taxes) of $5,000 a month. The

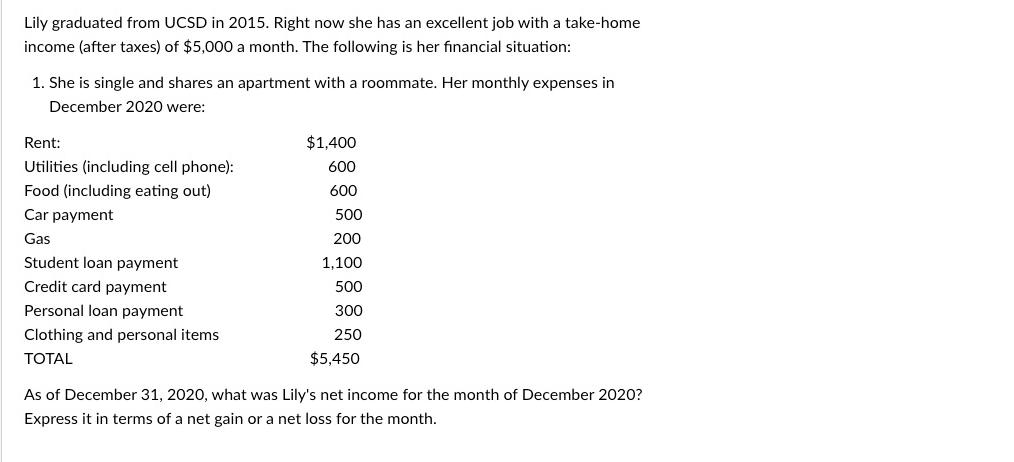

Lily graduated from UCSD in 2015. Right now she has an excellent job with a take-home income (after taxes) of $5,000 a month. The following is her financial situation: 1. She is single and shares an apartment with a roommate. Her monthly expenses in December 2020 were: Rent: Utilities (including cell phone): Food (including eating out) Car payment Gas Student loan payment Credit card payment Personal loan payment Clothing and personal items TOTAL $1,400 600 600 500 200 1,100 500 300 250 $5,450 As of December 31, 2020, what was Lily's net income for the month of December 2020? Express it in terms of a net gain or a net loss for the month.

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Lilys net income for December 2020 we need to s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Tools for business decision making

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso

6th Edition

978-1119191674, 047053477X, 111919167X, 978-0470534779

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App