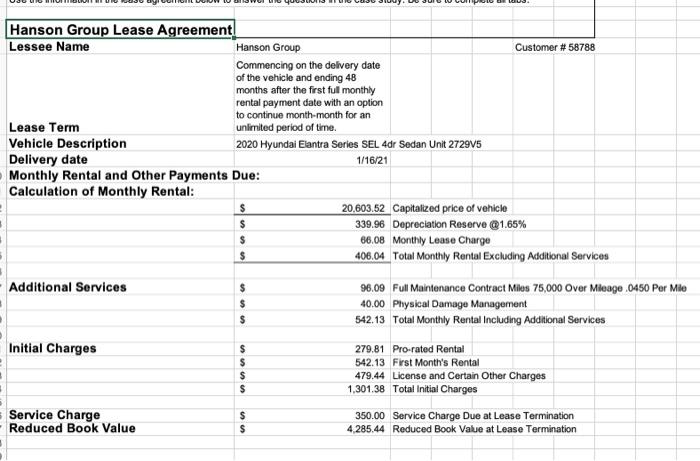

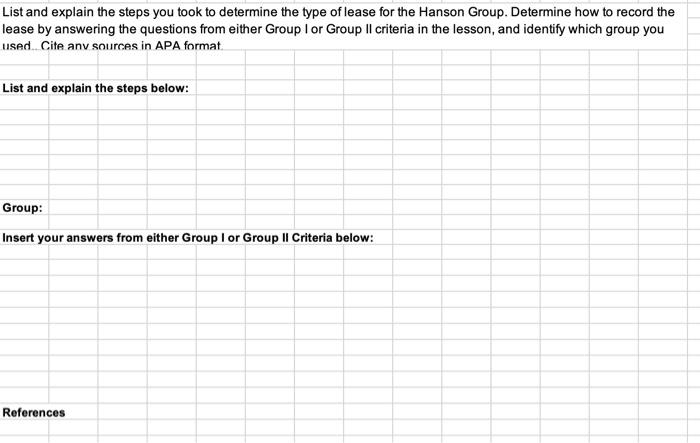

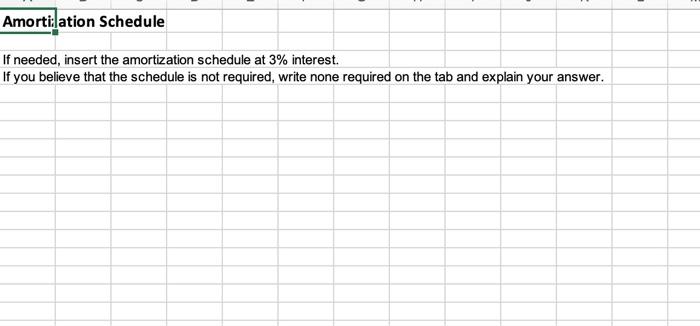

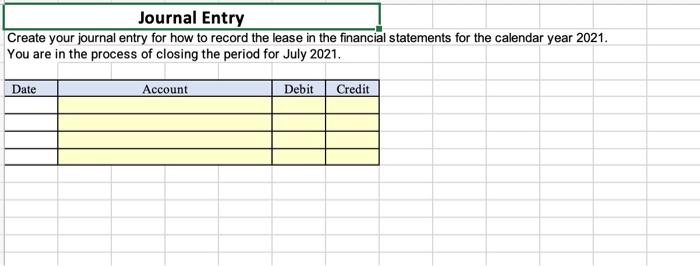

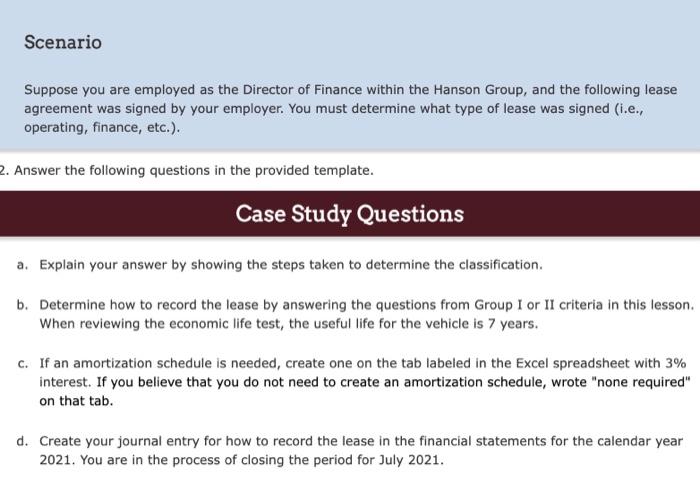

List and explain the steps you took to determine the type of lease for the Hanson Group. Determine how to record the lease by answering the questions from either Group I or Group II criteria in the lesson, and identify which group you used Cite anv sources in APA format. List and explain the steps below: Group: Insert your answers from either Group I or Group II Criteria below: References If needed, insert the amortization schedule at 3% interest. If you believe that the schedule is not required, write none required on the tab and explain your answer. Create your journal entry for how to record the lease in the financial statements for the calendar year 2021. You are in the process of closing the period for July 2021. Scenario Suppose you are employed as the Director of Finance within the Hanson Group, and the following lease agreement was signed by your employer. You must determine what type of lease was signed (i.e., operating, finance, etc.). . Answer the following questions in the provided template. Case Study Questions a. Explain your answer by showing the steps taken to determine the classification. b. Determine how to record the lease by answering the questions from Group I or II criteria in this lesson. When reviewing the economic life test, the useful life for the vehicle is 7 years. c. If an amortization schedule is needed, create one on the tab labeled in the Excel spreadsheet with 3% interest. If you believe that you do not need to create an amortization schedule, wrote "none required" on that tab. d. Create your journal entry for how to record the lease in the financial statements for the calendar year 2021. You are in the process of closing the period for July 2021. List and explain the steps you took to determine the type of lease for the Hanson Group. Determine how to record the lease by answering the questions from either Group I or Group II criteria in the lesson, and identify which group you used Cite anv sources in APA format. List and explain the steps below: Group: Insert your answers from either Group I or Group II Criteria below: References If needed, insert the amortization schedule at 3% interest. If you believe that the schedule is not required, write none required on the tab and explain your answer. Create your journal entry for how to record the lease in the financial statements for the calendar year 2021. You are in the process of closing the period for July 2021. Scenario Suppose you are employed as the Director of Finance within the Hanson Group, and the following lease agreement was signed by your employer. You must determine what type of lease was signed (i.e., operating, finance, etc.). . Answer the following questions in the provided template. Case Study Questions a. Explain your answer by showing the steps taken to determine the classification. b. Determine how to record the lease by answering the questions from Group I or II criteria in this lesson. When reviewing the economic life test, the useful life for the vehicle is 7 years. c. If an amortization schedule is needed, create one on the tab labeled in the Excel spreadsheet with 3% interest. If you believe that you do not need to create an amortization schedule, wrote "none required" on that tab. d. Create your journal entry for how to record the lease in the financial statements for the calendar year 2021. You are in the process of closing the period for July 2021