Listed answers may not be correct.

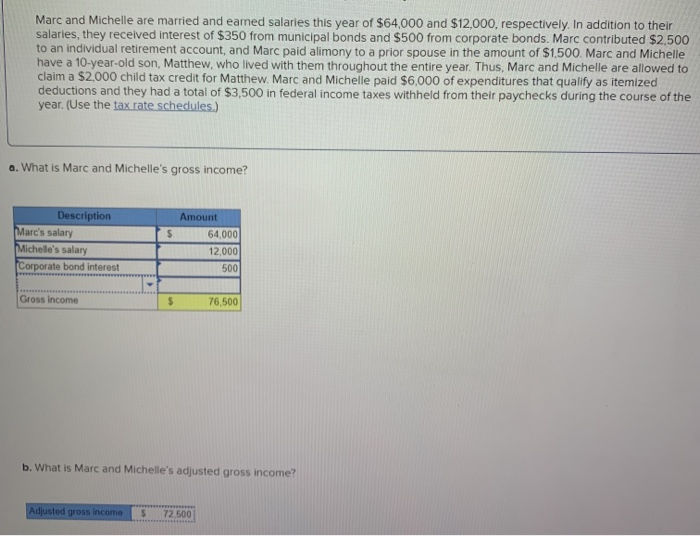

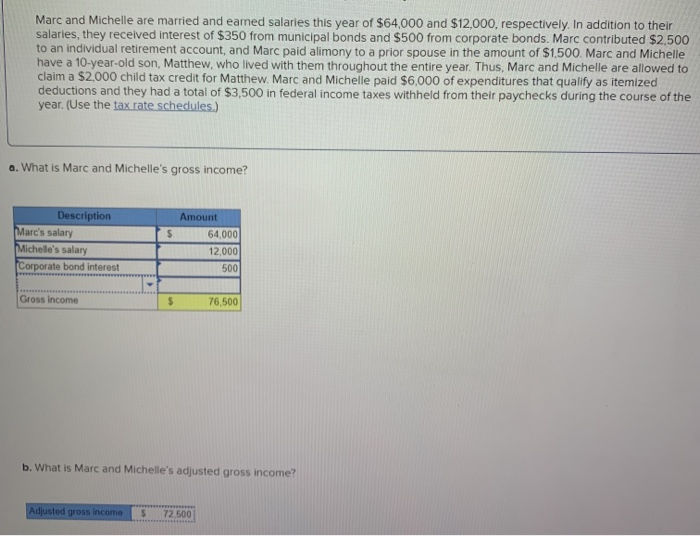

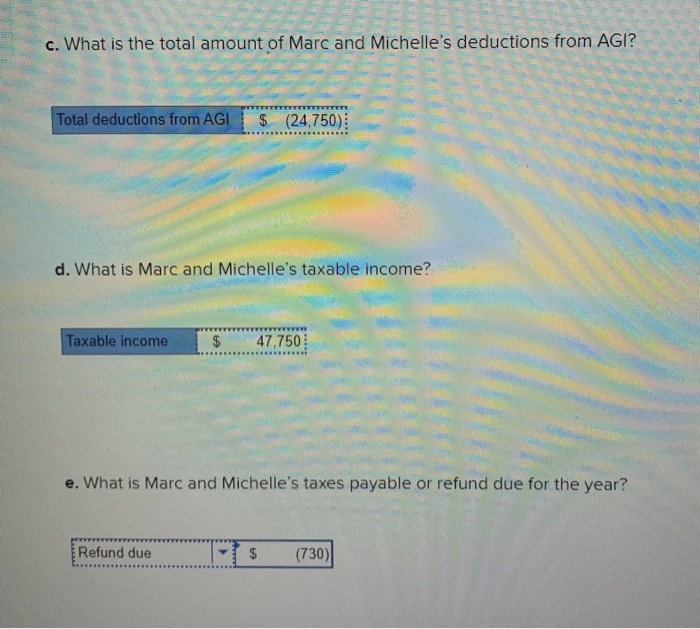

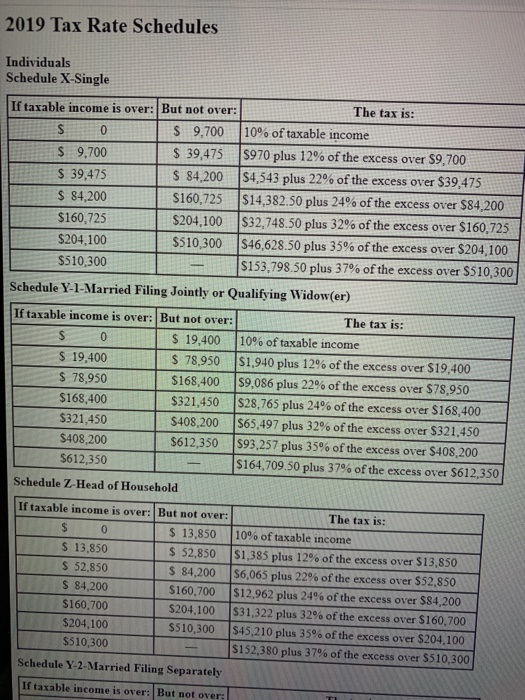

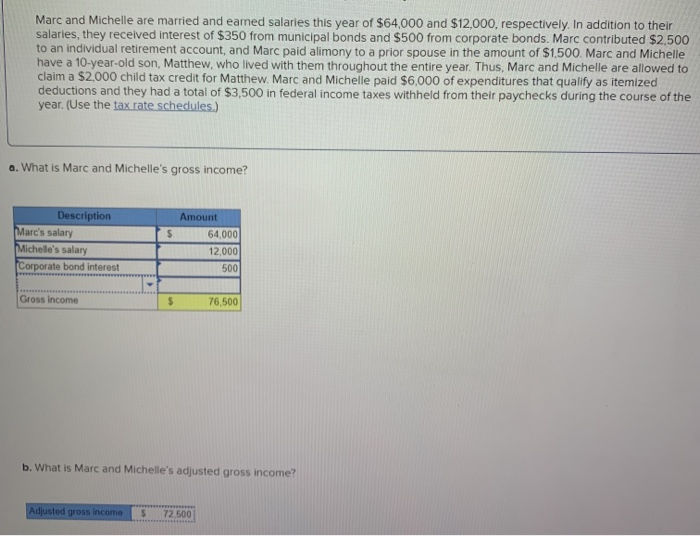

Marc and Michelle are married and eamed salaries this year of $64,000 and $12,000, respectively. In addition to their salaries, they received interest of $350 from municipal bonds and $500 from corporate bonds. Marc contributed $2,500 to an individual retirement account, and Marc paid alimony to a prior spouse in the amount of $1.500. Marc and Michelle have a 10-year-old son, Matthew, who lived with them throughout the entire year. Thus, Marc and Michelle are allowed to claim a $2.000 child tax credit for Matthew. Marc and Michelle paid $6,000 of expenditures that qualify as itemized deductions and they had a total of $3,500 in federal income taxes withheld from their paychecks during the course of the year. (Use the tax rate schedules.) a. What is Marc and Michelle's gross income? $ Description Marc's salary Michele's salary Corporate bond interest Amount 64.000 12.000 500 Gross income $ 76,500 b. What is Marc and Michelle's adjusted gross income? Adjusted gross income $ 72,500 c. What is the total amount of Marc and Michelle's deductions from AGI? Total deductions from AGI $ (24,750) d. What is Marc and Michelle's taxable income? Taxable income $ 47,750 e. What is Marc and Michelle's taxes payable or refund due for the year? Refund due TS (730) 