Answered step by step

Verified Expert Solution

Question

1 Approved Answer

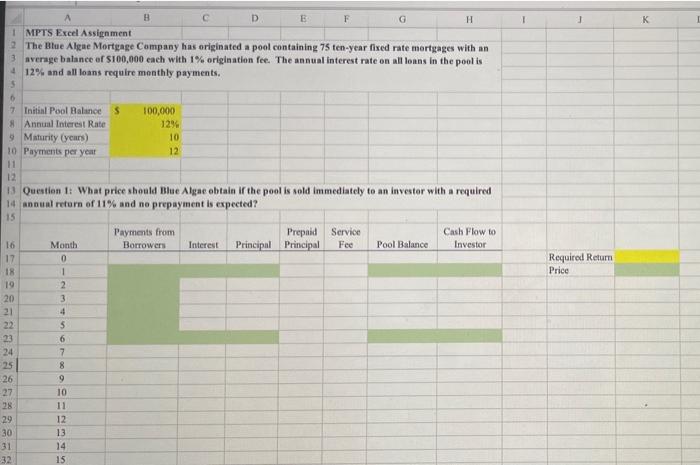

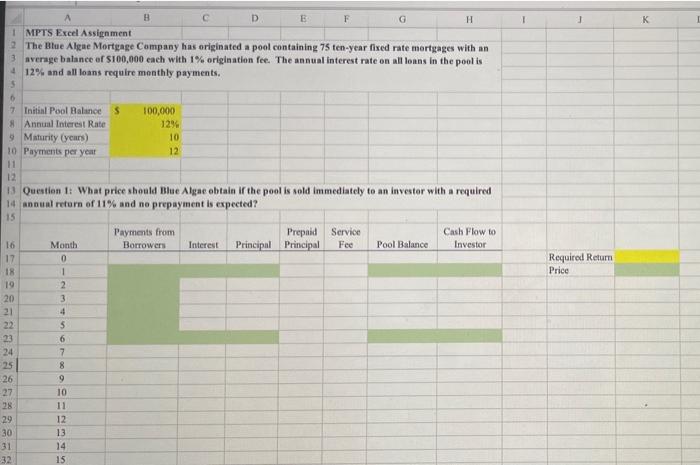

list goes to 120 months. 1 K A D E F G H 1 MPTS Excel Assignment 2 The Blue Algae Mortgage Company has originated

list goes to 120 months.

1 K A D E F G H 1 MPTS Excel Assignment 2 The Blue Algae Mortgage Company has originated a pool containing 75 ten-year fixed rate mortgages with an 3 average balance of $100.000 ench with 1% origination fee. The annual interest rate on all loans in the pool is 4 12% and all loans require monthly payments. 5 6 7 Initial Pool Balance 100,000 8 Annual Interest Rate 1294 9 Maturity years) 10 10 Payments per year 12 11 12 13. Question 1: What price should Blue Algae obtain if the pool is sold immediately to an investor with a required 14 annual return of 11% and ne prepayment is expected? 15 Payments from Prepaid Service Cash Flow to 16 Month Borrowers Interest Principal Principal Fee Pool Balance Investor 17 0 18 1 19 2 20 3 21 22 5 23 6 24 7 25 8 26 9 27 10 28 11 29 12 30 13 31 14 32 15 Required Return Price 4 B c D E F G 1 113 96 97 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 1 K A D E F G H 1 MPTS Excel Assignment 2 The Blue Algae Mortgage Company has originated a pool containing 75 ten-year fixed rate mortgages with an 3 average balance of $100.000 ench with 1% origination fee. The annual interest rate on all loans in the pool is 4 12% and all loans require monthly payments. 5 6 7 Initial Pool Balance 100,000 8 Annual Interest Rate 1294 9 Maturity years) 10 10 Payments per year 12 11 12 13. Question 1: What price should Blue Algae obtain if the pool is sold immediately to an investor with a required 14 annual return of 11% and ne prepayment is expected? 15 Payments from Prepaid Service Cash Flow to 16 Month Borrowers Interest Principal Principal Fee Pool Balance Investor 17 0 18 1 19 2 20 3 21 22 5 23 6 24 7 25 8 26 9 27 10 28 11 29 12 30 13 31 14 32 15 Required Return Price 4 B c D E F G 1 113 96 97 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started