Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lisa Hunter's company, Hunter Environmental Consulting (HEC), in the first month of her business Transaction 1: Starting the Business Hunter invests $250,000 of her

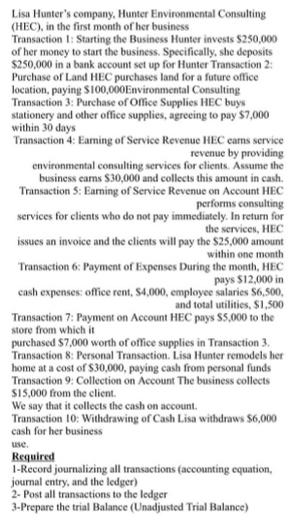

Lisa Hunter's company, Hunter Environmental Consulting (HEC), in the first month of her business Transaction 1: Starting the Business Hunter invests $250,000 of her money to start the business. Specifically, she deposits $250,000 in a bank account set up for Hunter Transaction 2: Purchase of Land HEC purchases land for a future office location, paying $100,000Environmental Consulting Transaction 3: Purchase of Office Supplies HEC buys stationery and other office supplies, agreeing to pay $7,000 within 30 days Transaction 4: Earning of Service Revenue HEC cars service revenue by providing environmental consulting services for clients. Assume the business carns $30,000 and collects this amount in cash. Transaction 5: Earning of Service Revenue on Account HEC performs consulting services for clients who do not pay immediately. In return for the services, HEC issues an invoice and the clients will pay the $25,000 amount within one month Transaction 6: Payment of Expenses During the month, HEC pays $12,000 in cash expenses: office rent, $4,000, employee salaries $6,500, and total utilities, $1,500 Transaction 7: Payment on Account HEC pays $5,000 to the store from which it purchased $7,000 worth of office supplies in Transaction 3. Transaction 8: Personal Transaction. Lisa Hunter remodels her home at a cost of $30,000, paying cash from personal funds Transaction 9: Collection on Account The business collects $15,000 from the client. We say that it collects the cash on account. Transaction 10: Withdrawing of Cash Lisa withdraws $6,000 cash for her business Required 1-Record journalizing all transactions (accounting equation, journal entry, and the ledger) 2- Post all transactions to the ledger 3-Prepare the trial Balance (Unadjusted Trial Balance)

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Journals Transaction 1 Cash Lisa Capital Transaction 2 Land Cash Transaction 3 Office suppli...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started