Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lionel is a council clerk living in Dundee, earning 20,500 a year after deductions for tax, National Insurance and pension contributions. He is about to

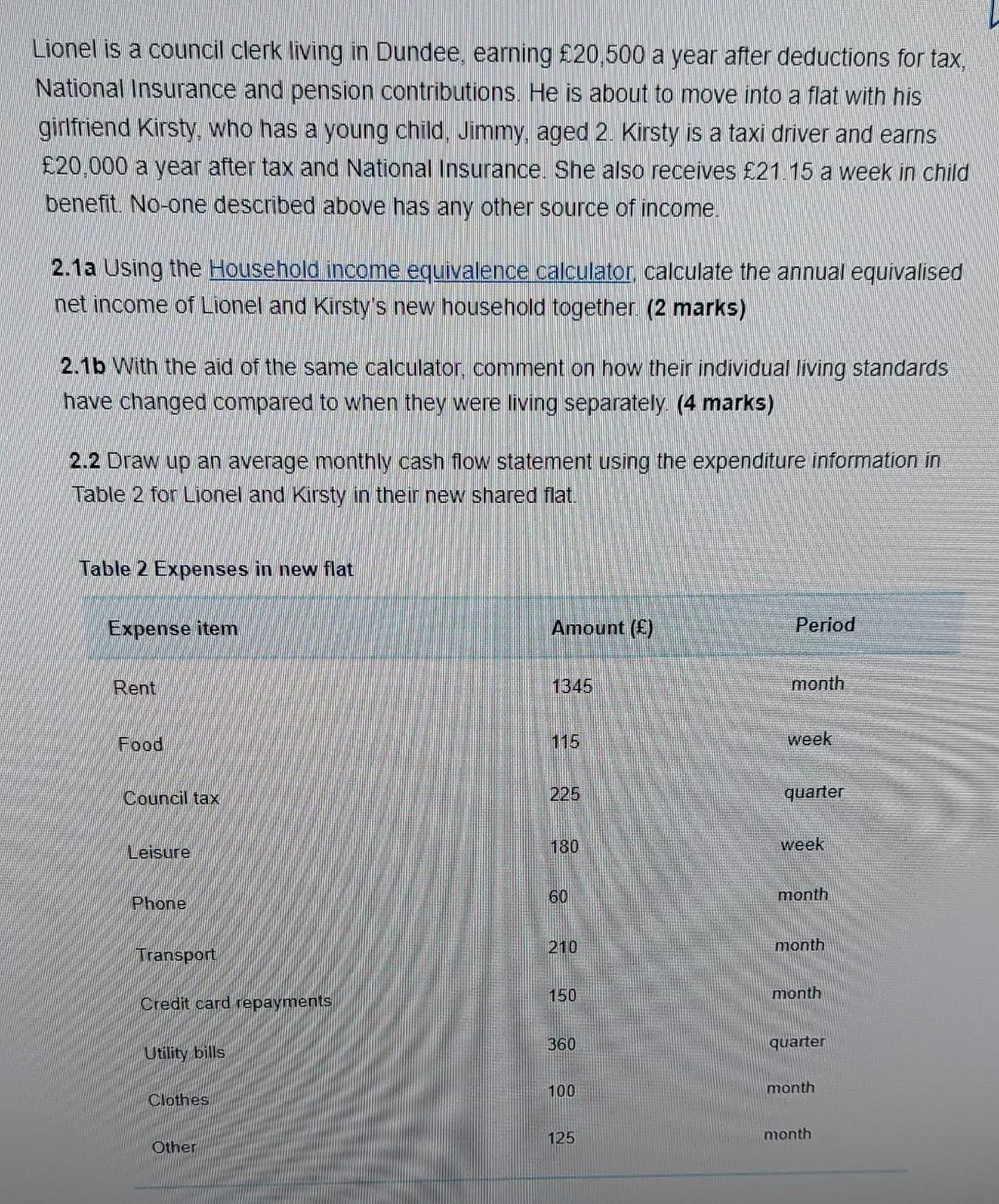

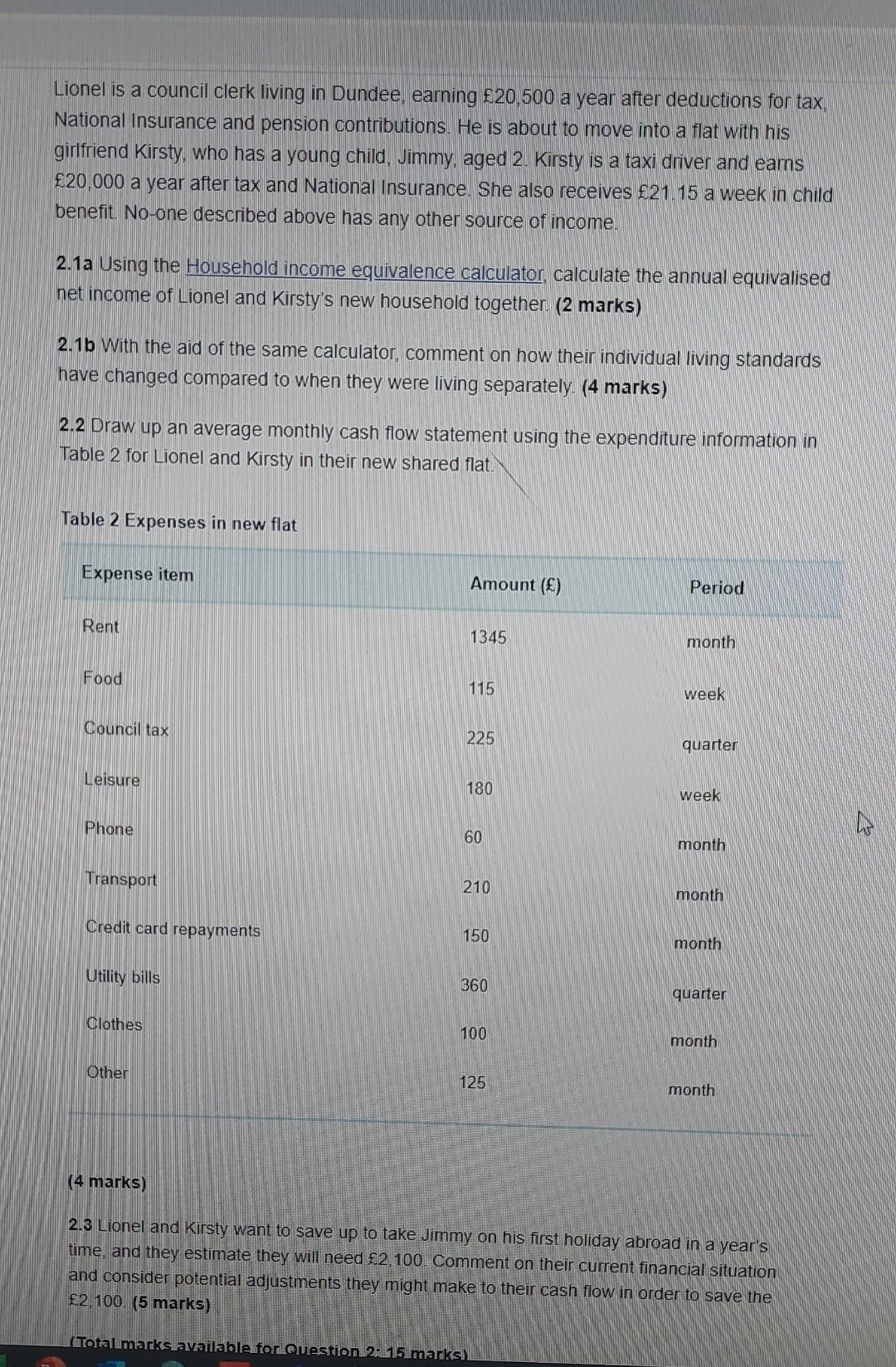

Lionel is a council clerk living in Dundee, earning 20,500 a year after deductions for tax, National Insurance and pension contributions. He is about to move into a flat with his girlfriend Kirsty, who has a young child, Jimmy, aged 2. Kirsty is a taxi driver and earns 20,000 a year after tax and National Insurance. She also receives 21.15 a week in child benefit. No-one described above has any other source of income. 2.1a Using the Household income equivalence calculator, calculate the annual equivalised net income of Lionel and Kirsty's new household together. (2 marks) 2.1b With the aid of the same calculator, comment on how their individual living standards have changed compared to when they were living separately. (4 marks) 2.2 Draw up an average monthly cash flow statement using the expenditure information in Table 2 for Lionel and Kirsty in their new shared flat. Table 2 Expenses in new flat Expense item Amount () Period Rent 1345 month Food 115 week Council tax 225 quarter Leisure 180 week Phone 60 month 210 month Transport 150 month Credit card repayments 360 quarter Utility bills 100 month Clothes 125 month Other Lionel is a council clerk living in Dundee, earning 20,500 a year after deductions for tax, National Insurance and pension contributions. He is about to move into a flat with his girlfriend Kirsty, who has a young child, Jimmy, aged 2. Kirsty is a taxi driver and ears 20,000 a year after tax and National Insurance. She also receives 21.15 a week in child benefit. No-one described above has any other source of income. 