Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Linfrae plc is a computer software development firm and it is considering a hostile takeover of Jaffikake plc, a software distribution firm. Linfrae has

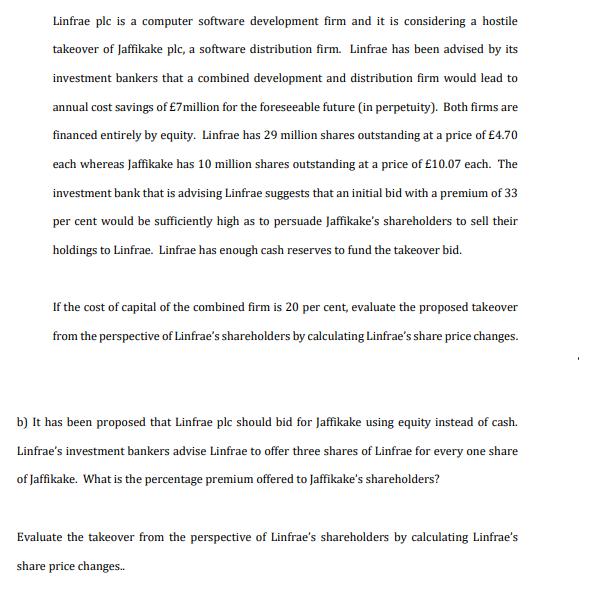

Linfrae plc is a computer software development firm and it is considering a hostile takeover of Jaffikake plc, a software distribution firm. Linfrae has been advised by its investment bankers that a combined development and distribution firm would lead to annual cost savings of 7million for the foreseeable future (in perpetuity). Both firms are financed entirely by equity. Linfrae has 29 million shares outstanding at a price of 4.70o each whereas Jaffikake has 10 million shares outstanding at a price of 10.07 each. The investment bank that is advising Linfrae suggests that an initial bid with a premium of 33 per cent would be sufficiently high as to persuade Jaffikake's shareholders to sell their holdings to Linfrae. Linfrae has enough cash reserves to fund the takeover bid. If the cost of capital of the combined firm is 20 per cent, evaluate the proposed takeover from the perspective of Linfrae's shareholders by calculating Linfrae's share price changes. b) It has been proposed that Linfrae ple should bid for Jaffikake using equity instead of cash. Linfrae's investment bankers advise Linfrae to offer three shares of Linfrae for every one share of Jaffikake. What is the percentage premium offered to Jaffikake's shareholders? Evaluate the takeover from the perspective of Linfrae's shareholders by calculating Linfrae's share price changes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Benefit Per Annum 7000000 PV of Benefit Perpetual Benefit Re 7000000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started