Answered step by step

Verified Expert Solution

Question

1 Approved Answer

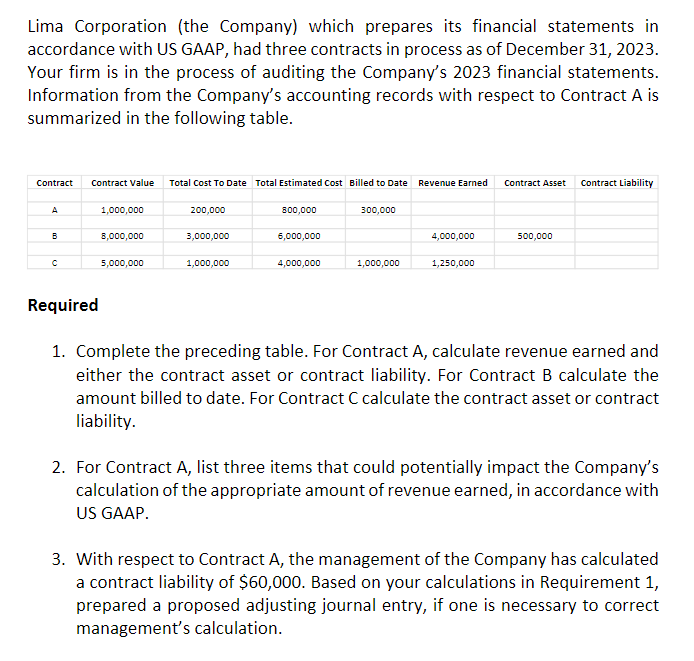

Lima Corporation (the Company) which prepares its financial statements in accordance with US GAAP, had three contracts in process as of December 31, 2023.

Lima Corporation (the Company) which prepares its financial statements in accordance with US GAAP, had three contracts in process as of December 31, 2023. Your firm is in the process of auditing the Company's 2023 financial statements. Information from the Company's accounting records with respect to Contract A is summarized in the following table. Contract Contract Value Total Cost To Date Total Estimated Cost Billed to Date Revenue Earned Contract Asset Contract Liability A 1,000,000 200,000 800,000 300,000 B 8,000,000 3,000,000 6,000,000 4,000,000 500,000 5,000,000 1,000,000 4,000,000 1,000,000 1,250,000 Required 1. Complete the preceding table. For Contract A, calculate revenue earned and either the contract asset or contract liability. For Contract B calculate the amount billed to date. For Contract C calculate the contract asset or contract liability. 2. For Contract A, list three items that could potentially impact the Company's calculation of the appropriate amount of revenue earned, in accordance with US GAAP. 3. With respect to Contract A, the management of the Company has calculated a contract liability of $60,000. Based on your calculations in Requirement 1, prepared a proposed adjusting journal entry, if one is necessary to correct management's calculation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started