2019 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: The tax is: S 0 $ 9,700 10% of taxable income $ 9,700 $ 39,475 $970 plus 12% of the excess over $9,700 $ 39,475 $ 84,200 $4,543 plus 22% of the excess over $39,475 $ 84,200 $160,725 $14,382.50 plus 24% of the excess over $84,200 $160,725 $204,100 $32,748.50 plus 32% of the excess over $160,725 $204,100 $510,300 $46,628.50 plus 35% of the excess over $204,100 $510,300 $153.798.50 plus 37% of the excess over $510,300 Schedule Y-1- Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: S 0 $ 19,400 10% of taxable income $ 19,400 $ 78,950 $1,940 plus 12% of the excess over $19.400 $ 78,950 $168,400 $9,086 plus 22% of the excess over $78,950 $168.400 $321,450 $28,765 plus 24% of the excess over $168,400 $321,450 $408,200 $65,497 plus 32% of the excess over $321,450 $408,200 $612,350 $93,257 plus 35% of the excess over $408,200 5612,350 $164,709.50 plus 37% of the excess over $612,350 Schedule Z Head of Household If taxable income is over: But not over: $ 0 $ 13,850 $ 13,850 $ 52,850 $ 52,850 $ 84,200 $ 84,200 $160,700 $160,700 $204,100 $204,100 5510,300 $510,300 Schedule Y-2-Married Filing Separately The tax is: 10% of taxable income $1,385 plus 12% of the excess over $13,850 56,065 plus 22% of the excess over $52,850 $12.962 plus 24% of the excess over $84,200 $31,322 plus 32% of the excess over $160,700 $45,210 plus 35% of the excess over $204,100 $152,380 plus 37% of the excess over $510,300 If taxable income is over: But not over