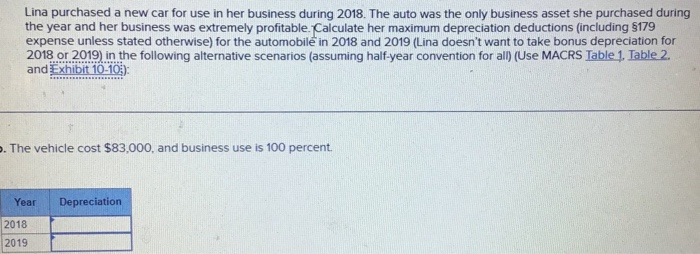

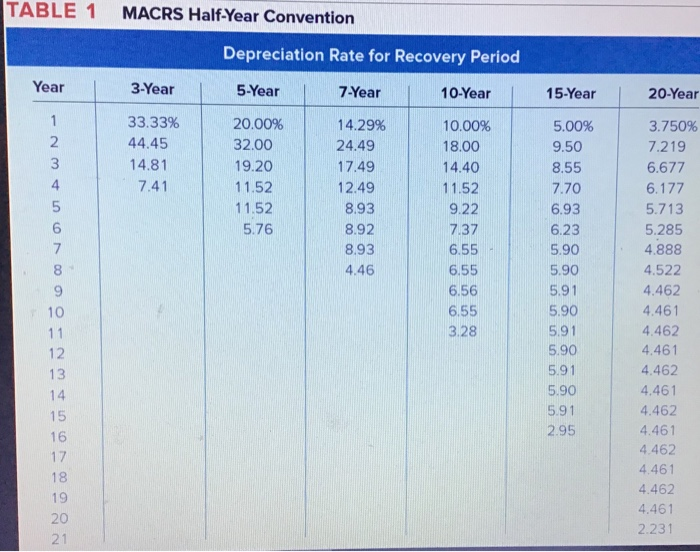

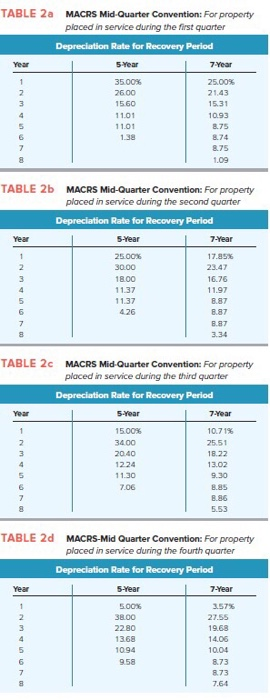

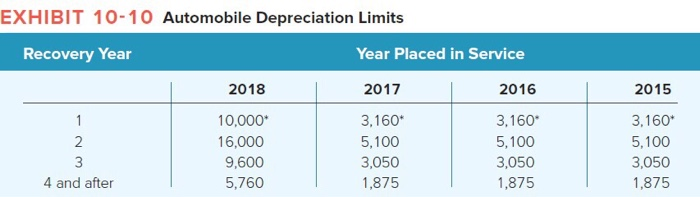

Lina purchased a new car for use in her business during 2018. The auto was the only business asset she purchased during the year and her business was extremely profitable. Calculate her maximum depreciation deductions (including 5179 expense unless stated otherwise) for the automobil in 2018 and 2019 (Lina doesn't want to take bonus depreciation for 2018 or 2019) in the following alternative scenarios (assuming half-year convention for all) (Use MACRS Table 1. Iable 2 and . The vehicle cost $83,000, and business use is 100 percent Year Depreciation 2018 2019 TABLE 1 MACRS Half-Year Convention Depreciation Rate for Recovery Period 10-Year 15-Year 20-Year Year 3-Year 5-Year 7-Year 3.750% 7.219 6.677 10.00% 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 5.00% 9.50 8.55 7.70 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 14.29% 33.33% 44.45 14.81 7.41 20.00% 32.00 19.20 11.52 11.52 5.76 24.49 17.49 12.49 8.93 8.92 8.93 4.46 4 5.713 5.285 4.888 4.522 4462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4. 461 4.462 4.461 2.231 6 9 10 12 15 16 17 18 21 TABLE 2a MACRS Mid-Quarter Convention: For property placed in service during the first quarter Depreciation Rate for Recovery Period s Year 7Year 3500% 6.00 15.60 11.01 11.01 .38 25.00% 1.43 15.31 1093 8.75 8.74 8.75 1.09 TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarter Depreciation Rate for Recovery Period 7-Year 18.00 11.37 11.37 426 17.85% 23.47 16.76 11.97 887 8.87 B.87 TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter Depreciation Rate for Recovery Period 7 Year 1 00% 3400 20.40 1224 1.30 7.06 10.71% 25.51 18.22 13.02 .85 8.86 5.53 TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter Depreciation Rate for Recovery Period 7-Year 157% 38.00 2280 1368 1094 958 27.55 19.68 14.06 1004 873 873 7.64 EXHIBIT 10-10 Automobile Depreciation Limits Recovery Year Year Placed in Service 2018 2017 2016 2015 10,000* 16,000 9,600 5,760 3,160 5,100 3,050 1,875 3,160 5,100 3,050 1,875 3,160 5,100 3,050 1,875 4 and after