2.1a Using the Household income equivalence calculator, calculate the annual equivalised net income of Lionel and Kirsty's new household together. (2 marks) 2.1b With the aid of the same calculator, comment on how their individual living standards have changed compared to when they were living separately. (4 marks) 2.2 Draw up an average monthly cash flow statement using the expenditure information in Table 2 for Lionel and Kirsty in their new shared flat. Table 2 Expenses in new flat Expense item Amount () Period Rent 1345 month Food 115 week Council tax 225 quarter Leisure 180 week Phone 60 month 111111111 Transport 210 month Credit card repayments 150 month Utility bills 360 quarter Clothes 100 month Other 125 month (4 marks) 2.3 Lionel and Kirsty want to save up to take Jimmy on his first holiday abroad in a year's time, and they estimate they will need 2,100 Comment on their current financial situation and consider potential adjustments they might make to their cash flow in order to save the 2,100. (5 marks) Totallmarks available for Question 2015 marks) Lionel is a council clerk living in Dundee, earning 20,500 a year after deductions for tax, National Insurance and pension contributions. He is about to move into a flat with his girlfriend Kirsty, who has a young child, Jimmy, aged 2. Kirsty is a taxi driver and earns 20,000 a year after tax and National Insurance. She also receives 21.15 a week in child benefit. No-one described above has any other source of income. 2.1a Using the Household income equivalence calculator, calculate the annual equivalised net income of Lionel and Kirsty's new household together. (2 marks) 2.1b With the aid of the same calculator, comment on how their individual living standards have changed compared to when they were living separately. (4 marks) 2.2 Draw up an average monthly cash flow statement using the expenditure