Answered step by step

Verified Expert Solution

Question

1 Approved Answer

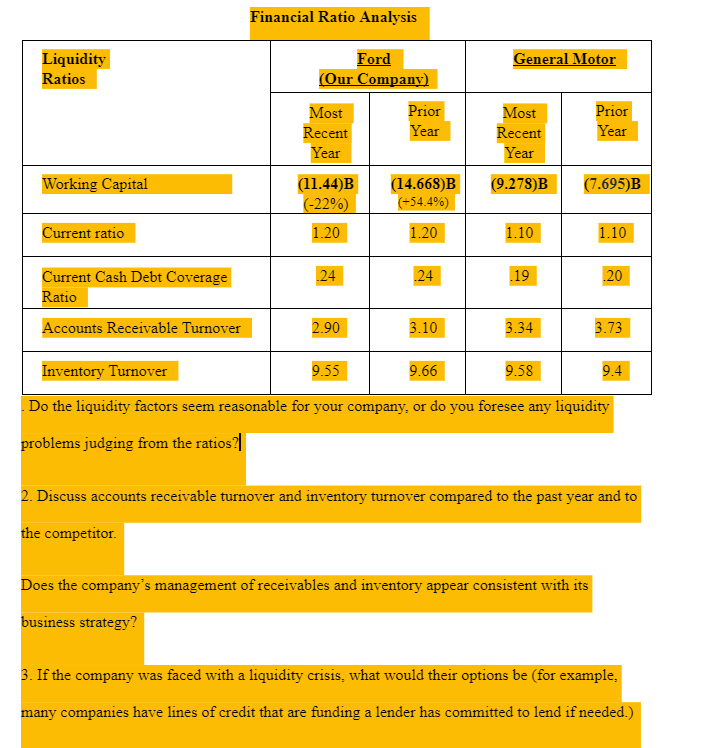

Liquidity Ratios Working Capital Current ratio Current Cash Debt Coverage Ratio Accounts Receivable Turnover Financial Ratio Analysis Ford (Our Company) Most Recent Year (11.44)B

Liquidity Ratios Working Capital Current ratio Current Cash Debt Coverage Ratio Accounts Receivable Turnover Financial Ratio Analysis Ford (Our Company) Most Recent Year (11.44)B (-22%) 1.20 24 2.90 Prior Year (14.668)B (+54.4%) 1.20 .24 3.10 General Motor Most Recent Year (9.278)B 1.10 19 3.34 9.58 Prior Year (7.695)B 1.10 Does the company's management of receivables and inventory appear consistent with its business strategy? 20 Inventory Turnover 9.55 9.66 . Do the liquidity factors seem reasonable for your company, or do you foresee any liquidity problems judging from the ratios? 3.73 9.4 2. Discuss accounts receivable turnover and inventory turnover compared to the past year and to the competitor. 3. If the company was faced with a liquidity crisis, what would their options be (for example, many companies have lines of credit that are funding a lender has committed to lend if needed.)

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Solution Based on the liquidity ratios provided it appears that Fords liquidity has decreased in the most recent year compared to the prior year The w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started