Answered step by step

Verified Expert Solution

Question

1 Approved Answer

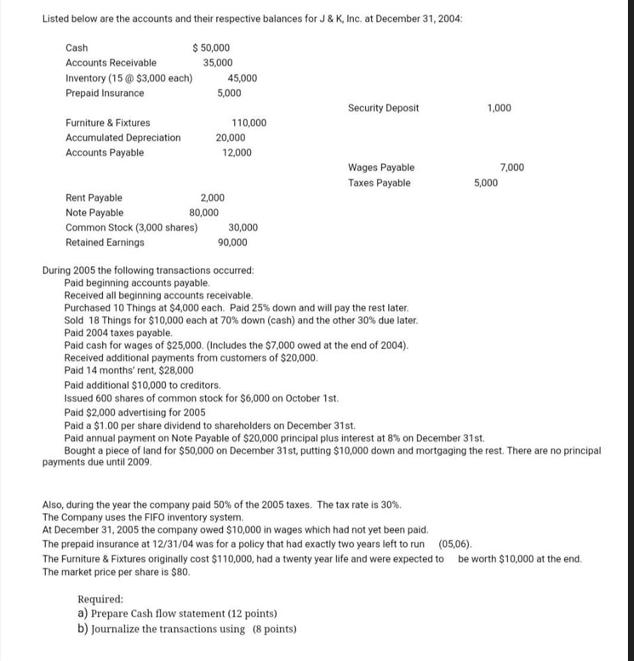

Listed below are the accounts and their respective balances for J & K, Inc. at December 31, 2004: Cash $ 50,000 35,000 Accounts Receivable

Listed below are the accounts and their respective balances for J & K, Inc. at December 31, 2004: Cash $ 50,000 35,000 Accounts Receivable Inventory (15 @ $3,000 each) Prepaid Insurance Furniture & Fixtures Accumulated Depreciation Accounts Payable Rent Payable Note Payable Common Stock (3,000 shares) Retained Earnings 5,000 45,000 80,000 20,000 2,000 110,000 12,000 30,000 90,000 Paid additional $10,000 to creditors. Issued 600 shares of common stock for $6,000 on October 1st. Security Deposit During 2005 the following transactions occurred: Paid beginning accounts payable. Received all beginning accounts receivable. Purchased 10 Things at $4,000 each. Paid 25% down and will pay the rest later. Sold 18 Things for $10,000 each at 70% down (cash) and the other 30% due later. Paid 2004 taxes payable. Paid cash for wages of $25,000. (Includes the $7,000 owed at the end of 2004). Received additional payments from customers of $20,000. Paid 14 months' rent, $28,000 Wages Payable Taxes Payable Paid $2,000 advertising for 2005 Paid a $1.00 per share dividend to shareholders on December 31st. Paid annual payment on Note Payable of $20,000 principal plus interest at 8% on December 31st. Also, during the year the company paid 50% of the 2005 taxes. The tax rate is 30%. The Company uses the FIFO inventory system. At December 31, 2005 the company owed $10,000 in wages which had not yet been paid. The prepaid insurance at 12/31/04 was for a policy that had exactly two years left to run Required: a) Prepare Cash flow statement (12 points) b) Journalize the transactions using (8 points) 1,000 5,000 Bought a piece of land for $50,000 on December 31st, putting $10,000 down and mortgaging the rest. There are no principal payments due until 2009. 7,000 (05,06). The Furniture & Fixtures originally cost $110,000, had a twenty year life and were expected to be worth $10,000 at the end. The market price per share is $80.

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Here are the journal entries with calculations shown 1 Accounts Receivable 35000 Cash To record coll...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started