Answered step by step

Verified Expert Solution

Question

1 Approved Answer

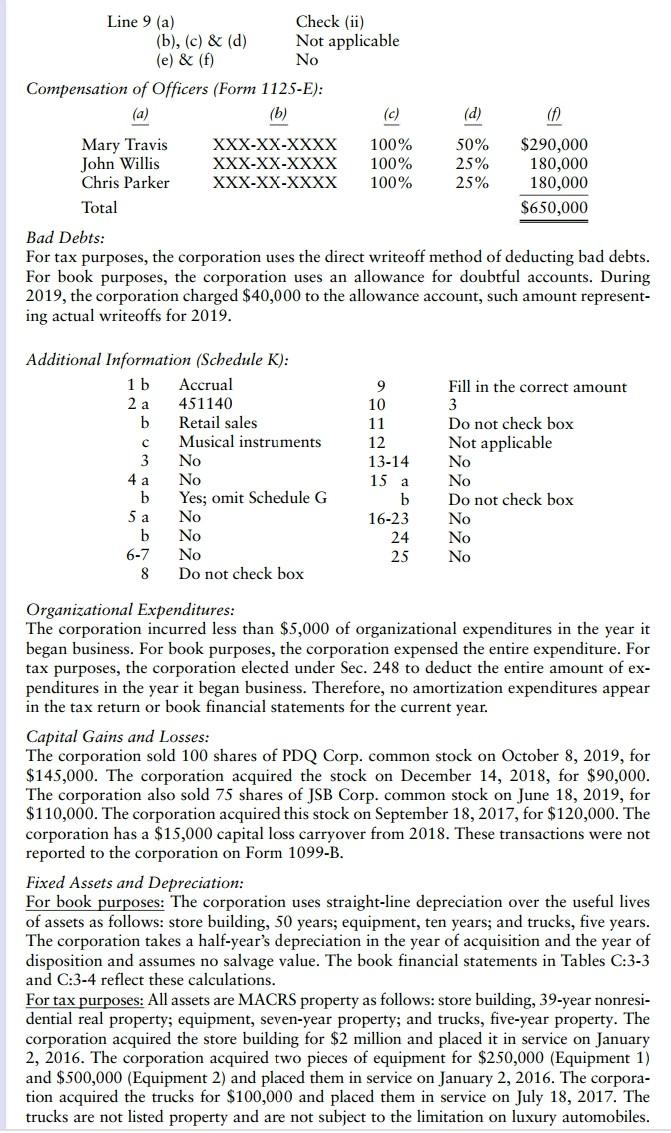

Line 9 (a) Check (ii) (b), (c) & (d) Not applicable (e) & (f) No Compensation of Officers (Form 1125-E): (a) (b) (c) (d) (f

