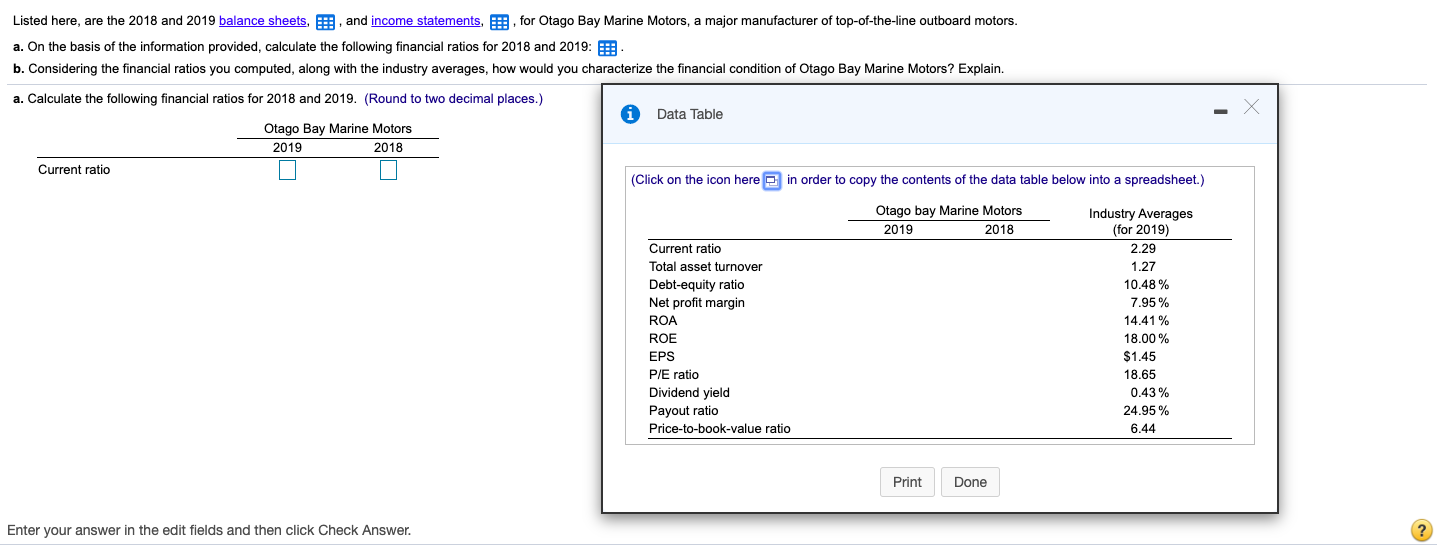

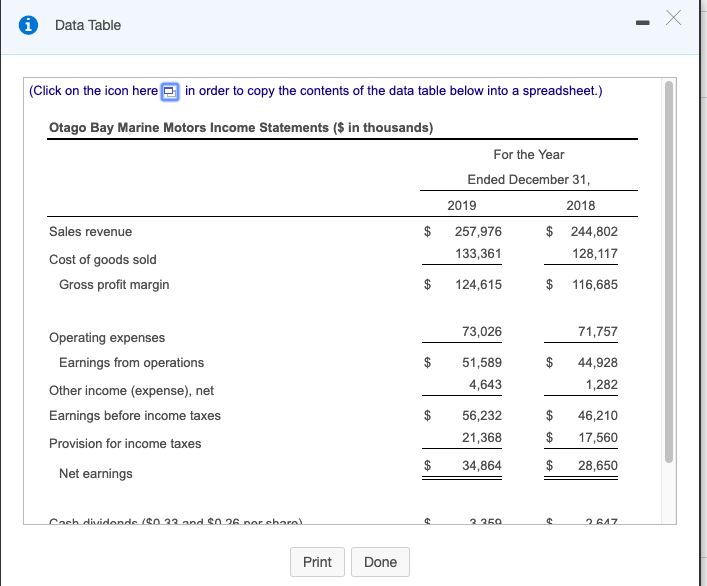

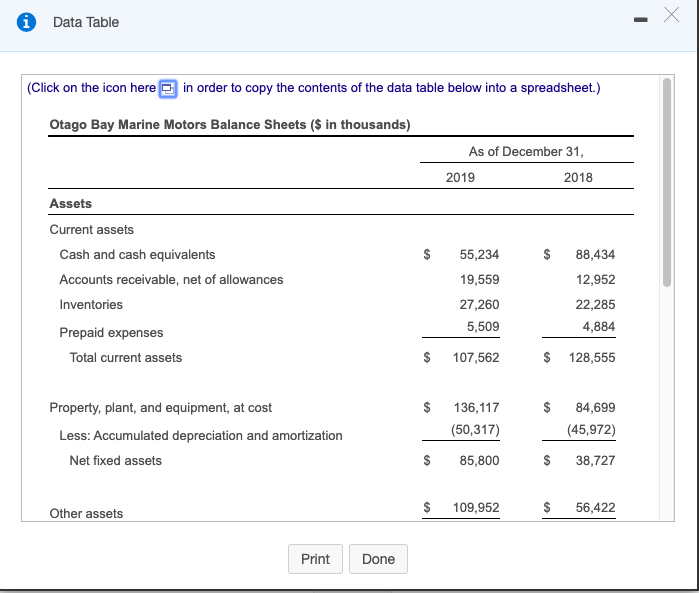

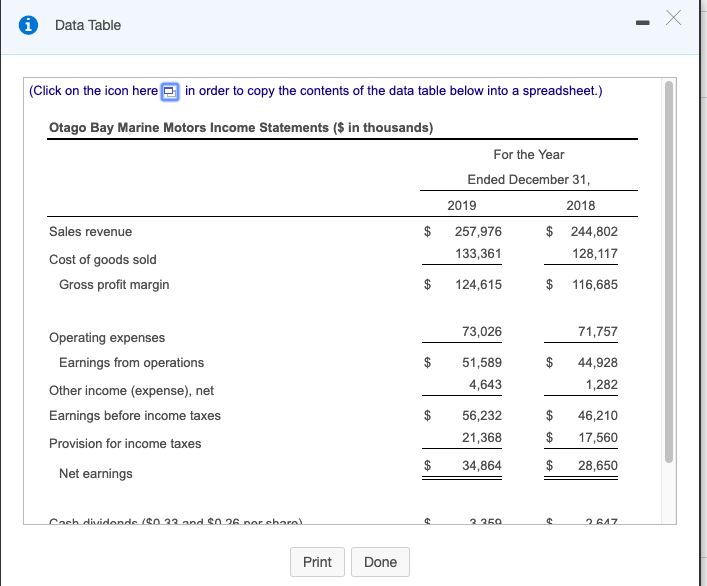

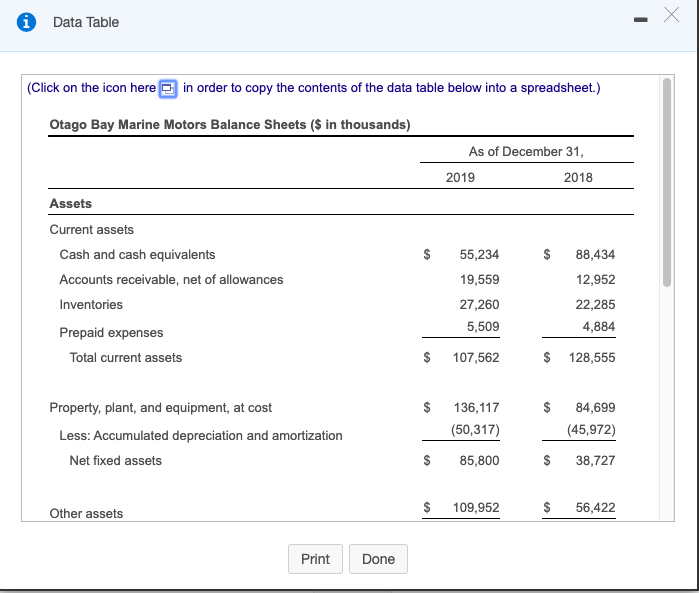

Listed here, are the 2018 and 2019 balance sheets, and income statements, : , for Otago Bay Marine Motors, a major manufacturer of top-of-the-line outboard motors. a. On the basis of the information provided, calculate the following financial ratios for 2018 and 2019: b. Considering the financial ratios you computed, along with the industry averages, how would you characterize the financial condition of Otago Bay Marine Motors? Explain. a. Calculate the following financial ratios for 2018 and 2019. (Round to two decimal places.) Data Table Otago Bay Marine Motors 2019 2018 Current ratio (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Otago bay Marine Motors 2019 2018 Current ratio Total asset turnover Debt-equity ratio Net profit margin ROA ROE EPS P/E ratio Dividend yield Payout ratio Price-to-book-value ratio Industry Averages (for 2019) 2.29 1.27 10.48% 7.95% 14.41% 18.00% $1.45 18.65 0.43% 24.95% 6.44 Print Done Enter your answer in the edit fields and then click Check Answer. i Data Table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Otago Bay Marine Motors Income Statements ($ in thousands) For the Year Ended December 31, 2019 2018 257,976 $ 244,802 