Answered step by step

Verified Expert Solution

Question

1 Approved Answer

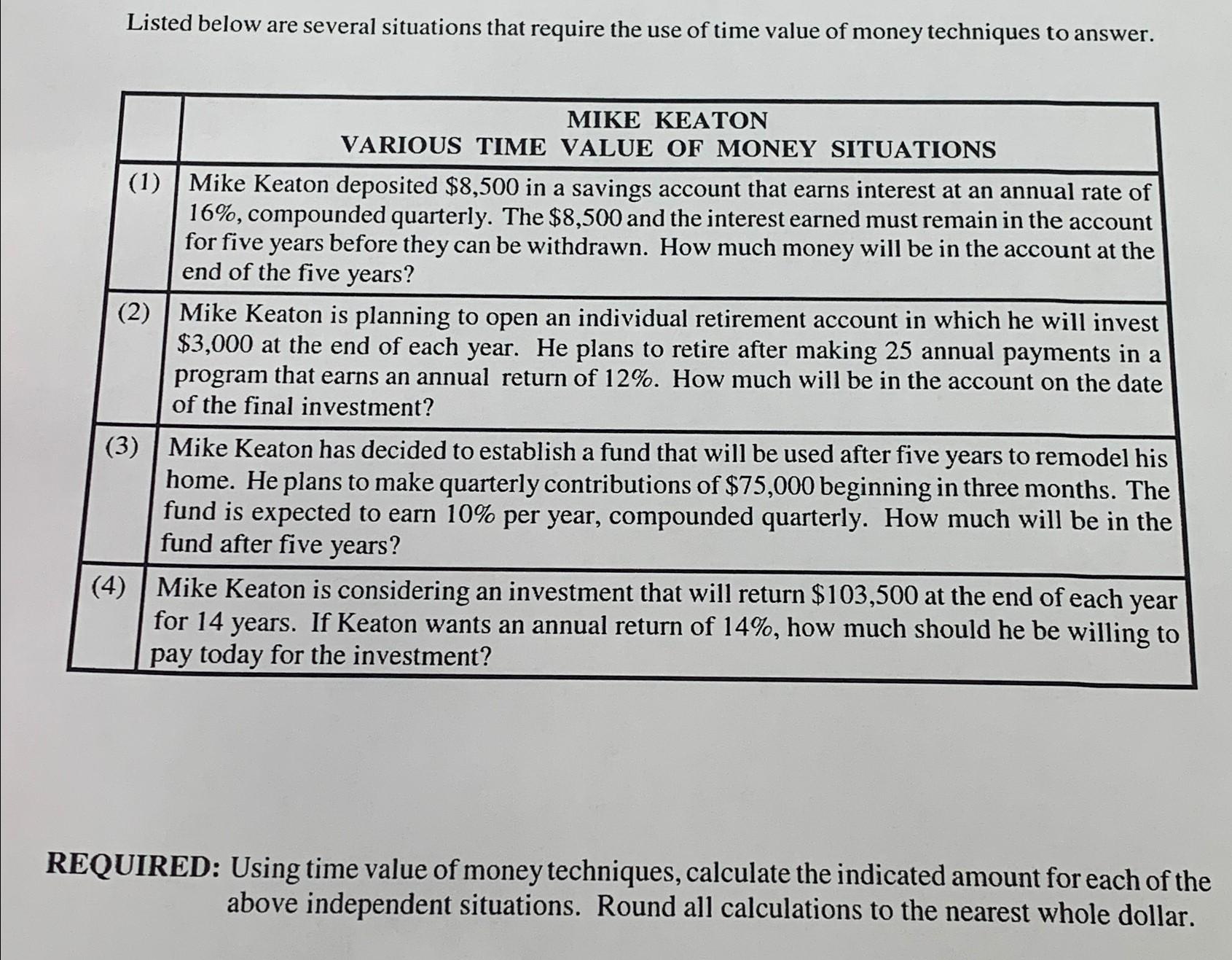

Listed below are several situations that require the use of time value of money techniques to answer. MIKE KEATON VARIOUS TIME VALUE OF MONEY

Listed below are several situations that require the use of time value of money techniques to answer. MIKE KEATON VARIOUS TIME VALUE OF MONEY SITUATIONS (1) Mike Keaton deposited $8,500 in a savings account that earns interest at an annual rate of 16%, compounded quarterly. The $8,500 and the interest earned must remain in the account for five years before they can be withdrawn. How much money will be in the account at the end of the five years? (2) Mike Keaton is planning to open an individual retirement account in which he will invest $3,000 at the end of each year. He plans to retire after making 25 annual payments in a program that earns an annual return of 12%. How much will be in the account on the date of the final investment? (3) Mike Keaton has decided to establish a fund that will be used after five years to remodel his home. He plans to make quarterly contributions of $75,000 beginning in three months. The fund is expected to earn 10% per year, compounded quarterly. How much will be in the fund after five years? (4) Mike Keaton is considering an investment that will return $103,500 at the end of each year for 14 years. If Keaton wants an annual return of 14%, how much should he be willing to pay today for the investment? REQUIRED: Using time value of money techniques, calculate the indicated amount for each of the above independent situations. Round all calculations to the nearest whole dollar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets calculate each situation using time value of money techniques 1 Future Value of a Single Sum Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

664285f95cdb1_979512.pdf

180 KBs PDF File

664285f95cdb1_979512.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started