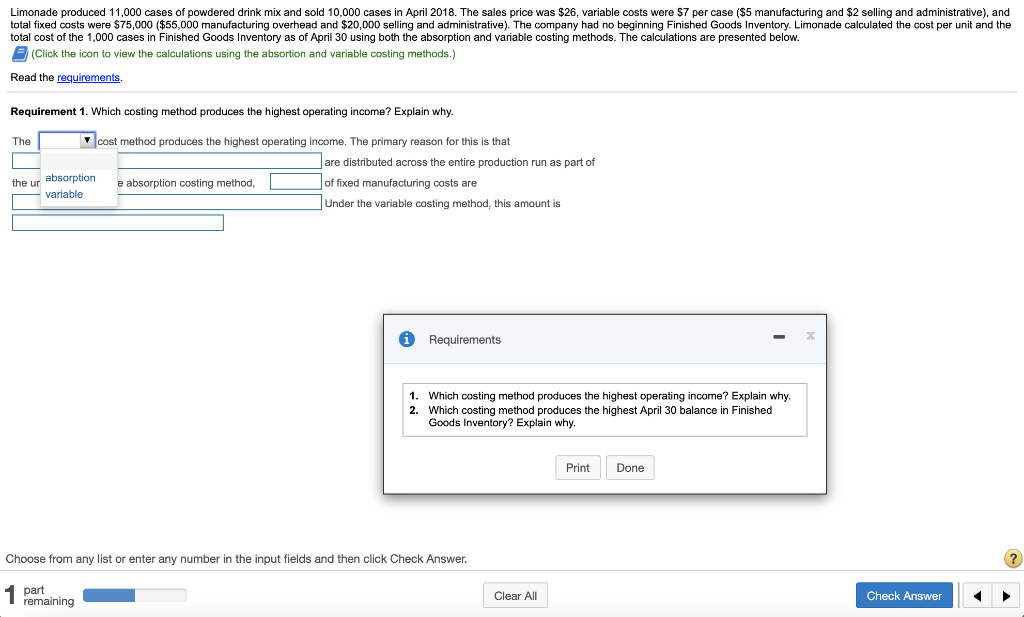

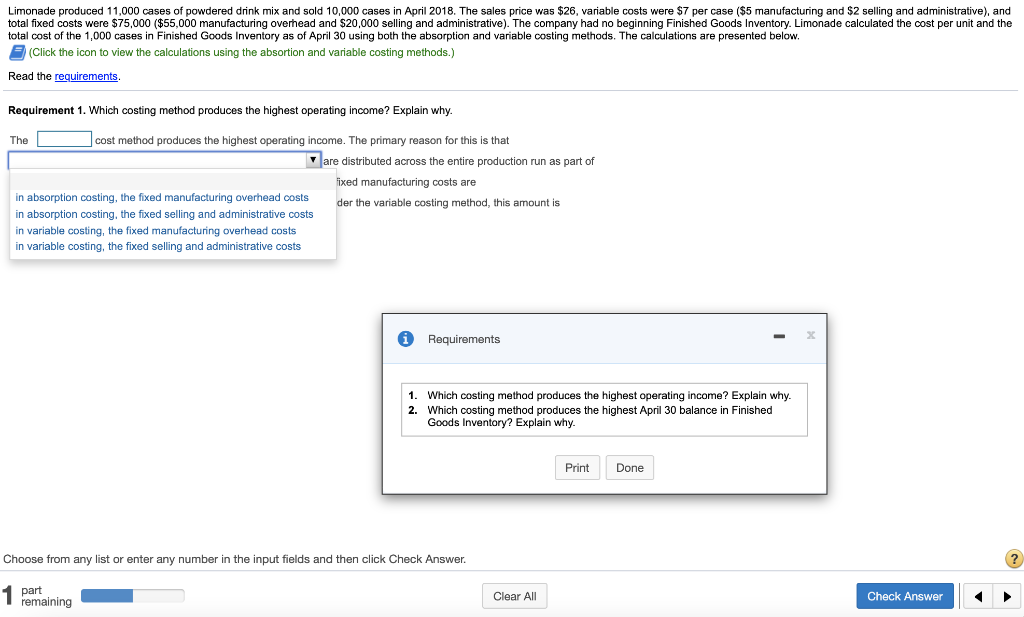

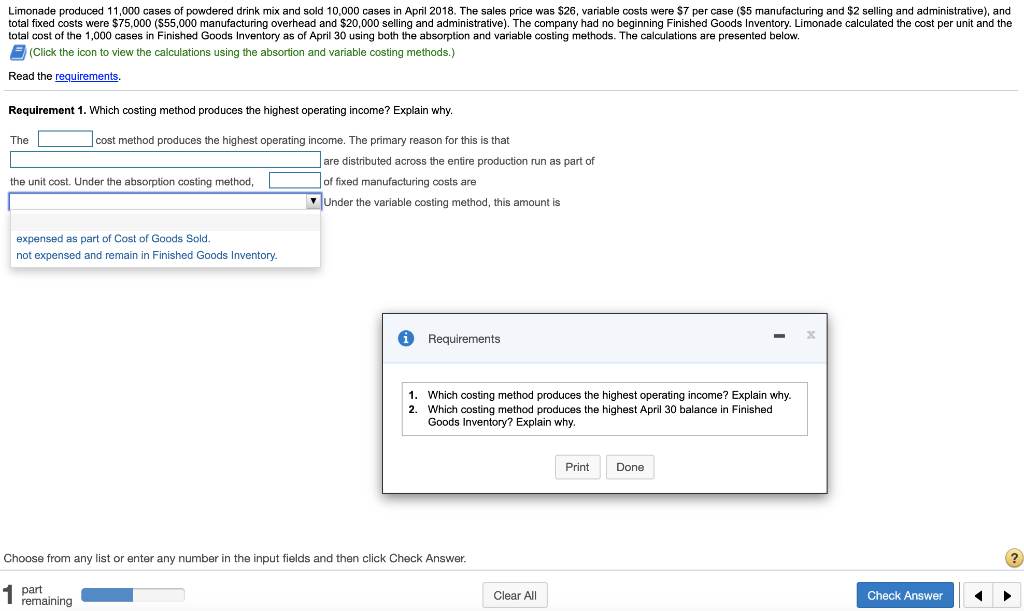

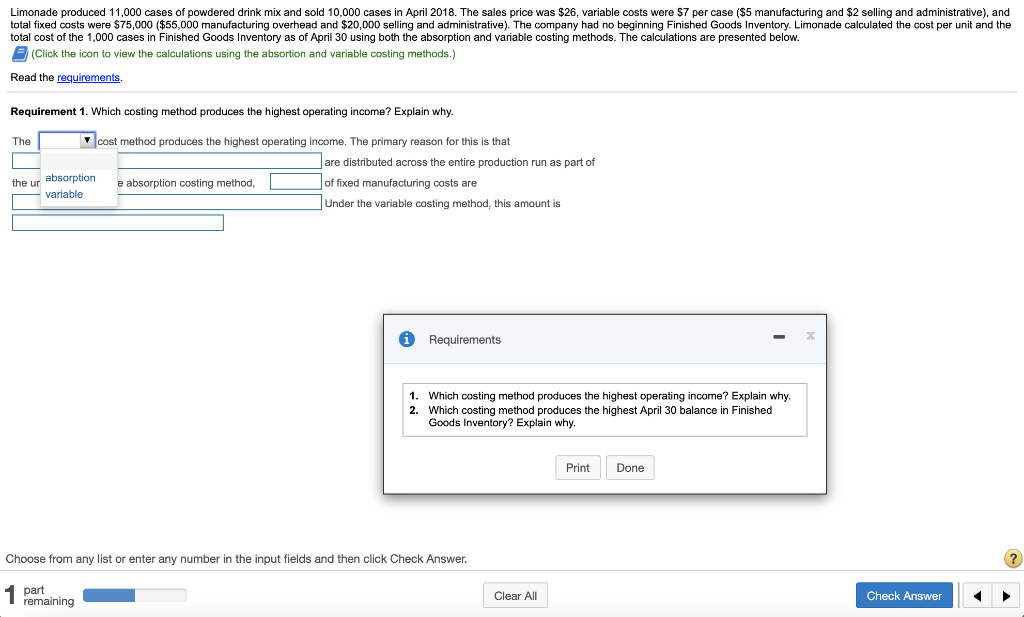

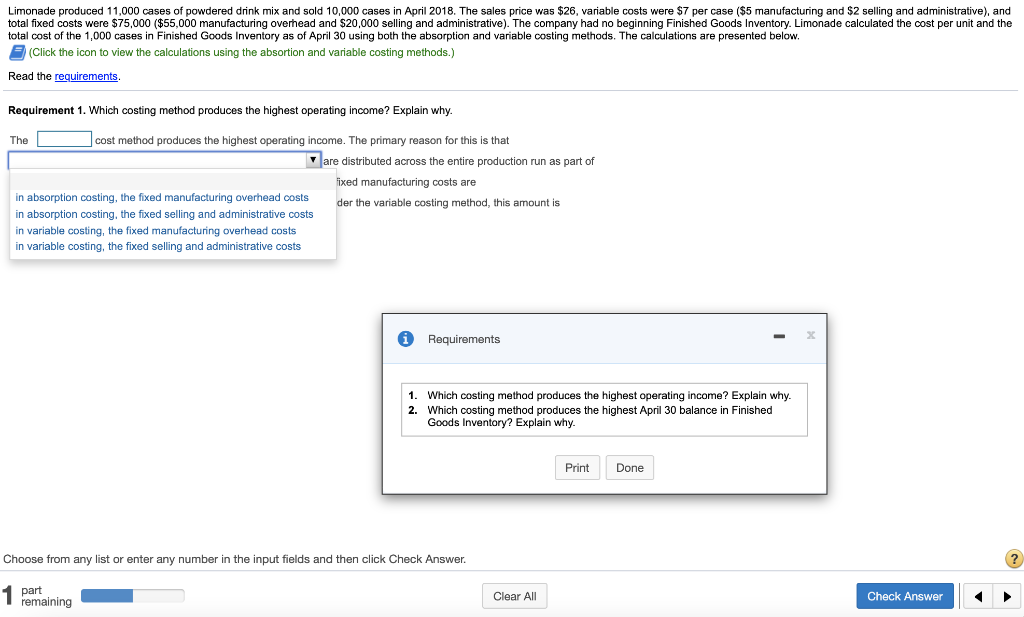

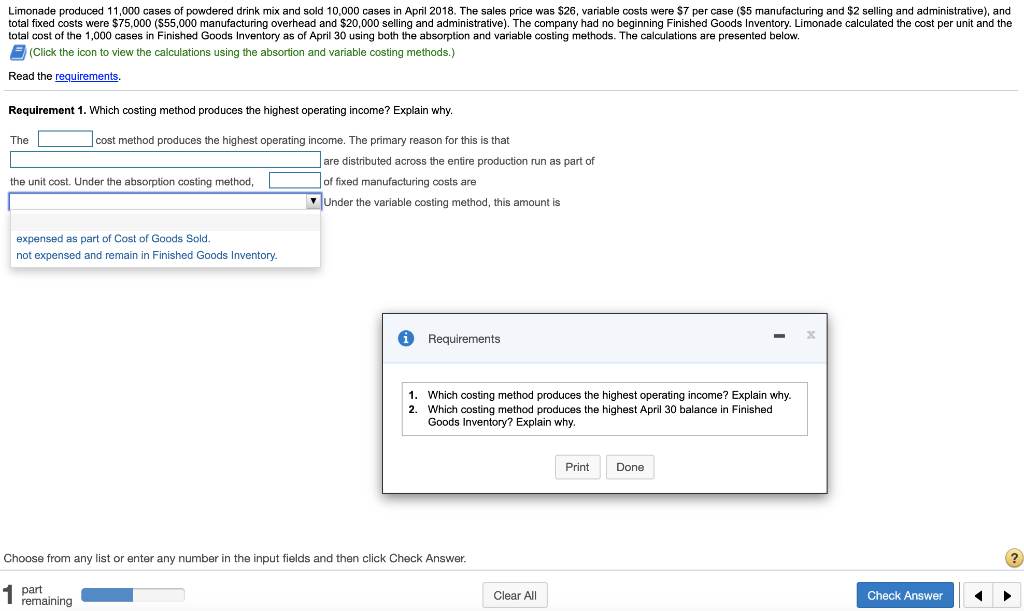

Limonade produced 11,000 cases of powdered drink mix and sold 10,000 cases in April 2018. The sales price was $26, variable costs were $7 per case ($5 manufacturing and $2 selling and administrative), and total fixed costs were $75,000 ($55,000 manufacturing overhead and $20,000 selling and administrative). The company had no beginning Finished Goods Inventory. Limonade calculated the cost per unit and the total cost of the 1.000 cases in Finished Goods Inventory as of April 30 using both the absorption and variable costing methods. The calculations are presented below. (Click the icon to view the calculations using the absortion and variable costing methods.) Read the requirements. Requirement 1. Which costing method produces the highest operating income? Explain why. The cost method produces the highest operating income. The primary reason for this is that are distributed across the entire production run as part of e absorption costing method, of fixed manufacturing costs are Under the variable costing method, this amount is the ur absorption variable Requirements 1. Which costing method produces the highest operating income? Explain why. 2. Which costing method produces the highest April 30 balance i Finished Goods Inventory? Explain why. Print Done Choose from any list