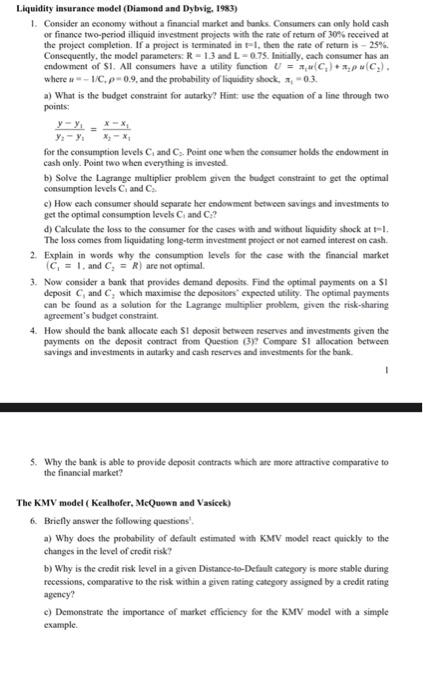

Liquidity insurance model (Diamond and Dybvig. 1983) 1. Consider an cconomy without a financial market and banks. Consumers can only hold cash or finance two-period illiquid investment projects with the rate of return of 30% received at the project completion. If a project is terminated in t1, then the rate of return is - 25% Consequently, the model parameters R-13 and L-075. Initially, cach consumer has an endowment of S1. All consumers have a utility function U = C)**,C). where # -- 1/C. p-0.9, and the probability of liquidity shock, 2-03. a) What is the budget constraint for autarky? Hint use the equation of a line through two points *-* YY X-X for the consumption levels C and Cs Point one when the consumer holds the endowment in cash only. Point two when everything is invested b) Solve the Lagrange multiplier problem given the budget constraint to get the optimal consumption levels C and C c) How each consumer should separate her endowment between savings and investments to get the optimal consumption levels and C? d) Calculate the loss to the consumer for the cases with and without liquidity shock at -1. The loss comes from liquidating long-term investment project or not eamed interest on cash. 2. Explain in words why the consumption levels for the case with the financial market C = 1. and C = R) are not optimal. 3. Now consider a bank that provides demand deposits. Find the optimal payments on a si deposit and C, which maximise the depositos expected utility. The optimal payments can be found as a solution for the Lagrange multiplier problem, given the risk-sharing agreement's budget constraint. 4. How should the bank allocate each si deposit between reserves and investments given the payments on the deposit contract from Question (3) Compare si allocation between savings and investments in autarky and cash reserves and investments for the bank 5. Why the bank is able to provide deposit contracts which are more attractive comparative to the financial market? m The KMV model (Kealhofer, MeQuown and Vasicek) 6. Briefly answer the following questions a) Why does the probability of default estimated with KMV model react quickly to the changes in the level of credit risk? b) Why is the credit risk level in a given Distance-to-Default Category is more stable during recessions, comparative to the risk within a given rating category assigned by a credit rating agency? c) Demonstrate the importance of market efficiency for the KMV model with a simple example, Liquidity insurance model (Diamond and Dybvig. 1983) 1. Consider an cconomy without a financial market and banks. Consumers can only hold cash or finance two-period illiquid investment projects with the rate of return of 30% received at the project completion. If a project is terminated in t1, then the rate of return is - 25% Consequently, the model parameters R-13 and L-075. Initially, cach consumer has an endowment of S1. All consumers have a utility function U = C)**,C). where # -- 1/C. p-0.9, and the probability of liquidity shock, 2-03. a) What is the budget constraint for autarky? Hint use the equation of a line through two points *-* YY X-X for the consumption levels C and Cs Point one when the consumer holds the endowment in cash only. Point two when everything is invested b) Solve the Lagrange multiplier problem given the budget constraint to get the optimal consumption levels C and C c) How each consumer should separate her endowment between savings and investments to get the optimal consumption levels and C? d) Calculate the loss to the consumer for the cases with and without liquidity shock at -1. The loss comes from liquidating long-term investment project or not eamed interest on cash. 2. Explain in words why the consumption levels for the case with the financial market C = 1. and C = R) are not optimal. 3. Now consider a bank that provides demand deposits. Find the optimal payments on a si deposit and C, which maximise the depositos expected utility. The optimal payments can be found as a solution for the Lagrange multiplier problem, given the risk-sharing agreement's budget constraint. 4. How should the bank allocate each si deposit between reserves and investments given the payments on the deposit contract from Question (3) Compare si allocation between savings and investments in autarky and cash reserves and investments for the bank 5. Why the bank is able to provide deposit contracts which are more attractive comparative to the financial market? m The KMV model (Kealhofer, MeQuown and Vasicek) 6. Briefly answer the following questions a) Why does the probability of default estimated with KMV model react quickly to the changes in the level of credit risk? b) Why is the credit risk level in a given Distance-to-Default Category is more stable during recessions, comparative to the risk within a given rating category assigned by a credit rating agency? c) Demonstrate the importance of market efficiency for the KMV model with a simple example