133,361 128,117 Sales revenue $ Cost of goods sold Gross profit margin $ 124,615 $ 116,685 73,026 71,757 Operating expenses Earnings from operations $ 51,589 4,643 44,928 1,282 Other income (expense), net Earnings before income taxes 56,232 21,368 Provision for income taxes $ $ $ 46,210 17,560 28,650 $ 34,864 Net earnings Cach dividende CO 22 and CO 26.nor charol 2.250 2647 Print Done * Data Table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Otago Bay Marine Motors Balance Sheets ($ in thousands) As of December 31, 2019 2018 Assets Current assets $ Cash and cash equivalents Accounts receivable, net of allowances 55,234 19,559 88,434 12,952 22,285 4,884 Inventories 27,260 5,509 Prepaid expenses Total current assets $ 107,562 $ 128,555 Property, plant, and equipment, at cost $ $ 136,117 (50,317) 84,699 (45,972) Less: Accumulated depreciation and amortization Net fixed assets $ 85,800 $ 38,727 Other assets $ 109,952 $ 56,422 Print Done Listed here, are the 2018 and 2019 balance sheets, and income statements, : , for Otago Bay Marine Motors, a major manufacturer of top-of-the-line outboard motors. a. On the basis of the information provided, calculate the following financial ratios for 2018 and 2019: b. Considering the financial ratios you computed, along with the industry averages, how would you characterize the financial condition of Otago Bay Marine Motors? Explain. a. Calculate