Answered step by step

Verified Expert Solution

Question

1 Approved Answer

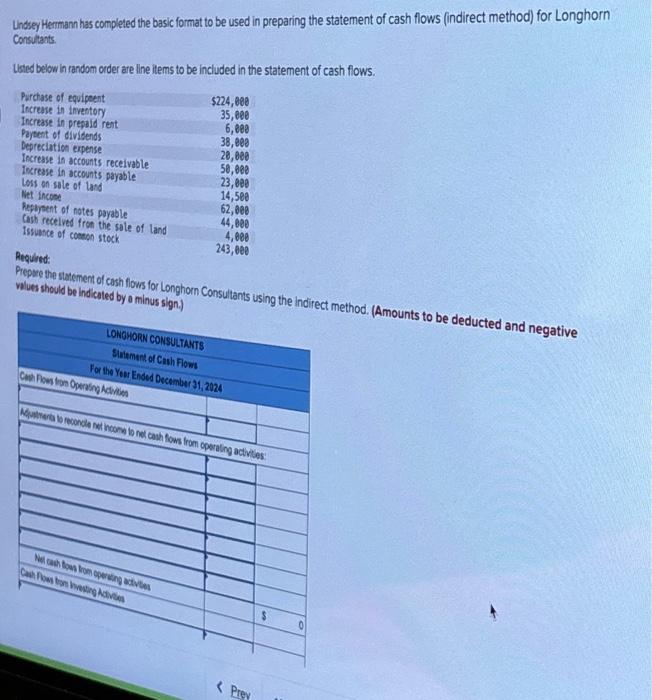

Lindsey Hermann has completed the basic format to be used in preparing the statement of cash flows (indirect method) for Longhorn Consultants Listed below

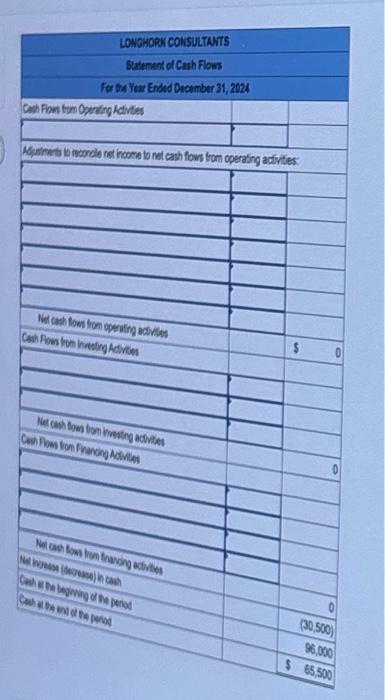

Lindsey Hermann has completed the basic format to be used in preparing the statement of cash flows (indirect method) for Longhorn Consultants Listed below in random order are line items to be included in the statement of cash flows. Purchase of equipment $224,000 Increase in inventory 35,000 Increase in prepaid rent 6,000 Payment of dividends 38,000 Depreciation expense 20,000 Increase in accounts receivable 50,000 Increase in accounts payable 23,000 Loss on sale of land 14,500 Net income 62,000 Repayment of notes payable Cash received from the sale of land 44,000 4,000 243,000 Issuance of common stock Required: Prepare the statement of cash flows for Longhorn Consultants using the indirect method. (Amounts to be deducted and negative values should be indicated by a minus sign.) LONGHORN CONSULTANTS Statement of Cash Flows For the Year Ended December 31, 2024 Cash Flows from Operating Activities Adjustments to reconcile net income to net cash flows from operating activities Net cash flows from operating activities 0 Cash Flows from Investing Activities LONGHORN CONSULTANTS Statement of Cash Flows For the Year Ended December 31, 2024 Cash Flows from Operating Activities Adjustments to reconcile net income to net cash flows from operating activities Net cash flows from operating activities Cash Flows from Investing Activibes Net cash flows from investing activites Cash Flows from Financing Activities Net cash flows from financing activities Net increase (decrease) in cash Cash at the beginning of the period Cash at the end of the period 0 (30,500) 96,000 $ 65,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started