or enter any number in the input fields and then click Check Answer. ? part remaining Clear All Check Answer Limonade produced 11,000 cases of powdered drink mix and sold 10,000 cases in April 2018. The sales price was $26, variable costs were $7 per case ($5 manufacturing and $2 selling and administrative), and total fixed costs were $75,000 ($55,000 manufacturing overhead and $20,000 selling and administrative). The company had no beginning Finished Goods Inventory. Limonade calculated the cost per unit and the total cost of the 1,000 cases in Finished Goods Inventory as of April 30 using both the absorption and variable costing methods. The calculations are presented below. (Click the icon view the calculations using the absortion and variable costing methods.) Read the requirements Requirement 1. Which costing method produces the highest operating income? Explain why. The cost method produces the highest operating income. The primary reason for this is that are distributed across the entire production run as part of fixed manufacturing costs are in absorption costing, the fixed manufacturing overhead costs der the variable costing method, this amount is in absorption costing, the fixed selling and administrative costs in variable costing, the fixed manufacturing overhead costs in variable costing, the fixed selling and administrative costs Requirements 1. Which costing method produces the highest operating income? Explain why. 2. Which costing method produces the highest April 30 balance Finished Goods Inventory? Explain why. Print Done Choose from any list or enter any number in the input fields and then click Check Answer. ? 