Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lisa earns $59,280 per year. She is married and claims three allowances. Assume that her employer uses wage bracket tables method. Use withholding allowance ,

Lisa earns $59,280 per year. She is married and claims three allowances. Assume that her employer uses wage bracket tables method. Use withholding allowance, wage bracket table and IRS Publication 15.

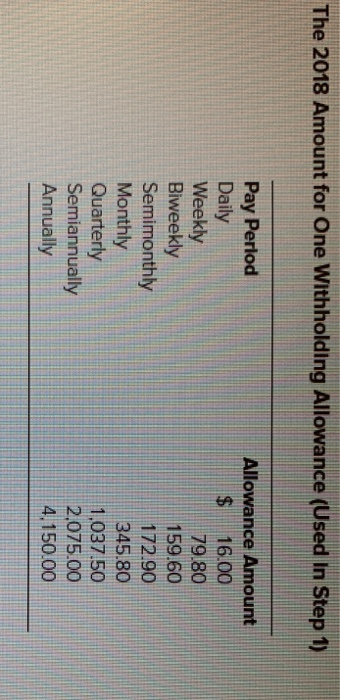

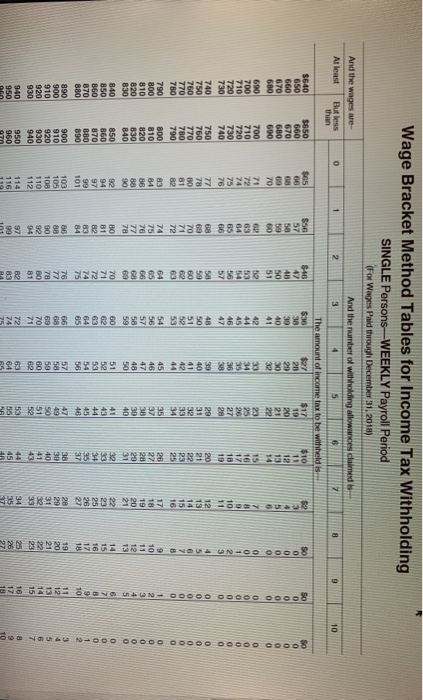

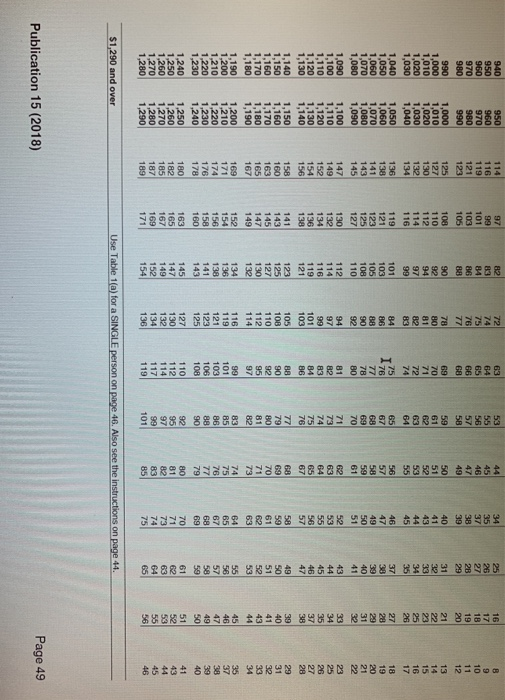

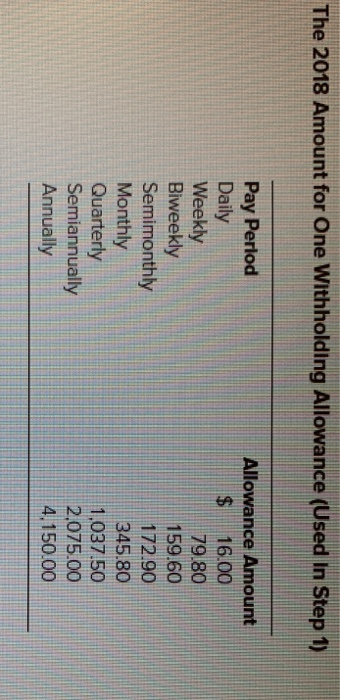

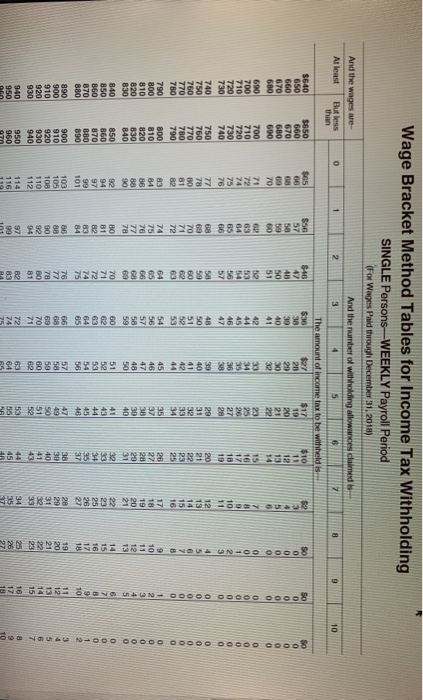

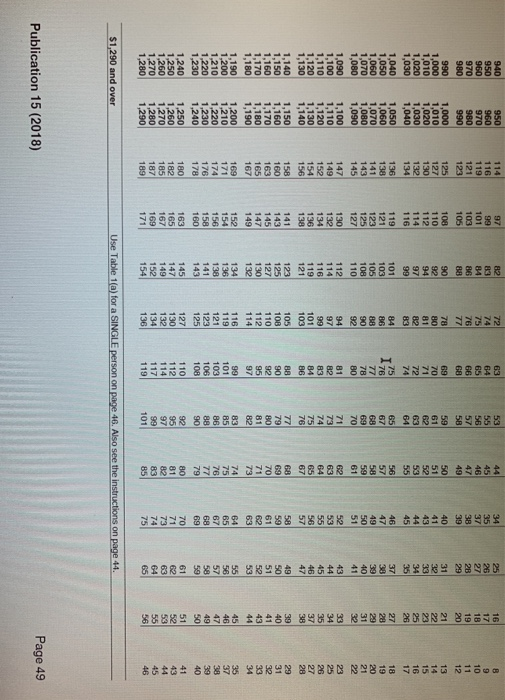

RM a cia S unee dilowances. ASSume that her emplover uses wage bracket tables method. Use withholding allowance, wage bracket table and IRS Publication 15 a. If she is paid weekly, what is her withholding per paycheck? b. If she is paid monthly, what is her withholding per paycheck? c. If she is paid biweekly, what is her withholding per paycheck? d. If she is paid semimonthly, what is her withholding per paycheck? a. Withholdings per paycheck b. Withholdings per paycheck c Withholdings per paycheck d. Withholdings per paycheck The 2018 Amount for One Withholding Allowance (Used In Step 1) Pay Perlod Daily Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Annually Allowance Amount $ 16.00 79.80 159.60 172.90 345.80 1,037.50 2,075.00 4,150.00 8828 8888 9 