Answered step by step

Verified Expert Solution

Question

1 Approved Answer

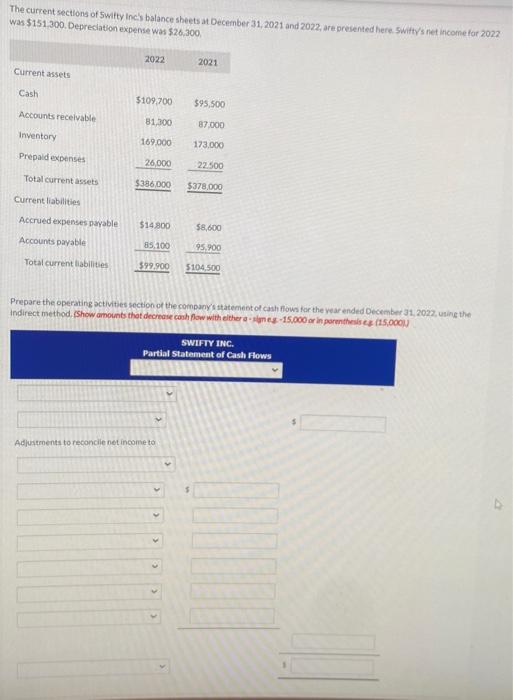

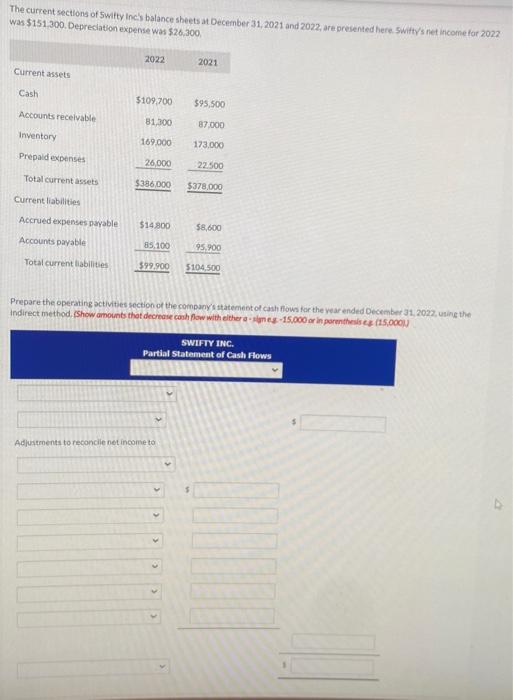

list of accounts Depreciation xpense Decrease in Prepaid Expenses Decrease in Accounts Receivable Increase in Accounts Receivable Decrease in Accrued Expenses Payable Increase in Prepaid

list of accounts

The current sections of 5 witty incis balance sheets at December 31,2021 and 2022 , are presented here. Swifty's net iticome for 2022 . was $151300. Depreslation expense was $20,300 Prepare the operating activities section of the companys statemest of cash fiows for the vear ended December 31,2022 , using the indirect method, (show amounts that decrease conh flow with elther a - simes 15,000 or in parentheris es (15,000) Depreciation xpense

Decrease in Prepaid Expenses

Decrease in Accounts Receivable

Increase in Accounts Receivable

Decrease in Accrued Expenses Payable

Increase in Prepaid Expenses

Net Income

Increase in Accrued Expenses Payable

Decrease in Inventory

Increase in Accounts Payable

Increase in Inventory

Decrease in Accounts Payable Cash at Beginning of Period

Cash at End of Period

Cash Flows from Financing Activities

Cash Flows from Investing Activities

Cash Flows from Operating Activities

Net Cash Provided by Financing Activities

Net Cash Provided by Investing Activities

Net Cash Provided by Operating Activities

Net Cash Used by Financing Activities

Net Cash Used by Investing Activities

Net Cash Used by Operating Activities

Net Decrease in Cash

Net Increase in Cash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started