Answered step by step

Verified Expert Solution

Question

1 Approved Answer

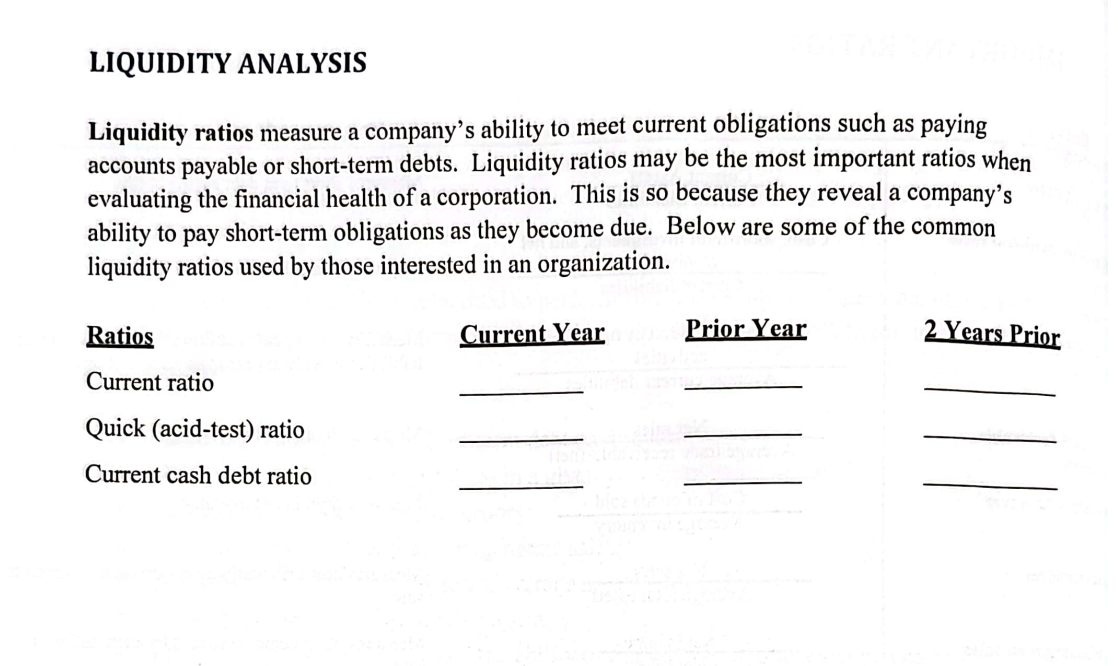

LIQUIDITY ANALYSIS Liquidity ratios measure a company's ability to meet current obligations such as paying accounts payable or short-term debts. Liquidity ratios may be

