Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Listed below are a series of transactions that occurred during the first three years of operations for Truman Turf Company: 1. On January 1,

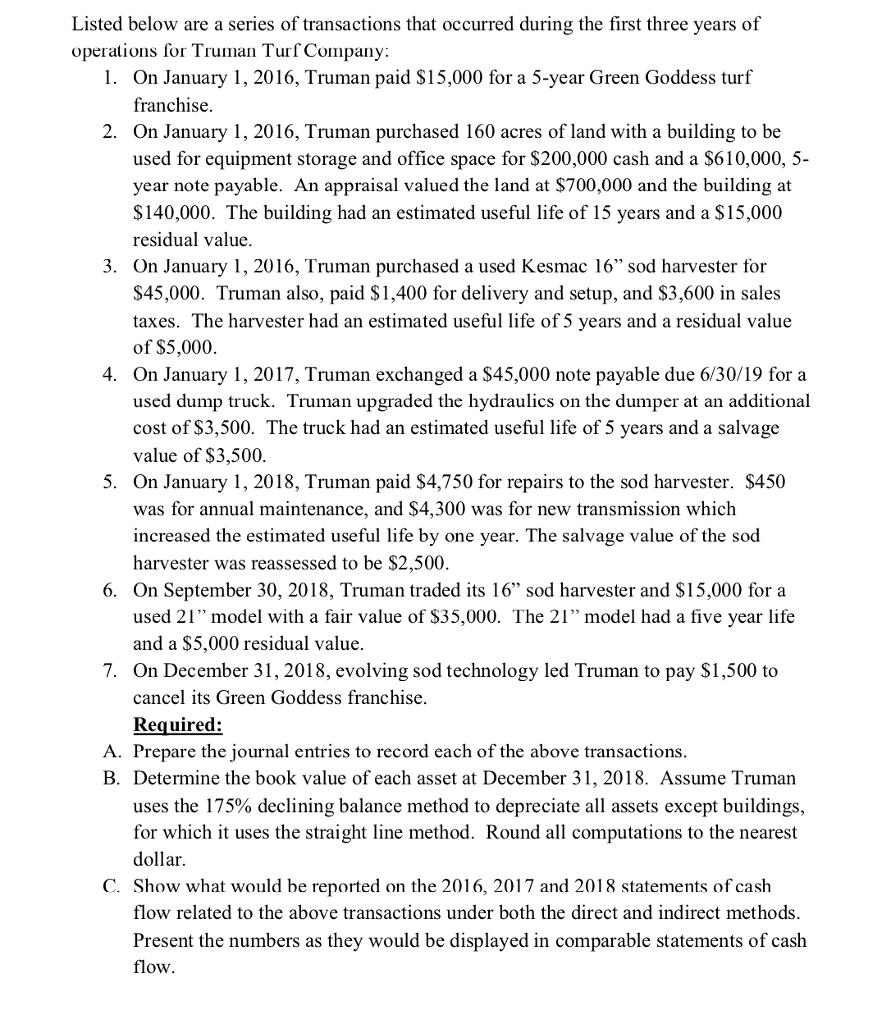

Listed below are a series of transactions that occurred during the first three years of operations for Truman Turf Company: 1. On January 1, 2016, Truman paid $15,000 for a 5-year Green Goddess turf franchise. 2. On January 1, 2016, Truman purchased 160 acres of land with a building to be used for equipment storage and office space for $200,000 cash and a $610,000, 5- year note payable. An appraisal valued the land at $700,000 and the building at $140,000. The building had an estimated useful life of 15 years and a $15,000 residual value. 3. On January 1, 2016, Truman purchased a used Kesmac 16" sod harvester for $45,000. Truman also, paid $1,400 for delivery and setup, and $3,600 in sales taxes. The harvester had an estimated useful life of 5 years and a residual value of $5,000. 4. On January 1, 2017, Truman exchanged a $45,000 note payable due 6/30/19 for a used dump truck. Truman upgraded the hydraulics on the dumper at an additional cost of $3,500. The truck had an estimated useful life of 5 years and a salvage value of $3,500. 5. On January 1, 2018, Truman paid $4,750 for repairs to the sod harvester. $450 was for annual maintenance, and $4,300 was for new transmission which increased the estimated useful life by one year. The salvage value of the sod harvester was reassessed to be $2,500. 6. On September 30, 2018, Truman traded its 16" sod harvester and $15,000 for a used 21" model with a fair value of $35,000. The 21" model had a five year life and a $5,000 residual value. 7. On December 31, 2018, evolving sod technology led Truman to pay $1,500 to cancel its Green Goddess franchise. Required: A. Prepare the journal entries to record each of the above transactions. B. Determine the book value of each asset at December 31, 2018. Assume Truman uses the 175% declining balance method to depreciate all assets except buildings, for which it uses the straight line method. Round all computations to the nearest dollar. C. Show what would be reported on the 2016, 2017 and 2018 statements of cash flow related to the above transactions under both the direct and indirect methods. Present the numbers as they would be displayed in comparable statements of cash flow.

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

lournal Entries Date Particulars DrCr Amount Amount ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started