Question

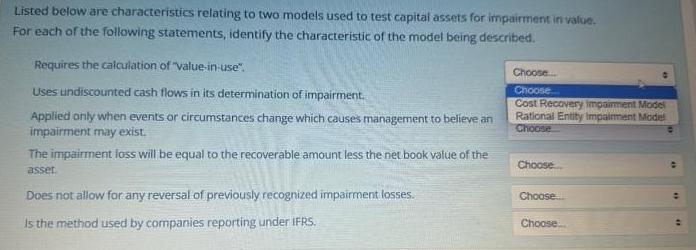

Listed below are characteristics relating to two models used to test capital assets for impairment in value. For each of the following statements, identify

Listed below are characteristics relating to two models used to test capital assets for impairment in value. For each of the following statements, identify the characteristic of the model being described. Requires the calculation of "value-in-use". Uses undiscounted cash flows in its determination of impairment. Applied only when events or circumstances change which causes management to believe an impairment may exist. The impairment loss will be equal to the recoverable amount less the net book value of the asset. Does not allow for any reversal of previously recognized impairment losses. Is the method used by companies reporting under IFRS. Choose.... Choose... Cost Recovery impairment Model Rational Entity Impairment Model Choose Choose... Choose... Choose... * " **

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Kin Lo, George Fisher

Volume 1, 1st Edition

132612119, 978-0132612111

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App