Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lisa and Collin are married. Lisa works as an engineer and earns a salary of $207,000. For this tax year, Lisa's employer mailed her

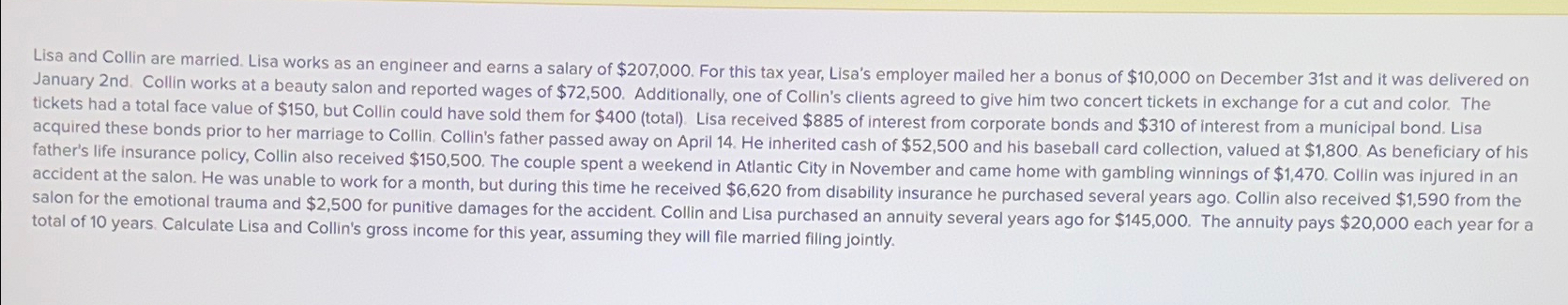

Lisa and Collin are married. Lisa works as an engineer and earns a salary of $207,000. For this tax year, Lisa's employer mailed her a bonus of $10,000 on December 31st and it was delivered on January 2nd. Collin works at a beauty salon and reported wages of $72,500. Additionally, one of Collin's clients agreed to give him two concert tickets in exchange for a cut and color. The tickets had a total face value of $150, but Collin could have sold them for $400 (total). Lisa received $885 of interest from corporate bonds and $310 of interest from a municipal bond. Lisa acquired these bonds prior to her marriage to Collin. Collin's father passed away on April 14. He inherited cash of $52,500 and his baseball card collection, valued at $1,800. As beneficiary of his father's life insurance policy, Collin also received $150,500. The couple spent a weekend in Atlantic City in November and came home with gambling winnings of $1,470. Collin was injured in an accident at the salon. He was unable to work for a month, but during this time he received $6,620 from disability insurance he purchased several years ago. Collin also received $1,590 from the salon for the emotional trauma and $2,500 for punitive damages for the accident. Collin and Lisa purchased an annuity several years ago for $145,000. The annuity pays $20,000 each year for a total of 10 years. Calculate Lisa and Collin's gross income for this year, assuming they will file married filing jointly.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Lisa and Collins gross income for the year we need to consider all the different source...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started