Question

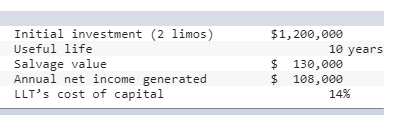

Lindas Luxury Travel (LLT) is considering the purchase of two Hummer limousines. Various information about the proposed investment follows: Assume straight line depreciation method is

Lindas Luxury Travel (LLT) is considering the purchase of two Hummer limousines. Various information about the proposed investment follows:

Assume straight line depreciation method is used.

Required:

Help LLT evaluate this project by calculating each of the following:

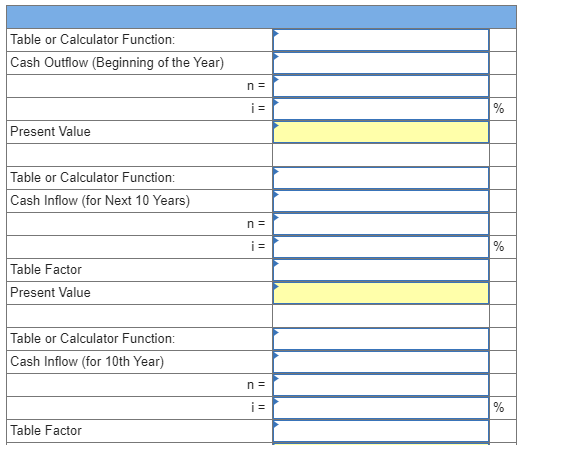

3. Net present value.

Calculate net present value. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Cash Outflows and negative amounts should be indicated by a minus sign. Round your "Present Values" to the nearest whole dollar amount.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started