information in Table 2 for Lionel and Kirsty in their new shared flat. Table 2 Expenses in new flat Expense item Amount () Period Rent 1345 month Food 115 week Council tax 225 quarter Leisure 180 week Phone 60 month 210 month Transport 150 month Credit card repayments 360 quarter Utility bills 100 month Clothes 125 month Other Lionel is a council clerk living in Dundee, earning 20,500 a year after deductions for tax, National Insurance and pension contributions. He is about to move into a flat with his girlfriend Kirsty, who has a young child, Jimmy, aged 2. Kirsty is a taxi driver and ears 20,000 a year after tax and National Insurance. She also receives 21.15 a week in child benefit. No-one described above has any other source of income. 2.1a Using the Household income equivalence calculator, calculate the annual equivalised net income of Lionel and Kirsty's new household together. (2 marks) 2.1b With the aid of the same calculator, comment on how their individual living standards have changed compared to when they were living separately. (4 marks) 2.2 Draw up an average monthly cash flow statement using the expenditure information in Table 2 for Lionel and Kirsty in their new shared flat. Table 2 Expenses in new flat Expense item Amount () Period Rent 1345 month Food 115 week Council tax 225 quarter Leisure 180 week Phone 60 month 111111111 Transport 210 month Credit card repayments 150 month Utility bills 360 quarter Clothes 100 month Other 125 month (4 marks) 2.3 Lionel and Kirsty want to save up to take Jimmy on his first holiday abroad in a year's time, and they estimate they will need 2,100 Comment on their current financial situation and consider potential adjustments they might make to their cash flow in order to save the 2,100. (5 marks) Totallmarks available for Question 2015 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started