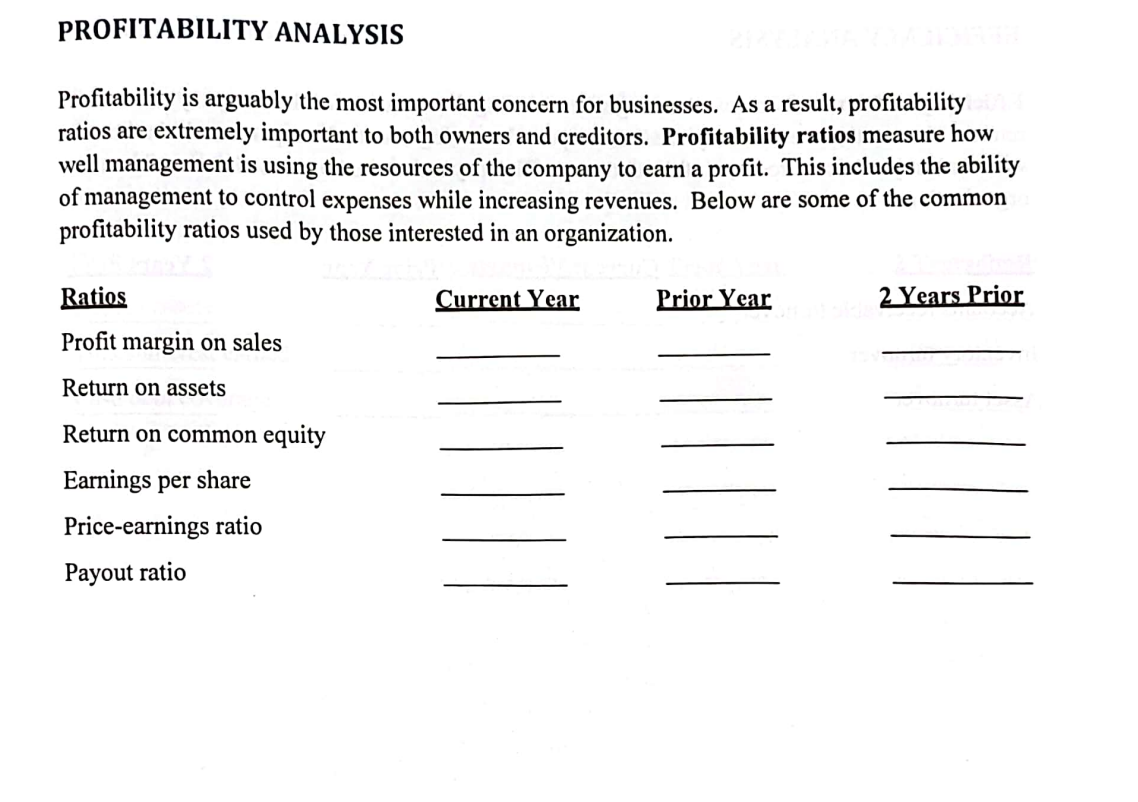

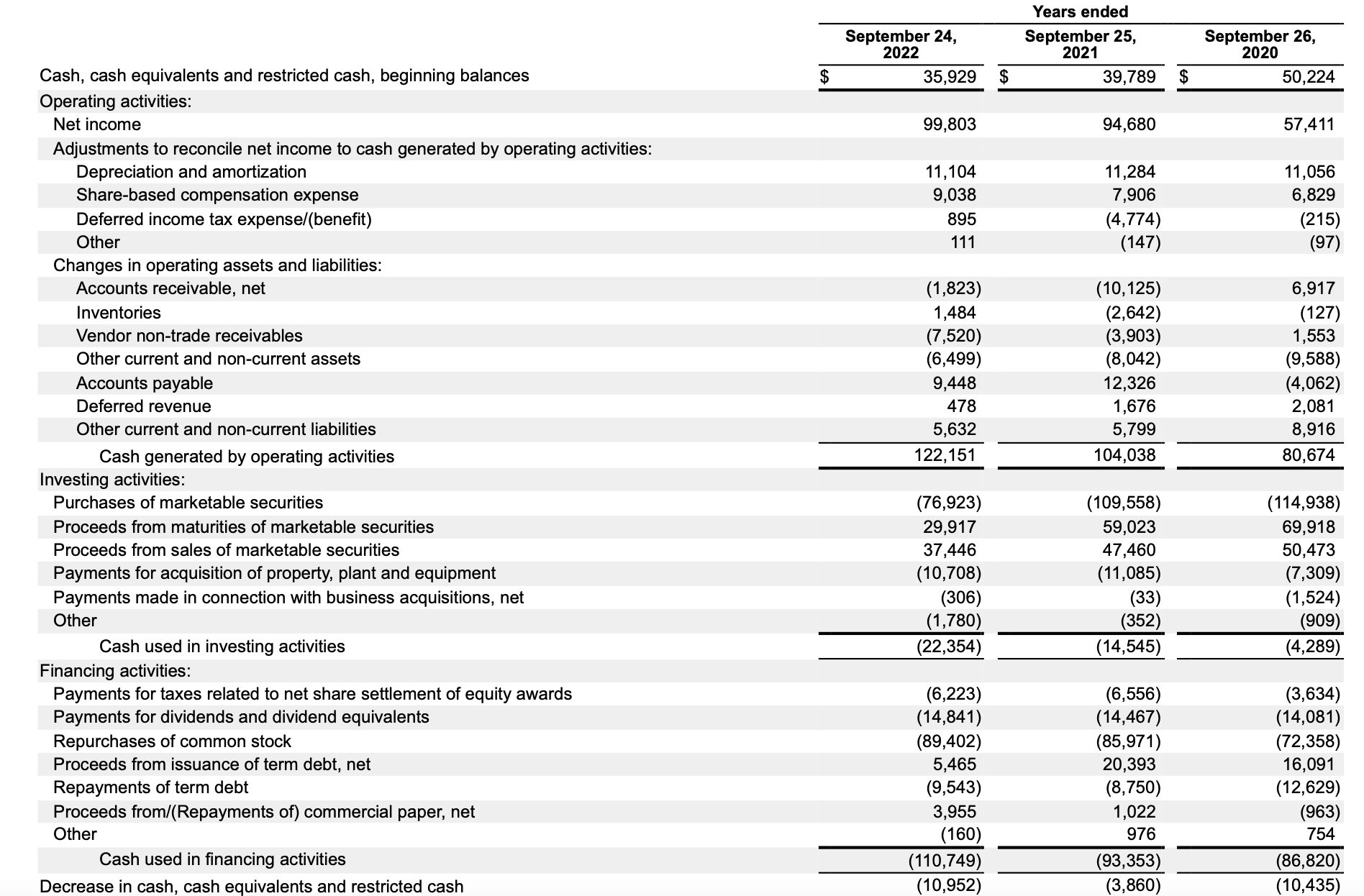

LIQUIDITY ANALYSIS Liquidity ratios measure a company's ability to meet current obligations such as paying accounts payable or short-term debts. Liquidity ratios may be the most important ratios when evaluating the financial health of a corporation. This is so because they reveal a company's ability to pay short-term obligations as they become due. Below are some of the common liquidity ratios used by those interested in an organization. Ratios Current ratio Quick (acid-test) ratio Current cash debt ratio Current Year dvda Prior Year 2 Years Prior PROFITABILITY ANALYSIS Profitability is arguably the most important concern for businesses. As a result, profitability ratios are extremely important to both owners and creditors. Profitability ratios measure how well management is using the resources of the company to earn a profit. This includes the ability of management to control expenses while increasing revenues. Below are some of the common profitability ratios used by those interested in an organization. Ratios Profit margin on sales Return on assets Return on common equity Earnings per share Price-earnings ratio Payout ratio Current Year Prior Year YOYONOMETER 2 Years Prior Cash, cash equivalents and restricted cash, beginning balances Operating activities: Net income Adjustments to reconcile net income to cash generated by operating activities: Depreciation and amortization Share-based compensation expense Deferred income tax expense/(benefit) Other Changes in operating assets and liabilities: Accounts receivable, net Inventories Vendor non-trade receivables Other current and non-current