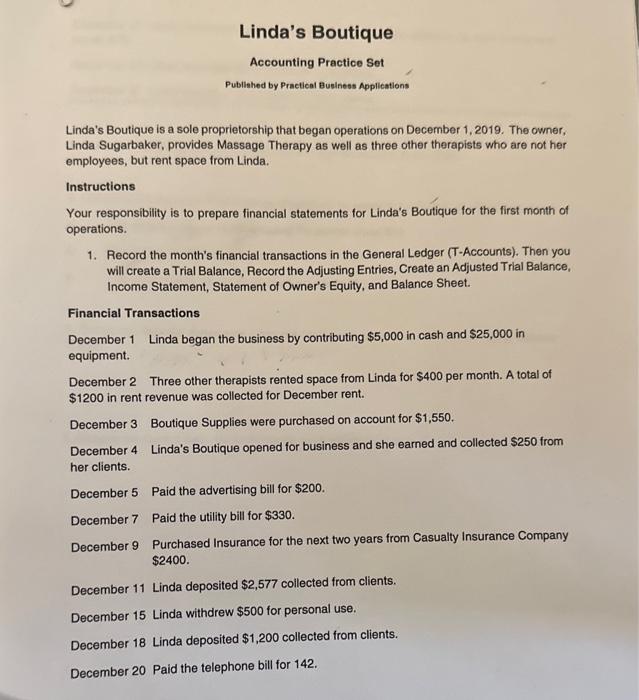

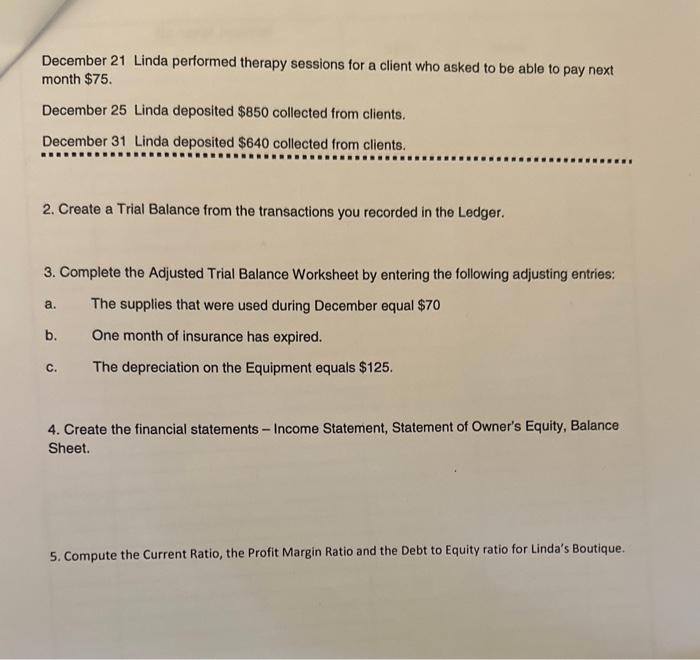

Linda's Boutique Accounting Practice Set Publiahed by Practical Business Applieations Linda's Boutique is a sole proprietorship that began operations on December 1, 2019. The owner, Linda Sugarbaker, provides Massage Therapy as well as three other therapists who are not her employees, but rent space from Linda. Instructions Your responsibility is to prepare financial statements for Linda's Boutique for the first month of operations. 1. Record the month's financial transactions in the General Ledger (T-Accounts). Then you will create a Trial Balance, Record the Adjusting Entries, Create an Adjusted Trial Balance, Income Statement, Statement of Owner's Equity, and Balance Sheet. Financial Transactions December 1 Linda began the business by contributing $5,000 in cash and $25,000 in equipment. December 2 Three other therapists rented space from Linda for $400 per month. A total of $1200 in rent revenue was collected for December rent. December 3 Boutique Supplies were purchased on account for $1,550. December 4 Linda's Boutique opened for business and she earned and collected $250 from her clients. December 5 Paid the advertising bill for $200. December 7 Paid the utility bill for $330. December 9 Purchased Insurance for the next two years from Casualty Insurance Company $2400. December 11 Linda deposited $2,577 collected from clients. December 15 Linda withdrew $500 for personal use. December 18 Linda deposited $1,200 collected from clients. December 20 Paid the telephone bill for 142. December 21 Linda performed therapy sessions for a client who asked to be able to pay next month $75. December 25 Linda deposited $850 collected from clients. December 31 Linda deposited $640 collected from clients. 2. Create a Trial Balance from the transactions you recorded in the Ledger. 3. Complete the Adjusted Trial Balance Worksheet by entering the following adjusting entries: a. The supplies that were used during December equal $70 b. One month of insurance has expired. c. The depreciation on the Equipment equals $125. 4. Create the financial statements - Income Statement, Statement of Owner's Equity, Balance Sheet. 5. Compute the Current Ratio, the Profit Margin Ratio and the Debt to Equity ratio for Linda's Boutique