Line 9 (a) Check (ii) (b), (c) & (d) Not applicable (e) & (f) No Compensation of Officers (Form 1125-E): (a) (b) (c) (d) (f Mary Travis XXX-XX-XXXX 100% 50% $290,000 John Willis XXX-XX-XXXX 100% 25% 180,000 Chris Parker XXX-XX-XXXX 100% 25% 180,000 Total $650,000 Bad Debts: For tax purposes, the corporation uses the direct writeoff method of deducting bad debts. For book purposes, the corporation uses an allowance for doubtful accounts. During 2019, the corporation charged $40,000 to the allowance account, such amount represent- ing actual writeoffs for 2019. Additional Information (Schedule K): 1 b Accrual 2 a 451140 b Retail sales Musical instruments 3 No 4 a No b Yes; omit Schedule G Sa No b No 6-7 No 8 Do not check box 9 10 11 12 13-14 15 a b 16-23 24 25 Fill in the correct amount 3 Do not check box Not applicable No No Do not check box No No No Organizational Expenditures: The corporation incurred less than $5,000 of organizational expenditures in the year it began business. For book purposes, the corporation expensed the entire expenditure. For tax purposes, the corporation elected under Sec. 248 to deduct the entire amount of ex- penditures in the year it began business. Therefore, no amortization expenditures appear in the tax return or book financial statements for the current year. Capital Gains and Losses: The corporation sold 100 shares of PDQ Corp. common stock on October 8, 2019, for $145,000. The corporation acquired the stock on December 14, 2018, for $90,000. The corporation also sold 75 shares of JSB Corp. common stock on June 18, 2019, for $110,000. The corporation acquired this stock on September 18, 2017, for $120,000. The corporation has a $15,000 capital loss carryover from 2018. These transactions were not reported to the corporation on Form 1099-B. Fixed Assets and Depreciation: For book purposes: The corporation uses straight-line depreciation over the useful lives of assets as follows: store building, 50 years; equipment, ten years; and trucks, five years. The corporation takes a half-year's depreciation in the year of acquisition and the year of disposition and assumes no salvage value. The book financial statements in Tables C:3-3 and C:3-4 reflect these calculations. For tax purposes: All assets are MACRS property as follows: store building, 39-year nonresi- dential real property; equipment, seven-year property; and trucks, five-year property. The corporation acquired the store building for $2 million and placed it in service on January 2, 2016. The corporation acquired two pieces of equipment for $250,000 (Equipment 1) and $500,000 (Equipment 2) and placed them in service on January 2, 2016. The corpora- tion acquired the trucks for $100,000 and placed them in service on July 18, 2017. The trucks are not listed property and are not subject to the limitation on luxury automobiles. Line 9 (a) Check (ii) (b), (c) & (d) Not applicable (e) & (f) No Compensation of Officers (Form 1125-E): (a) (b) (c) (d) (f Mary Travis XXX-XX-XXXX 100% 50% $290,000 John Willis XXX-XX-XXXX 100% 25% 180,000 Chris Parker XXX-XX-XXXX 100% 25% 180,000 Total $650,000 Bad Debts: For tax purposes, the corporation uses the direct writeoff method of deducting bad debts. For book purposes, the corporation uses an allowance for doubtful accounts. During 2019, the corporation charged $40,000 to the allowance account, such amount represent- ing actual writeoffs for 2019. Additional Information (Schedule K): 1 b Accrual 2 a 451140 b Retail sales Musical instruments 3 No 4 a No b Yes; omit Schedule G Sa No b No 6-7 No 8 Do not check box 9 10 11 12 13-14 15 a b 16-23 24 25 Fill in the correct amount 3 Do not check box Not applicable No No Do not check box No No No Organizational Expenditures: The corporation incurred less than $5,000 of organizational expenditures in the year it began business. For book purposes, the corporation expensed the entire expenditure. For tax purposes, the corporation elected under Sec. 248 to deduct the entire amount of ex- penditures in the year it began business. Therefore, no amortization expenditures appear in the tax return or book financial statements for the current year. Capital Gains and Losses: The corporation sold 100 shares of PDQ Corp. common stock on October 8, 2019, for $145,000. The corporation acquired the stock on December 14, 2018, for $90,000. The corporation also sold 75 shares of JSB Corp. common stock on June 18, 2019, for $110,000. The corporation acquired this stock on September 18, 2017, for $120,000. The corporation has a $15,000 capital loss carryover from 2018. These transactions were not reported to the corporation on Form 1099-B. Fixed Assets and Depreciation: For book purposes: The corporation uses straight-line depreciation over the useful lives of assets as follows: store building, 50 years; equipment, ten years; and trucks, five years. The corporation takes a half-year's depreciation in the year of acquisition and the year of disposition and assumes no salvage value. The book financial statements in Tables C:3-3 and C:3-4 reflect these calculations. For tax purposes: All assets are MACRS property as follows: store building, 39-year nonresi- dential real property; equipment, seven-year property; and trucks, five-year property. The corporation acquired the store building for $2 million and placed it in service on January 2, 2016. The corporation acquired two pieces of equipment for $250,000 (Equipment 1) and $500,000 (Equipment 2) and placed them in service on January 2, 2016. The corpora- tion acquired the trucks for $100,000 and placed them in service on July 18, 2017. The trucks are not listed property and are not subject to the limitation on luxury automobiles

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started