Answered step by step

Verified Expert Solution

Question

1 Approved Answer

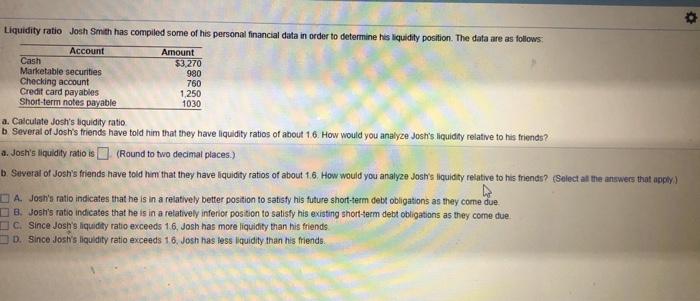

Liquidity ratio Josh Smith has compiled some of his personal financial data in order to determine his liquidity position. The data are as follows:

Liquidity ratio Josh Smith has compiled some of his personal financial data in order to determine his liquidity position. The data are as follows: Account Amount Cash Marketable securities Checking account Credit card payables Short-term notes payable $3,270 980 760 1,250 1030 a. Calculate Josh's liquidity ratio b Several of Josh's friends have told him that they have liquidity ratios of about 1.6. How would you analyze Josh's liquidity relative to his friends? a. Josh's liquidity ratio is (Round to two decimal places.) b. Several of Josh's friends have told him that they have liquidity ratios of about 1.6. How would you analyze Josh's liquidity relative to his friends? (Select all the answers that apply) A. Josh's ratio indicates that he is in a relatively better position to satisfy his future short-term debt obligations as they come due B. Josh's ratio indicates that he is in a relatively inferior position to satisfy his existing short-term debt obligations as they come due C. Since Josh's liquidity ratio exceeds 1.6, Josh has more liquidity than his friends. D. Since Josh's liquidity ratio exceeds 1.6, Josh has less liquidity than his friends. O

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Current Assets Cash Marketable securities checking account ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started