Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Linda Reed, an executive at VIP Inc., has earned a performance bonus. She has the option of accepting $30,000 now or $50,000, 5 years

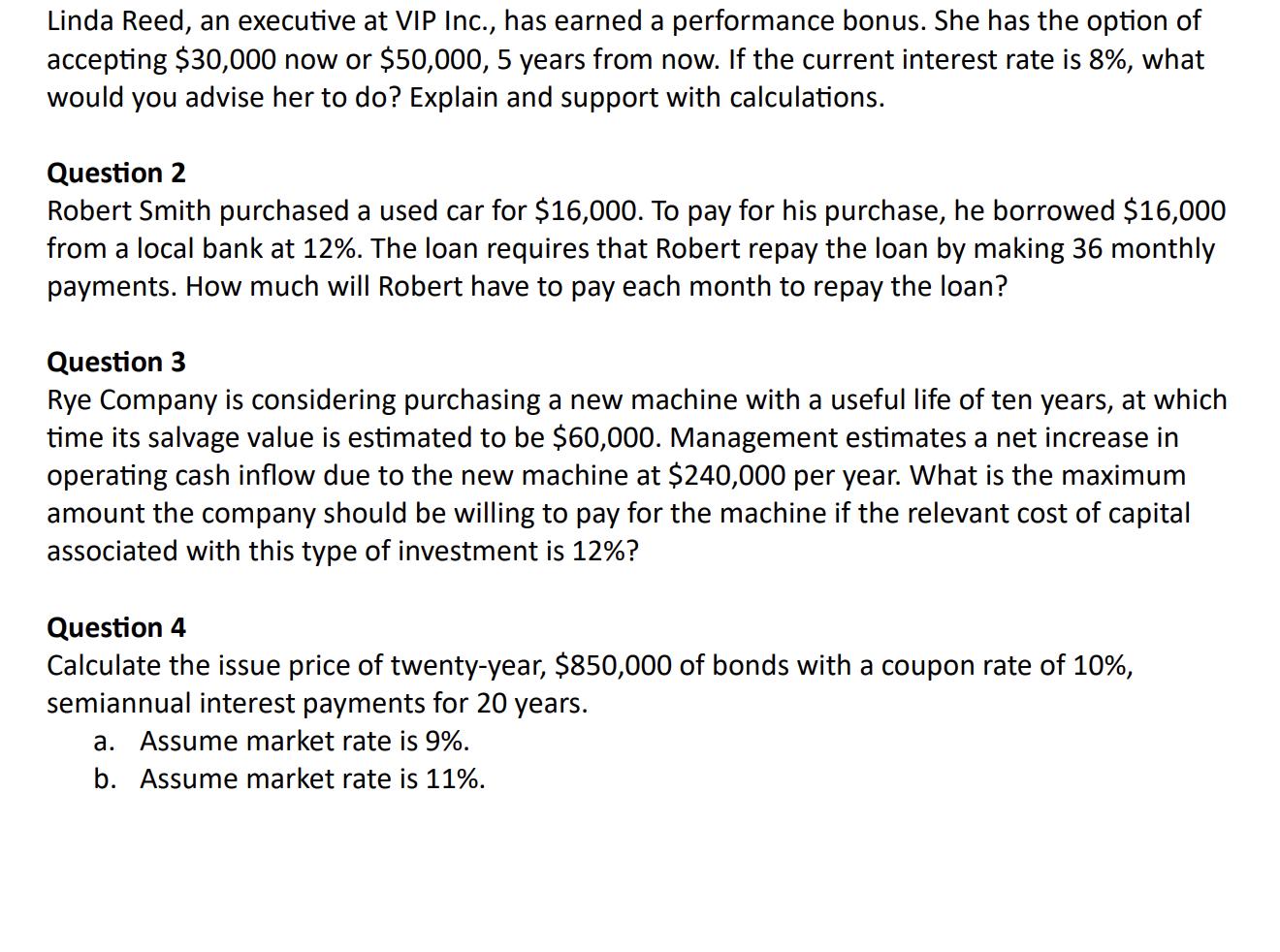

Linda Reed, an executive at VIP Inc., has earned a performance bonus. She has the option of accepting $30,000 now or $50,000, 5 years from now. If the current interest rate is 8%, what would you advise her to do? Explain and support with calculations. Question 2 Robert Smith purchased a used car for $16,000. To pay for his purchase, he borrowed $16,000 from a local bank at 12%. The loan requires that Robert repay the loan by making 36 monthly payments. How much will Robert have to pay each month to repay the loan? Question 3 Rye Company is considering purchasing a new machine with a useful life of ten years, at which time its salvage value is estimated to be $60,000. Management estimates a net increase in operating cash inflow due to the new machine at $240,000 per year. What is the maximum amount the company should be willing to pay for the machine if the relevant cost of capital associated with this type of investment is 12%? Question 4 Calculate the issue price of twenty-year, $850,000 of bonds with a coupon rate of 10%, semiannual interest payments for 20 years. a. Assume market rate is 9%. b. Assume market rate is 11%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started