1 part remaining Clear All Check Answer Limonade produced 11,000 cases of powdered drink mix and sold 10,000 cases in April 2018. The sales price was $26, variable costs were $7 per case ($5 manufacturing and $2 selling and administrative), and total fixed costs were $75,000 ($55,000 manufacturing overhead and $20,000 selling and administrative). The company had no beginning Finished Goods Inventory. Limonade calculated the cost per unit and the total cost of the 1,000 cases in Finished Goods Inventory as of April 30 using both the absorption and variable costing methods. The calculations are presented below. (Click the icon view the calculations using the absortion and variable costing methods.) Read the requirements Requirement 1. Which costing method produces the highest operating income? Explain why. The cost method produces the highest operating income. The primary reason for this is that are distributed across the entire production run as part of the unit cost. Under the absorption costing method, of fixed manufacturing costs are Under the variable costing method, this amount is expensed as part of Cast of Goods Sold. not expensed and remain in Finished Goods Inventory. Requirements 1. Which costing method produces the highest operating income? Explain why. 2 Which costing method produces the highest April 30 balance Finished Goods Inventory? Explain why. Print Done Choose from any list or enter any number in the input fields and then click Check Answer. ? 1 part remaining Clear All Check Answer Limonade produced 11,000 cases of powdered drink mix and sold 10,000 cases in April 2018. The sales price was $26, variable costs were $7 per case ($5 manufacturing and $2 selling and administrative), and total fixed costs were $75,000 ($55,000 manufacturing overhead and $20,000 selling and administrative). The company had no beginning Finished Goods Inventory. Limonade calculated the cost per unit and the total cost of the 1,000 cases in Finished Goods Inventory as of April 30 using both the absorption and variable costing methods. The calculations are presented below. (Click the icon to view the calculations using the absortion and variable costing methods.) Read the requirements Requirement Which costing method produces the highest operating income? Explain why. The cost method produces the highest operating income. The primary reason for this is that are distributed across the entire production run as part of the unit cost. Under the absorption costing method, of fixed manufacturing costs are Under the variable costing method, this amount is capitalized as a product cost. expensed as a period cost. Requirements x 1. Which costing method produces the highest operating income? Explain why. 2. Which costing method produces the highest April 30 balance in Finished Goods Inventory? Explain why. Print Done Choose from any list or enter any number in the input fields and then click Check Answer. ? 1 part remaining Clear All Check