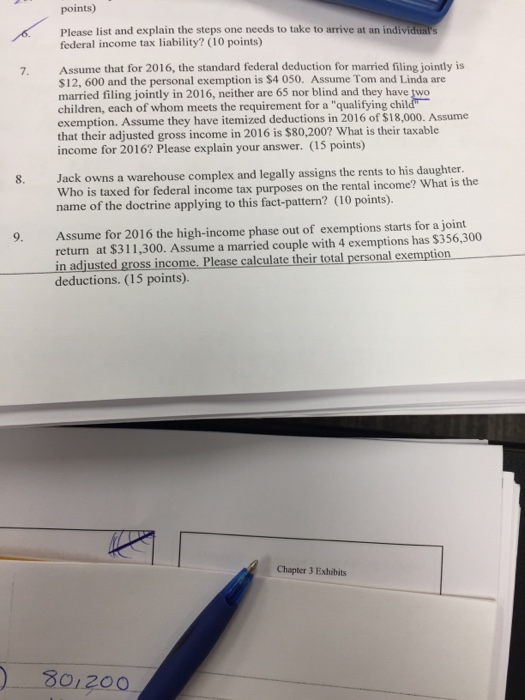

List and explain the steps one needs to take to arrive at an individual's federal income tax liability? Assume that for 2016, the standard federal deduction for married filing jointly is $12, 600 and the personal exemption is $4 050. Assume Tom and Linda are married filing jointly in 2016, neither arc 65 nor blind and they have two children, each of whom meets the requirement for a "qualifying child" exemption. Assume they have itemized deductions in 2016 of $18,000. Assume that their adjusted gross income in 2016 is $80, 200? What is their taxable income for 2016? Please explain your answer. Jack owns a warehouse complex and legally assigns the rents to his daughter. Who is taxed for federal income tax purposes on the rental income? What is the name of the doctrine applying to this fact-pattern? Assume for 2016 the high-income phase out of exemptions starts for a joint return at $311, 300. Assume a married couple with 4 exemptions has $356, 300 in adjusted gross income. Please calculate their total personal exemption deductions. List and explain the steps one needs to take to arrive at an individual's federal income tax liability? Assume that for 2016, the standard federal deduction for married filing jointly is $12, 600 and the personal exemption is $4 050. Assume Tom and Linda are married filing jointly in 2016, neither arc 65 nor blind and they have two children, each of whom meets the requirement for a "qualifying child" exemption. Assume they have itemized deductions in 2016 of $18,000. Assume that their adjusted gross income in 2016 is $80, 200? What is their taxable income for 2016? Please explain your answer. Jack owns a warehouse complex and legally assigns the rents to his daughter. Who is taxed for federal income tax purposes on the rental income? What is the name of the doctrine applying to this fact-pattern? Assume for 2016 the high-income phase out of exemptions starts for a joint return at $311, 300. Assume a married couple with 4 exemptions has $356, 300 in adjusted gross income. Please calculate their total personal exemption deductions