Answered step by step

Verified Expert Solution

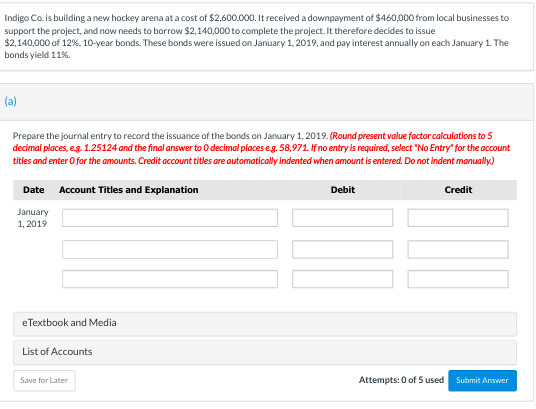

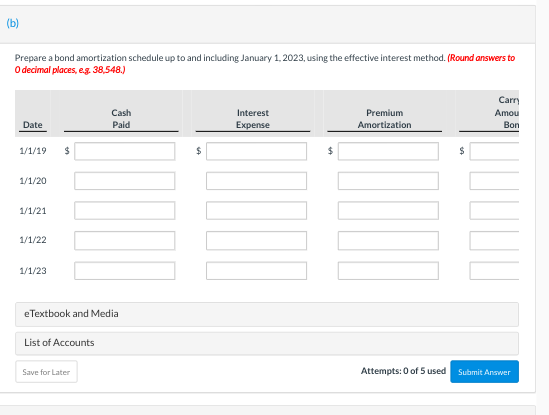

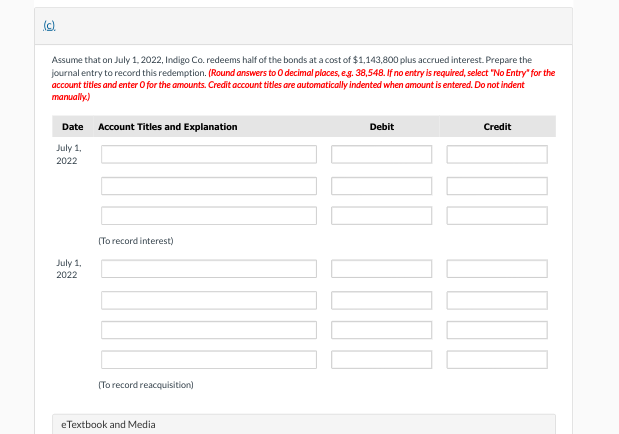

Question

1 Approved Answer

List of Accounts Accumulated Depreciation-Equipment Accumulated Depreciation-Machinery Accumulated Depreciation-Plant and Equipment Allowance for Doubtful Accounts Bad Debt Expense Bond Issue Expense Bonds Payable Buildings Cash

List of Accounts

- Accumulated Depreciation-Equipment

- Accumulated Depreciation-Machinery

- Accumulated Depreciation-Plant and Equipment

- Allowance for Doubtful Accounts

- Bad Debt Expense

- Bond Issue Expense

- Bonds Payable

- Buildings

- Cash

- Common Stock

- Cost of Goods Sold

- Debt Investments

- Depreciation Expense

- Discount on Bonds Payable

- Discount on Notes Payable

- Discount on Notes Receivable

- Equipment

- Equity Investments

- Gain on Disposal of Machinery

- Gain on Disposal of Land

- Gain on Disposal of Plant Assets

- Gain on Redemption of Bonds

- Gain on Restructuring of Debt

- Gain on Sale of Machinery

- Interest Expense

- Interest Payable

- Interest Receivable

- Interest Revenue

- Inventory

- Land

- Loss on Disposal of Equipment

- Loss on Disposal of Land

- Loss on Redemption of Bonds

- Machinery

- Mortgage Payable

- No Entry

- Notes Payable

- Notes Receivable

- Paid-in Capital in Excess of Par - Common Stock

- Paid-in Capital in Excess of Par - Preferred Stock

- Premium on Bonds Payable

- Retained Earnings

- Salaries and Wages Expense

- Sales

- Sales Revenue

- Unamortized Bond Issue Costs

- Unearned Revenue

- Unearned Sales Revenue

- Unrealized Holding Gain or Loss - Equity

- Unrealized Holding Gain or Loss - Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started