Answered step by step

Verified Expert Solution

Question

1 Approved Answer

link : https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/1397187/000139718723000012/lulu-20230129.htm 1. go through my Rough Draft of my SEC 10-K Company which is shown below and can you include the Conclusion Part

link : https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/1397187/000139718723000012/lulu-20230129.htm

1. go through my Rough Draft of my SEC 10-K Company which is shown below and can you include the Conclusion Part ?

2.provide sources by using APA format ? ( The link is provided above for lululemon athletica Inc. )

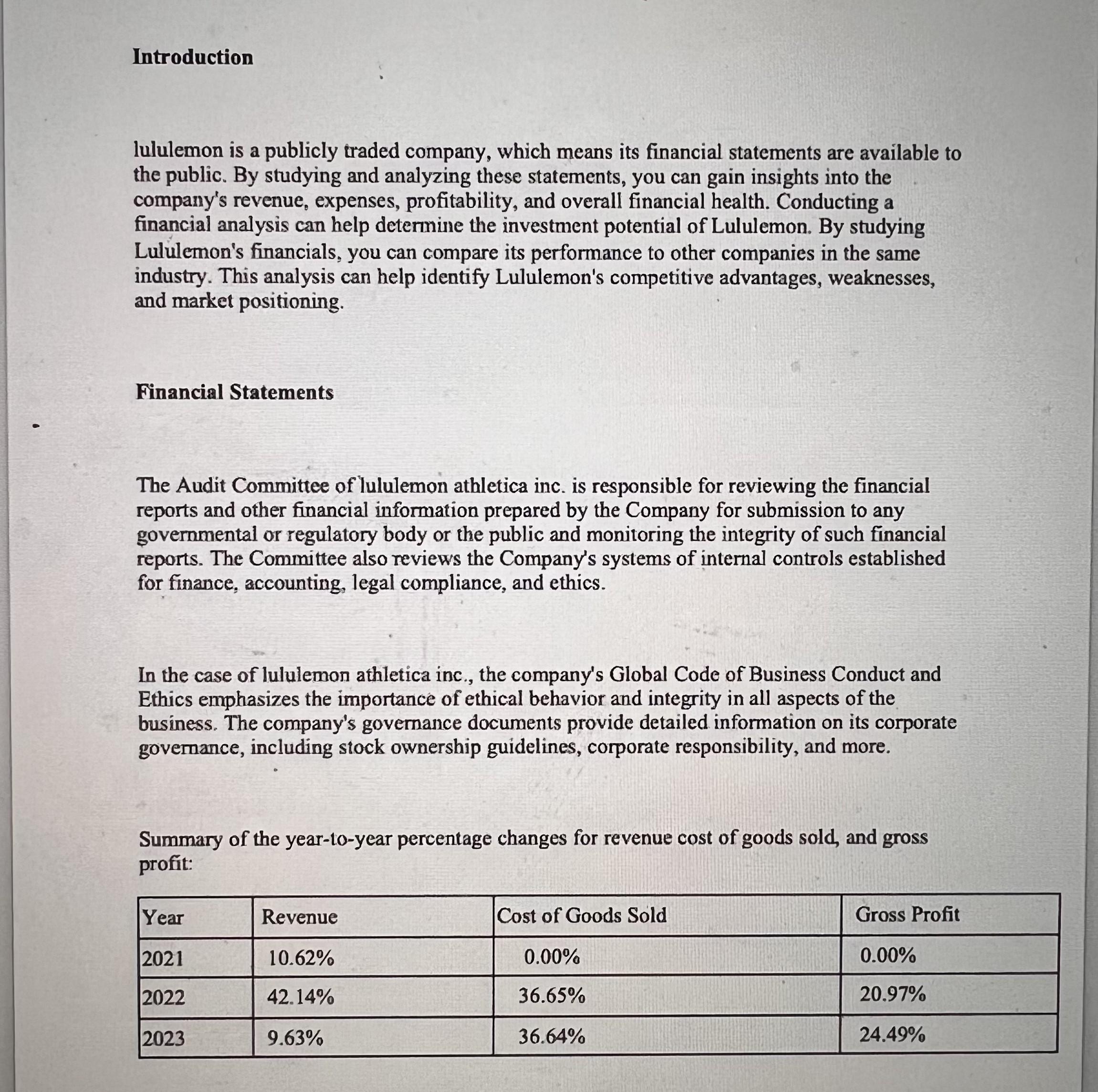

Introduction lululemon is a publicly traded company, which means its financial statements are available to the public. By studying and analyzing these statements, you can gain insights into the company's revenue, expenses, profitability, and overall financial health. Conducting a financial analysis can help determine the investment potential of Lululemon. By studying Lululemon's financials, you can compare its performance to other companies in the same industry. This analysis can help identify Lululemon's competitive advantages, weaknesses, and market positioning. Financial Statements The Audit Committee of lululemon athletica inc. is responsible for reviewing the financial reports and other financial information prepared by the Company for submission to any governmental or regulatory body or the public and monitoring the integrity of such financial reports. The Committee also reviews the Company's systems of internal controls established for finance, accounting, legal compliance, and ethics. In the case of lululemon athletica inc., the company's Global Code of Business Conduct and Ethics emphasizes the importance of ethical behavior and integrity in all aspects of the business. The company's governance documents provide detailed information on its corporate governance, including stock ownership guidelines, corporate responsibility, and more. Summary of the year-to-year percentage changes for revenue cost of goods sold, and gross profit: Year Revenue Cost of Goods Sold 2021 10.62% 0.00% 2022 42.14% 36.65% 2023 9.63% 36.64% Gross Profit 0.00% 20.97% 24.49%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started