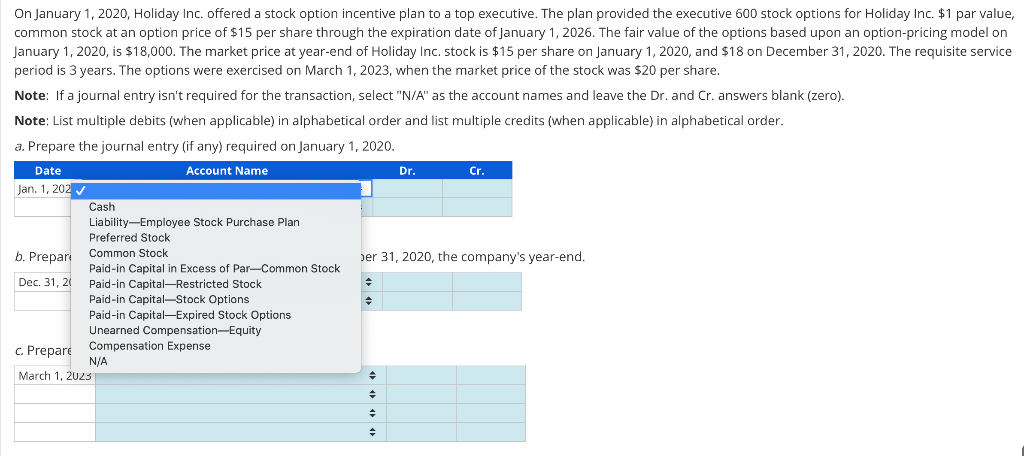

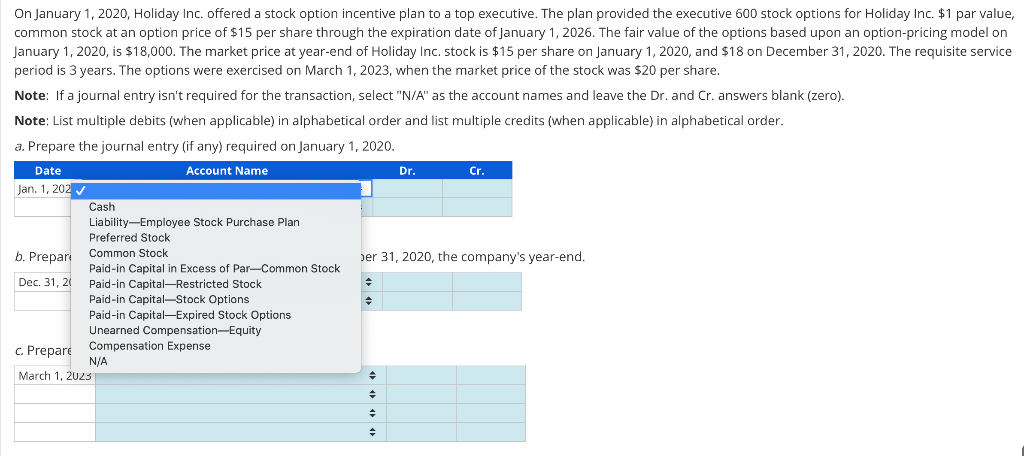

List of selections is the same for all "Account Name" fields

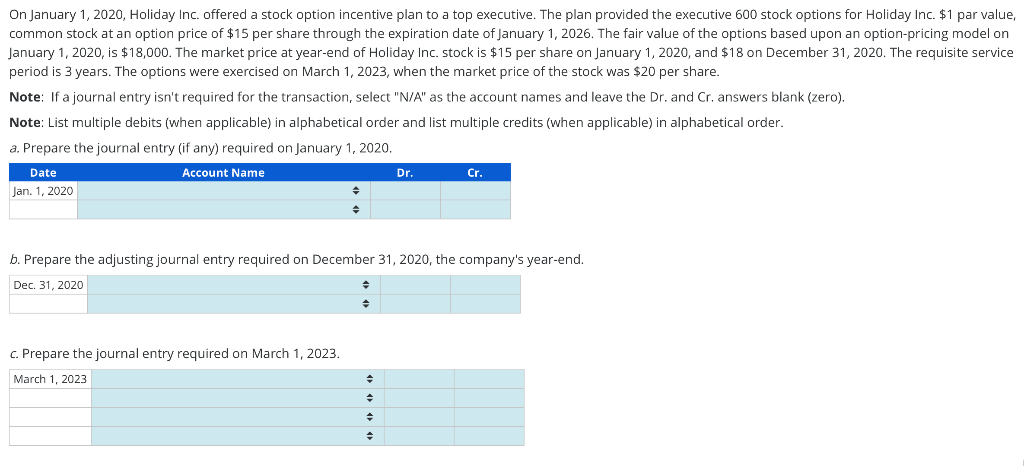

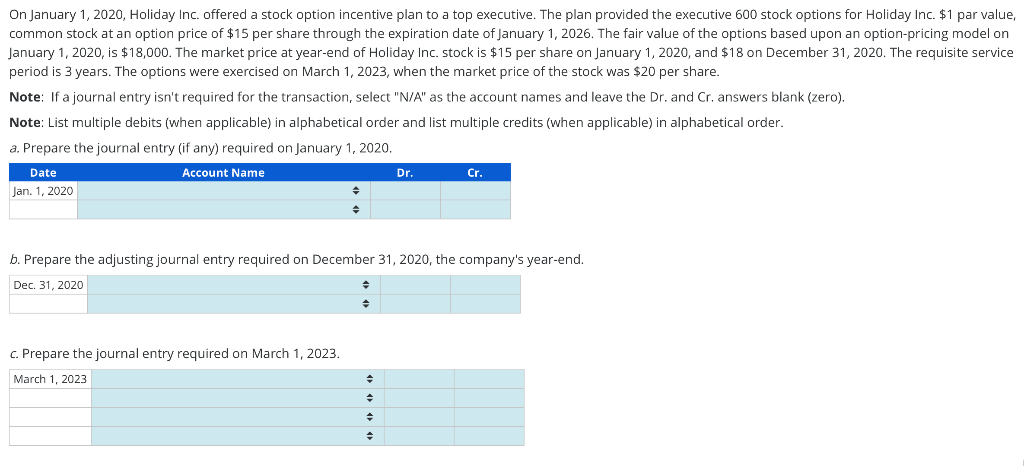

On January 1, 2020, Holiday Inc. offered a stock option incentive plan to a top executive. The plan provided the executive 600 stock options for Holiday Inc. $1 par value, common stock at an option price of $15 per share through the expiration date of January 1, 2026. The fair value of the options based upon an option-pricing model on January 1, 2020, is $18,000. The market price at year-end of Holiday Inc. stock is $15 per share on January 1, 2020, and $18 on December 31, 2020. The requisite service period is 3 years. The options were exercised on March 1, 2023, when the market price of the stock was $20 per share. Note: If a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). Note: List multiple debits (when applicable) in alphabetical order and list multiple credits (when applicable) in alphabetical order. a. Prepare the journal entry (if any) required on January 1, 2020. Date Account Name Dr. Cr. Jan 1, 202, Cash Liability-Employee Stock Purchase Plan Preferred Stock b. Prepar Common Stock Jer 31, 2020, the company's year-end. Paid-in Capital in Excess of Par-Common Stock Dec 31, 2 Paid-in CapitalRestricted Stock Paid-in Capital-Stock Options Paid-in CapitalExpired Stock Options Unearned Compensation-Equity c. Prepare Compensation Expense N/A March 1, 2023 On January 1, 2020, Holiday Inc. offered a stock option incentive plan to a top executive. The plan provided the executive 600 stock options for Holiday Inc. $1 par value, common stock at an option price of $15 per share through the expiration date of January 1, 2026. The fair value of the options based upon an option-pricing model on January 1, 2020, is $18,000. The market price at year-end of Holiday Inc. stock is $15 per share on January 1, 2020, and $18 on December 31, 2020. The requisite service period is 3 years. The options were exercised on March 1, 2023, when the market price of the stock was $20 per share. Note: If a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). Note: List multiple debits (when applicable) in alphabetical order and list multiple credits (when applicable) in alphabetical order. a. Prepare the journal entry (if any) required on January 1, 2020. Date Account Name Jan. 1, 2020 Dr. Cr. b. Prepare the adjusting journal entry required on December 31, 2020, the company's year-end. Dec 31, 2020 c. Prepare the journal entry required on March 1, 2023. March 1, 2023