Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Liquor Ltd sells liquor in special barrels. It purchases the barrels at GHC15 each but the barrels are valued at GHC12 each for stock

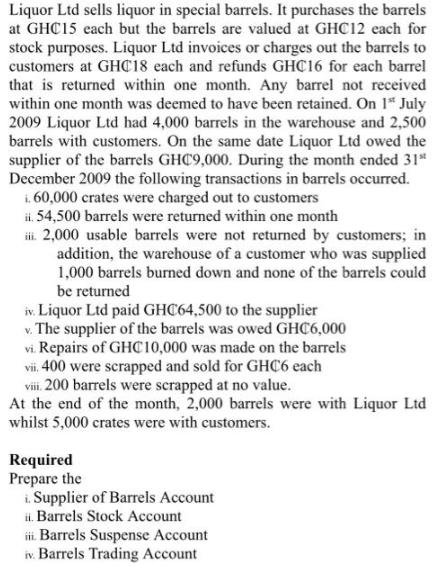

Liquor Ltd sells liquor in special barrels. It purchases the barrels at GHC15 each but the barrels are valued at GHC12 each for stock purposes. Liquor Ltd invoices or charges out the barrels to customers at GHC18 each and refunds GHC16 for each barrel that is returned within one month. Any barrel not received within one month was deemed to have been retained. On 1" July 2009 Liquor Ltd had 4,000 barrels in the warehouse and 2,500 barrels with customers. On the same date Liquor Ltd owed the supplier of the barrels GHC9,000. During the month ended 31st December 2009 the following transactions in barrels occurred. i. 60,000 crates were charged out to customers ii. 54,500 barrels were returned within one month iii. 2,000 usable barrels were not returned by customers; in addition, the warehouse of a customer who was supplied 1,000 barrels burned down and none of the barrels could be returned iv. Liquor Ltd paid GHC64,500 to the supplier v. The supplier of the barrels was owed GHC6,000 vi. Repairs of GHC10,000 was made on the barrels vii. 400 were scrapped and sold for GHC6 each viii. 200 barrels were scrapped at no value. At the end of the month, 2,000 barrels were with Liquor Ltd whilst 5,000 crates were with customers. Required Prepare the i. Supplier of Barrels Account ii. Barrels Stock Account iii. Barrels Suspense Account iv. Barrels Trading Account

Step by Step Solution

★★★★★

3.28 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Supplier of Barrels Account Opening Balance owed GHC9000 Payment to Supplier GHC64500 Closing Balanc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started