Answered step by step

Verified Expert Solution

Question

1 Approved Answer

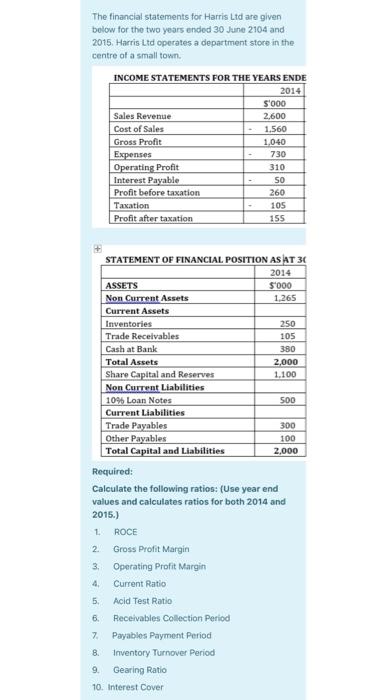

Liquidity Ratios: Current Ratio : Current Ratio = Current Assets / Current liabilities Quick Ratio: Quick Ratio = Current Assets less inventory / Current liabilities

Liquidity Ratios:

Current Ratio :

Current Ratio = Current Assets / Current liabilities

Quick Ratio:

Quick Ratio = Current Assets less inventory / Current liabilities

Profitability Ratios:

Return on Capital Employed/ROCE:

ROCE= Operating Profit before Interest and Tax/Capital Employed x 100

Gross Profit Margin:

Gross Profit Margin = Gross Profit / Net Sales x 100

Operating Profit Margin:

Operating Profit Margin= Operating Profit before interest and taxes / Net Sales x 100

Profit Margin:

Operating profit after income tax / Net Sales Revenue x 100

Cost/Sales Ratio:

Production cost of sales/ Sales x 100

Distribution and marketing costs/Sales x 100

Administrative Costs/Sales x 100

Market /Investor Ratios:

Earnings per share :

(Profit after income tax = Net profit provision for Tax)

Earnings per share=

Operating profits after income tax less Preference dividends / Number of ordinary shares issued

Price-earnings ratio :

Price-earnings ratio = Market price per ordinary share / Earnings per ordinary share

Dividend Cover:

Dividend Cover = Earnings per share/Dividend per share

Dividend Yield:

Dividend Yield = Dividend of the share for the year / Current market value of the share x 100

Capital Employed Formula:

Capital employed = non-current assets + investments + current assets current liabilities

Capital employed =share capital + reserves + long term liabilities

Efficiency Ratios:

Receivables turnover:

Receivables turnover=Net sales revenue / Average receivables balance

Average collection period:

Average collection period = Average receivables balance x 365 (12) / Net sales revenue

or

No of days or months/Receivables Turnover Ratio

Inventory turnover:

Inventory turnover= Cost of goods sold / Average inventory

Payables Turnover ratio :

Payables Turnover ratio = Net Credit Purchases / Average Payables

Average Payment period :

Average Payment period = Average Payables x 365 (12) / Net purchases OR

No of days or months/ Payables Turnover Ratio

Fixed Assets turnover ratio:

Fixed Assets turnover ratio = Net sales revenue / Average total assets

Working Capital Turnover:

Working Capital Turnover= Net Sales / Working Capital

Assets turnover: (Working Capital Turnover)

Assets Turnover= Net Sales / Net assets

Gearing/Financial stability ratio/Solvency/Leverage:

Gearing Ratio:

Gearing Ratio =(Total Long Term Debt + Preference Share Capital)/ Total Capital employed x 100

Times interest earned/ Interest Cover Ratio:

Times interest earned/ Interest Cover Ratio=Operating profit before income tax + Interest expense / Interest expense on long term debts

Liquidity Ratios:

Current Ratio :

Current Ratio = Current Assets / Current liabilities

Quick Ratio:

Quick Ratio = Current Assets less inventory / Current liabilities

Profitability Ratios:

Return on Capital Employed/ROCE:

ROCE= Operating Profit before Interest and Tax/Capital Employed x 100

Gross Profit Margin:

Gross Profit Margin = Gross Profit / Net Sales x 100

Operating Profit Margin:

Operating Profit Margin= Operating Profit before interest and taxes / Net Sales x 100

Profit Margin:

Operating profit after income tax / Net Sales Revenue x 100

Cost/Sales Ratio:

Production cost of sales/ Sales x 100

Distribution and marketing costs/Sales x 100

Administrative Costs/Sales x 100

Market /Investor Ratios:

Earnings per share :

(Profit after income tax = Net profit provision for Tax)

Earnings per share=

Operating profits after income tax less Preference dividends / Number of ordinary shares issued

Price-earnings ratio :

Price-earnings ratio = Market price per ordinary share / Earnings per ordinary share

Dividend Cover:

Dividend Cover = Earnings per share/Dividend per share

Dividend Yield:

Dividend Yield = Dividend of the share for the year / Current market value of the share x 100

Capital Employed Formula:

Capital employed = non-current assets + investments + current assets current liabilities

Capital employed =share capital + reserves + long term liabilities

Efficiency Ratios:

Receivables turnover:

Receivables turnover=Net sales revenue / Average receivables balance

Average collection period:

Average collection period = Average receivables balance x 365 (12) / Net sales revenue

or

No of days or months/Receivables Turnover Ratio

Inventory turnover:

Inventory turnover= Cost of goods sold / Average inventory

Payables Turnover ratio :

Payables Turnover ratio = Net Credit Purchases / Average Payables

Average Payment period :

Average Payment period = Average Payables x 365 (12) / Net purchases OR

No of days or months/ Payables Turnover Ratio

Fixed Assets turnover ratio:

Fixed Assets turnover ratio = Net sales revenue / Average total assets

Working Capital Turnover:

Working Capital Turnover= Net Sales / Working Capital

Assets turnover: (Working Capital Turnover)

Assets Turnover= Net Sales / Net assets

Gearing/Financial stability ratio/Solvency/Leverage:

Gearing Ratio:

Gearing Ratio =(Total Long Term Debt + Preference Share Capital)/ Total Capital employed x 100

Times interest earned/ Interest Cover Ratio:

Times interest earned/ Interest Cover Ratio=Operating profit before income tax + Interest expense / Interest expense on long term debts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started