Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lily operated a newsagency in Mosman for eight years. However, because of the long hours involved in running the newsagency, she sold it on

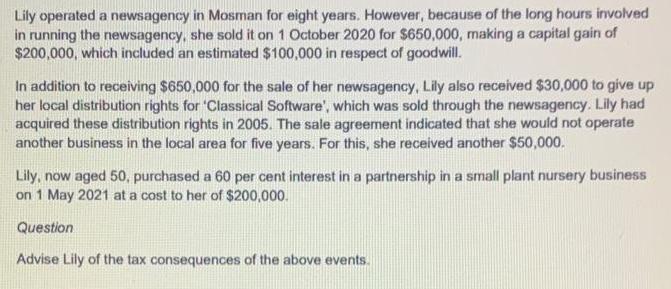

Lily operated a newsagency in Mosman for eight years. However, because of the long hours involved in running the newsagency, she sold it on 1 October 2020 for $650,000, making a capital gain of $200,000, which included an estimated $100,000 in respect of goodwill. In addition to receiving $650,000 for the sale of her newsagency, Lily also received $30,000 to give up her local distribution rights for 'Classical Software', which was sold through the newsagency. Lily had acquired these distribution rights in 2005. The sale agreement indicated that she would not operate another business in the local area for five years. For this, she received another $50,000. Lily, now aged 50, purchased a 60 per cent interest in a partnership in a small plant nursery business on 1 May 2021 at a cost to her of $200,000. Question Advise Lily of the tax consequences of the above events.

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Based on the situation Lily is subject to the below tax provisions in Australia Capi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started