Question

Lisa Jonas founded Modern Inc., a leading manufacturer of custom wood and upholstered furniture, in 1995. Its head office and main manufacturing facility are in

Lisa Jonas founded Modern Inc., a leading manufacturer of custom wood and upholstered furniture, in 1995. Its head office and main manufacturing facility are in Montreal. Modern reports under accounting standards for private enterprises (ASPE).

Ten years ago, Lisa’s nephew, Darren Carter, became the controller of the company. At first, Darren was very focused on the company. He instituted many worthwhile changes and improved the financial reporting process. More recently, however, Darren’s attention has shifted to a petroleum exploration venture that he and a couple of his university colleagues are pursuing.

On June 1 of this year, Darren resigned from Modern, acknowledging that he was spreading himself too thin. Lisa was understanding, but disappointed that none of her family wished to be actively involved in the business.

Lisa will be turning 64 this year and is starting to think about retirement. Currently, she personally guarantees the company’s bank loans; however, she is in discussions with the bank to remove this personal guarantee. Lisa feels that the company is financially healthy and profitable, and she is hoping that the bank will see that when the financial statements and this year’s review report are issued.

Lisa is also considering selling her business in the next six months or so. She has reached out to a valuations expert who indicated to her that the value of the company will be based on a multiplier of net income. Lisa’s investment in the business is her primary source of savings for retirement.

Task #1

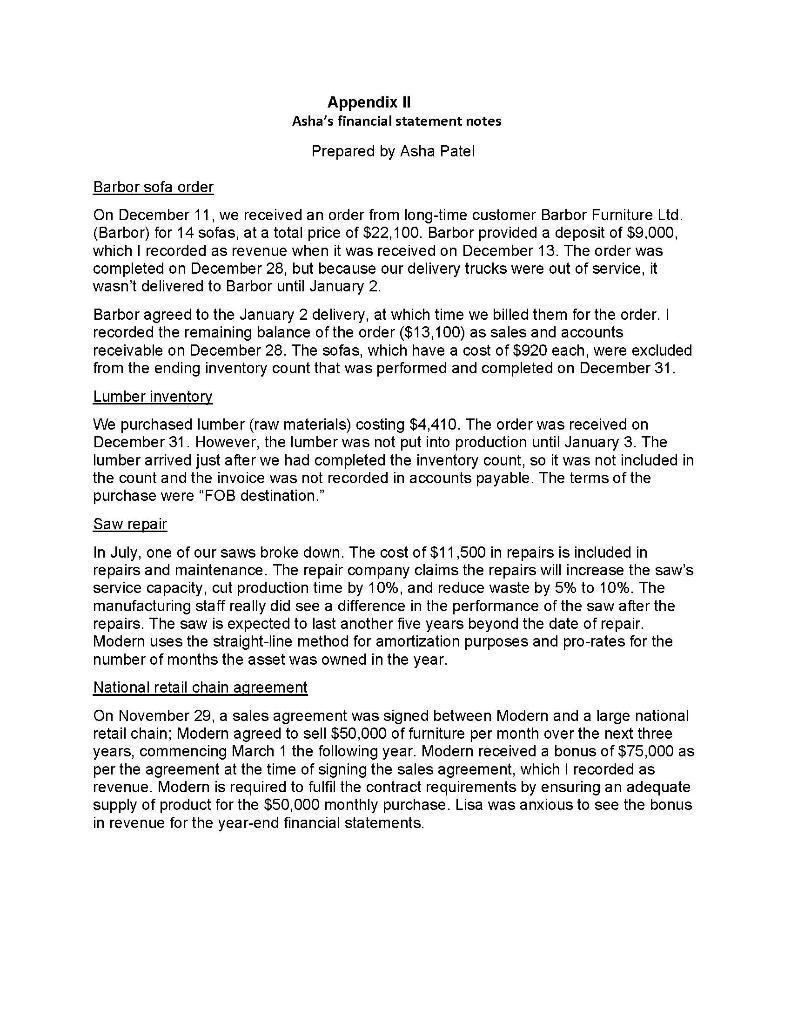

Lisa has come to you, CPA, for financial advisory services. Asha Patel, the accounting clerk who has been filling in for Darren, has some questions on financial reporting issues. She has sent over the draft financial statements (Appendix I) and her questions (Appendix II). Lisa has asked you to respond to Asha’s queries.

