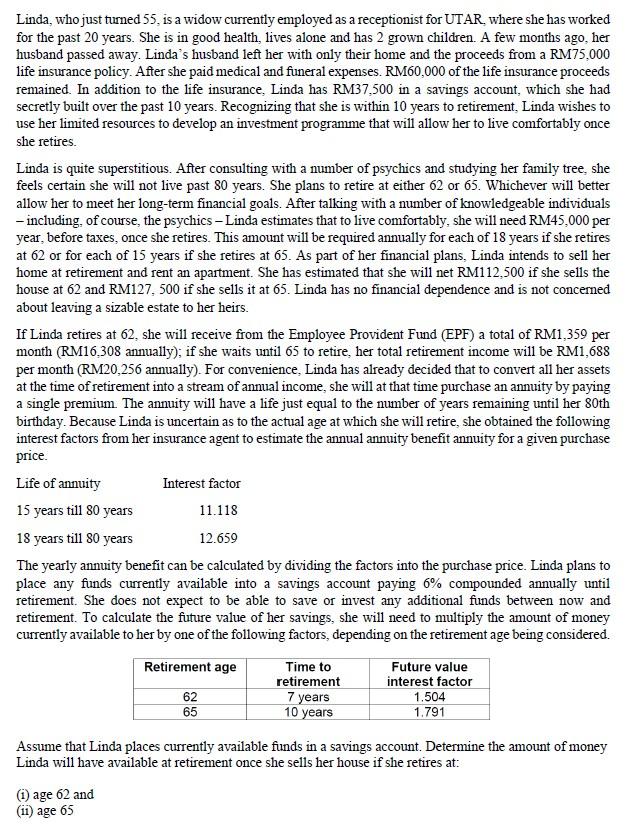

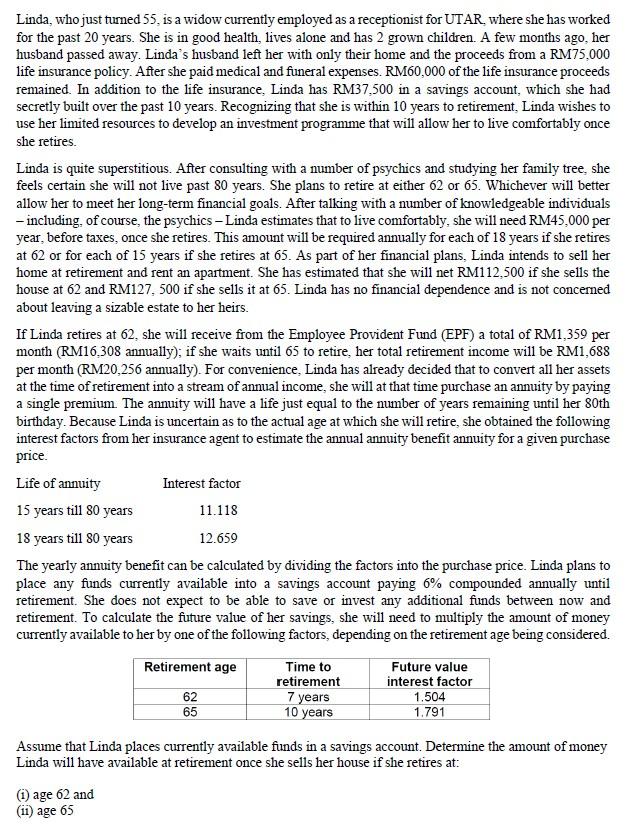

Linda, who just turned 55 , is a widow currently employed as a receptionist for UTAR, where she has worked for the past 20 years. She is in good health, lives alone and has 2 grown children. A few months ago, her husband passed away. Linda's husband left her with only their home and the proceeds from a RM75,000 life insurance policy. After she paid medical and funeral expenses. RM60,000 of the life insurance proceeds remained. In addition to the life insurance, Linda has RM37,500 in a savings account, which she had secretly built over the past 10 years. Recognizing that she is within 10 years to retirement, Linda wishes to use her limited resources to develop an investment programme that will allow her to live comfortably once she retires. Linda is quite superstitious. After consulting with a number of psychics and studying her family tree, she feels certain she will not live past 80 years. She plans to retire at either 62 or 65 . Whichever will better allow her to meet her long-term financial goals. After talking with a number of knowledgeable individuals - including, of course, the psychics - Linda estimates that to live comfortably, she will need RM45,000 per year, before taxes, once she retires. This amount will be required annually for each of 18 years if she retires at 62 or for each of 15 years if she retires at 65 . As part of her financial plans, Linda intends to sell her home at retirement and rent an apartment. She has estimated that she will net RM112,500 if she sells the house at 62 and RM127, 500 if she sells it at 65 . Linda has no financial dependence and is not concerned about leaving a sizable estate to her heirs. If Linda retires at 62, she will receive from the Employee Provident Fund (EPF) a total of RM1,359 per month (RM16,308 annually); if she waits until 65 to retire, her total retirement income will be RM1,688 per month (RM20,256 annually). For convenience, Linda has already decided that to convert all her assets at the time of retirement into a stream of annual income, she will at that time purchase an annuity by paying a single premium. The annuity will have a life just equal to the number of years remaining until her 80 th birthday. Because Linda is uncertain as to the actual age at which she will retire, she obtained the following interest factors from her insurance agent to estimate the annual annuity benefit annuity for a given purchase price. The yearly annuity benefit can be calculated by dividing the factors into the purchase price. Linda plans to place any funds currently available into a savings account paying 6% compounded annually until retirement. She does not expect to be able to save or invest any additional funds between now and retirement. To calculate the future value of her savings, she will need to multiply the amount of money currently available to her by one of the following factors, depending on the retirement age being considered. Assume that Linda places currently available funds in a savings account. Determine the amount of money Linda will have available at retirement once she sells her house if she retires at: (i) age 62 and (ii) age 65