Answered step by step

Verified Expert Solution

Question

1 Approved Answer

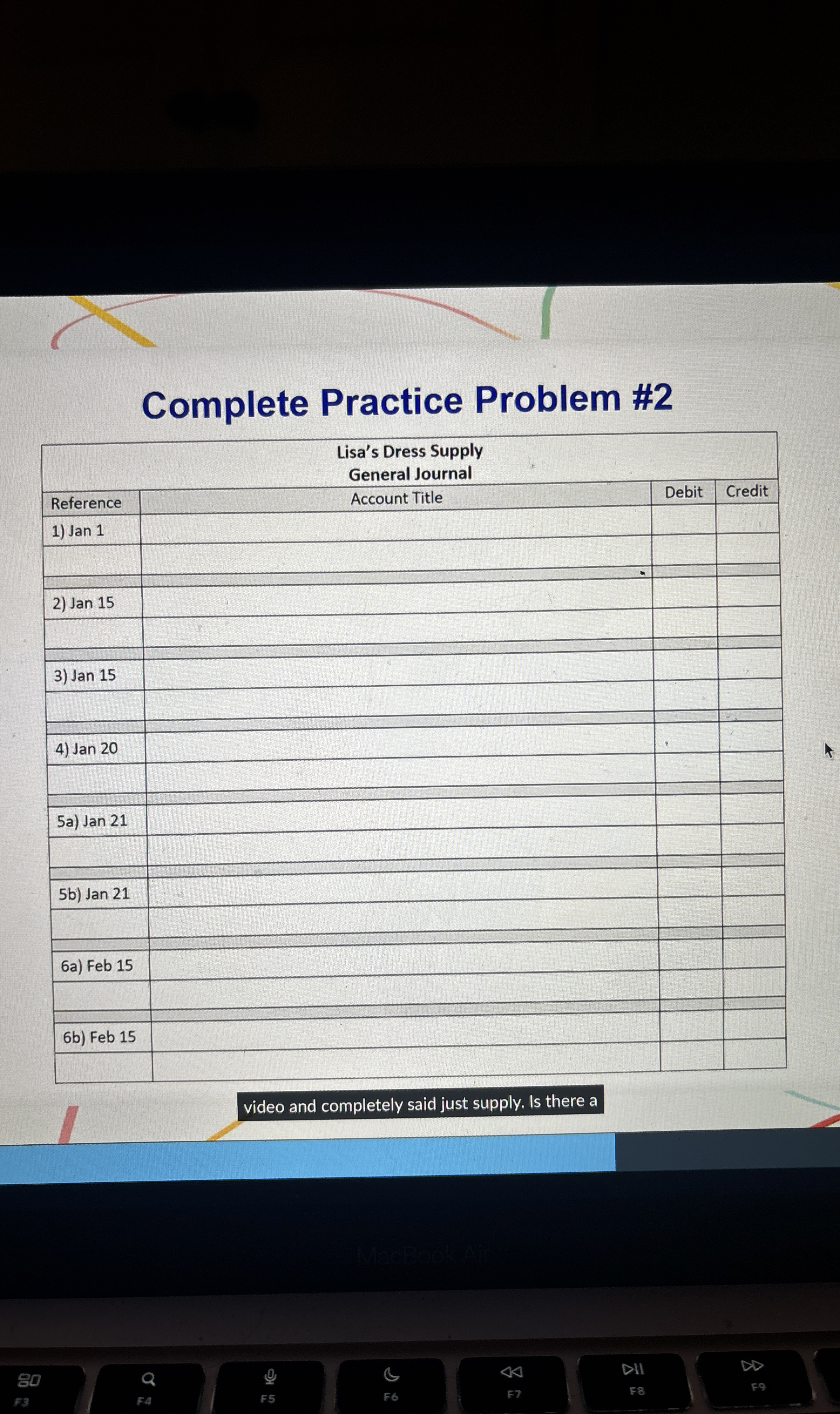

Lisa's Dress Supply ( LDS ) , a garment wholesaler, experienced the following events in Year 1 , its first year of operations. LDS uses

Lisa's Dress Supply LDS a garment wholesaler, experienced the following events in Year its first year of

operations. LDS uses the perpetual inventory method.

LDS was started when it issued common stock for $ cash.

LDS purchased on account inventory with a list price of $ Payment terms were LDS

records inventory transactions at the gross amount.

The freight terms for the merchandise delivered in Event No were FOB shipping point. LDS paid the

freight cost of $ in cash.

An inspection revealed that merchandise with a list price of $ purchased in Event No was

defective. LDS returned this merchandise to its supplier for credit.

LDS paid within the discount period for the inventory purchased in Event No

LDS sold inventory to various retail store customers on account. LDS offers customers payment terms

of The list price for the sales was $ The cost of the inventory sold was $

Customers returned some goods LDS had sold in Event No The goods had been sold for a list price

of $ and had a cost of $

LDS paid in cash freight cost of $ for goods delivered to customers FOB destination.

LDS collected cash from customers who paid off accounts receivable with a list price of $ within

the day discount period.

LDS paid $ in cash for other operating expenses.

Complete Practice Problem #

video and completely said just supply. Is there a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started