assets Accounts payable Deferred revenue Other current and non-current liabilities Cash generated by operating activities Investing activities: Purchases of marketable securities Proceeds from maturities of marketable securities Proceeds from sales of marketable securities Payments for acquisition of property, plant and equipment Payments made in connection with business acquisitions, net Other Cash used in investing activities Financing activities: Payments for taxes related to net share settlement of equity awards Payments for dividends and dividend equivalents Repurchases of common stock Proceeds from issuance of term debt, net Repayments of term debt Proceeds from/(Repayments of) commercial paper, net Other Cash used in financing activities Decrease in cash, cash equivalents and restricted cash $ September 24, 2022 35,929 99,803 11,104 9,038 895 111 (1,823) 1,484 (7,520) (6,499) 9,448 478 5,632 122,151 (76,923) 29,917 37,446 (10,708) (306) (1,780) (22,354) (6,223) (14,841) (89,402) 5,465 (9,543) 3,955 (160) (110,749) (10,952) $ Years ended September 25, 2021 39,789 94,680 11,284 7,906 (4,774) (147) (10,125) (2,642) (3,903) (8,042) 12,326 1,676 5,799 104,038 (109,558) 59,023 47,460 (11,085) (33) (352) (14,545) (6,556) (14,467) (85,971) 20,393 (8,750) 1,022 976 (93,353) (3,860) $ September 26, 2020 50,224 57,411 11,056 6,829 (215) (97) 6,917 (127) 1,553 (9,588) (4,062) 2,081 8,916 80,674 (114,938) 69,918 50,473 (7,309) (1,524) (909) (4,289) (3,634) (14,081) (72,358) 16,091 (12,629) (963) 754 (86,820) (10,435)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the changes in cash cash equivalents and restricted c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started