Lisa has also asked you to determine whether Modern is in compliance with its term loan bank covenant and, if necessary, provide next steps regarding the results of your covenant calculation.

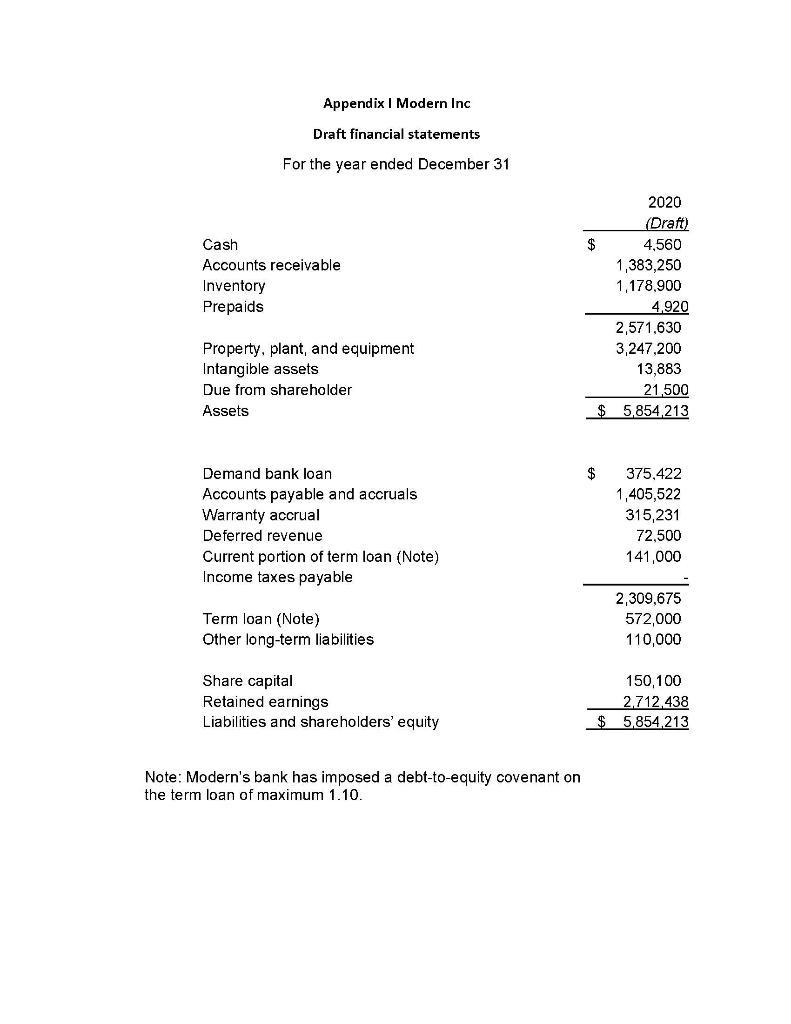

Appendix I Modern Inc Draft financial statements For the year ended December 31 Cash Accounts receivable Inventory Prepaids Property, plant, and equipment Intangible assets Due from shareholder Assets Demand bank loan Accounts payable and accruals Warranty accrual Deferred revenue Current portion of term loan (Note) Income taxes payable Term loan (Note) Other long-term liabilities Share capital Retained earnings Liabilities and shareholders' equity Note: Modern's bank has imposed a debt-to-equity covenant on the term loan of maximum 1.10. $ 2020 (Draft) 4,560 $ 1,383,250 1,178,900 4,920 2,571,630 3,247,200 13,883 21,500 $5,854,213 375.422 1,405,522 315,231 72,500 141,000 2,309,675 572,000 110,000 150,100 2,712,438 $ 5,854,213

Step by Step Solution

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

3 3 I will address Ashas questions regarding the draft financial statements Appendix I and then provide guidance on assessing compliance with the term loan bank covenant Ashas Questions on the Draft F...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started