88888R8 88882 88888 28IS 8 8 2888 8898 8 oaNaunu N-oo0 o00oo o0000 000O0 000o8 Wage Bracket Method Tables for Income Tax Withholding SINGLE Persons-WEEKLY Payroll Period (For Wages Paid through December 31, 2018) And the wages are- And the number of withholding allowances claimesd is At least 1 3 But less than 2 4 10 he amount of income tax to be withheld is 10 $650 660 670 680 690 $17 S640 650 660 670 680 11 900 910 103 105 108 110 920 930 940 950 112 114 960 116 89898 898 R8M 8883 28898 8898 988 982 8898898888 88888 828R2 888 940 950 960 970 980 114 97 116 119 121 123 101 103 105 108 066 1,000 1,010 1,000 1,010 1,020 1,030 110 1,020 1,030 1,040 1,050 1,060 1,070 1,080 1,090 112 114 116 1,040 1,050 1,060 1,070 1,080 136 119 138 105 108 110 141 143 145 1,090 1,100 1,110 1,120 1,130 1,100 1,110 1,120 1,130 1,140 147 112 114 116 119 149 152 154 156 121 123 105 1,140 1,150 1,160 1,170 1,180 1,150 1,160 1,170 1,180 1,190 158 141 160 143 108 110 163 145 165 147 112 167 149 114 1,200 1,210 1.220 1,230 1,240 1,250 1,260 1,270 1,280 1,290 1,190 1,200 1,210 1,220 1,230 169 171 152 116 119 174 121 176 123. 178 125 163 145 180 182 127 130 132 134 110 1,240 1,250 1,260 1,270 1,280 112 114 165. 147 149 152 154 167 169 117 171 136 119 $1,290 and over Use Table 1(a) for a SINGLE person on page 46. Also see the instructions on page 44. Publication 15 (2018) Page 49

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started