Answered step by step

Verified Expert Solution

Question

1 Approved Answer

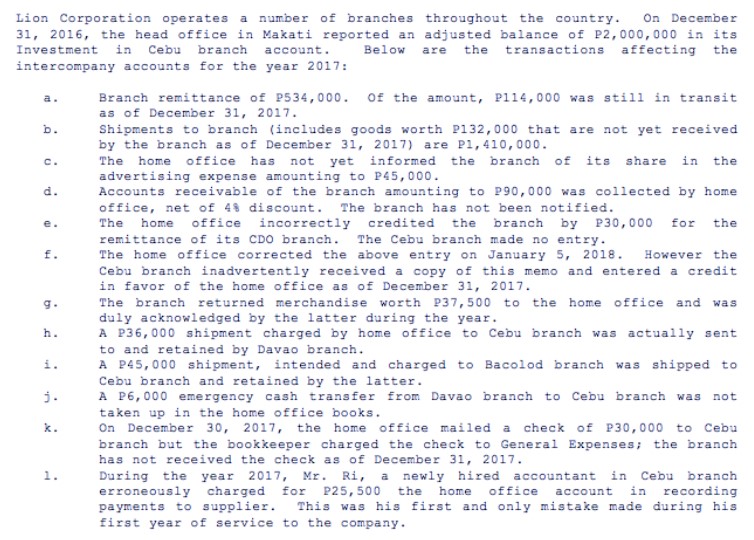

Lion Corporation operates a number of branches throughout the country. On December 31, 2016, the head office in Makati reported an adjusted balance of

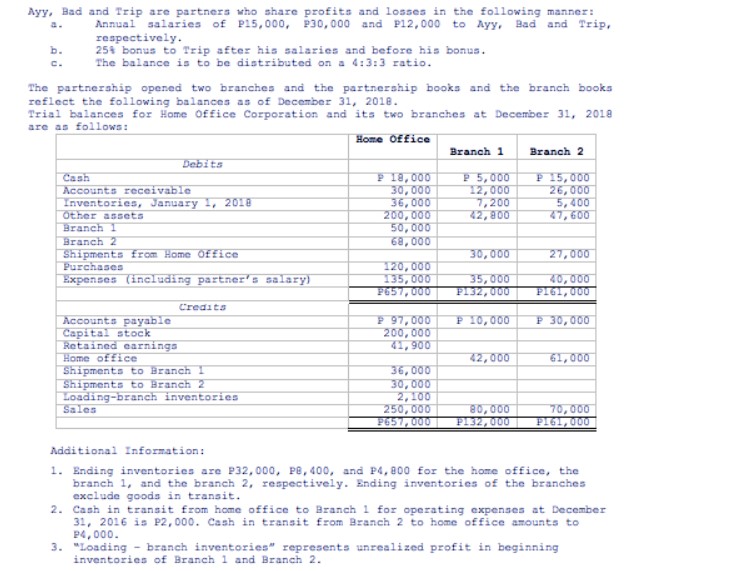

Lion Corporation operates a number of branches throughout the country. On December 31, 2016, the head office in Makati reported an adjusted balance of P2,000,000 in its Investment in Cebu branch account. Below are the transactions affecting the intercompany accounts for the year 2017: a. b. C. d. e. f. g. h. i. 5. k. Branch remittance of P534,000. of the amount, P114,000 was still in transit as of December 31, 2017. Shipments to branch (includes goods worth P132,000 that are not yet received by the branch as of December 31, 2017) are P1, 410,000. The home office has not yet informed the branch of its share in the advertising expense amounting to P45,000. Accounts receivable of the branch amounting to P90,000 was collected by home office, net of 4% discount. The branch has not been notified. The home office incorrectly credited the branch by P30,000 for the remittance of its CDO branch. The Cebu branch made no entry. The home office corrected the above entry on January 5, 2018. However the Cebu branch inadvertently received a copy of this memo and entered a credit in favor of the home office as of December 31, 2017. The branch returned merchandise worth P37,500 to the home office and was duly acknowledged by the latter during the year. A P36,000 shipment charged by home office to Cebu branch was actually sent to and retained by Davao branch. A P45,000 shipment, intended and charged to Bacolod branch was shipped to Cebu branch and retained by the latter. A P6,000 emergency cash transfer from Davao branch to Cebu branch was not taken up in the home office books. On December 30, 2017, the home office mailed a check of P30,000 to Cebu branch but the bookkeeper charged the check to General Expenses; the branch has not received the check as of December 31, 2017. During the year 2017, Mr. Ri, a newly hired accountant in Cebu branch erroneously charged for P25,500 the home office account in recording payments to supplier. This was his first and only mistake made during his first year of service to the company. Ayy, Bad and Trip are partners who share profits and losses in the following manner: Annual salaries of P15,000, P30,000 and P12,000 to Ayy, Bad and Trip, respectively. b. 25% bonus to Trip after his salaries and before his bonus. C. The balance is to be distributed on a 4:3:3 ratio. The partnership opened two branches and the partnership books and the branch books reflect the following balances as of December 31, 2018. Trial balances for Home Office Corporation and its two branches at December 31, 2018. are as follows: Home Office Branch 1 Branch 2 Debits Cash P 18,000 P 5,000 Accounts receivable 30,000 Inventories, January 1, 2018 Other assets 36,000 12,000 7,200 200,000 42,800 P 15,000 26,000 5,400 47,600 Branch 1 50,000 Branch 2 68,000 Shipments from Home Office 30,000 27,000 Purchases Expenses (including partner's salary) 120,000 135,000 35,000 40,000 P657,000 P132,000 P161,000 Credits Accounts payable Capital stock Retained earnings P 97,000 P 10,000 P 30,000 200,000 41,900 Home office Shipments to Branch I Shipments to Branch 2 42,000 61,000 36,000 30,000 Loading-branch inventories Sales 2,100 250,000 P657,000 80,000 P132,000 70,000 P161,000 Additional Information: 1. Ending inventories are P32,000, P8, 400, and P4,800 for the home office, the branch 1, and the branch 2, respectively. Ending inventories of the branches exclude goods in transit. 2. Cash in transit from home office to Branch 1 for operating expenses at December 31, 2016 is P2,000. Cash in transit from Branch 2 to home office amounts to P4,000. 3. "Loading branch inventories" represents unrealized profit in beginning inventories of Branch 1 and Branch 2.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started