the following financial ratios for 2018 and 2019. (Round to two decimal places.) Data Table Otago Bay Marine Motors 2019 2018 Current ratio (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Otago bay Marine Motors 2019 2018 Current ratio Total asset turnover Debt-equity ratio Net profit margin ROA ROE EPS P/E ratio Dividend yield Payout ratio Price-to-book-value ratio Industry Averages (for 2019) 2.29 1.27 10.48% 7.95% 14.41% 18.00% $1.45 18.65 0.43% 24.95% 6.44 Print Done Enter your answer in the edit fields and then click Check Answer. i Data Table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Otago Bay Marine Motors Income Statements ($ in thousands) For the Year Ended December 31, 2019 2018 257,976 $ 244,802 133,361 128,117 Sales revenue $ Cost of goods sold Gross profit margin $ 124,615 $ 116,685 73,026 71,757 Operating expenses Earnings from operations $ 51,589 4,643 44,928 1,282 Other income (expense), net Earnings before income taxes 56,232 21,368 Provision for income taxes $ $ $ 46,210 17,560 28,650 $ 34,864 Net earnings Cach dividende CO 22 and CO 26.nor charol 2.250 2647 Print Done * Data Table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Otago Bay Marine Motors Balance Sheets ($ in thousands) As of December 31, 2019 2018 Assets Current assets $ Cash and cash equivalents Accounts receivable, net of allowances 55,234 19,559 88,434 12,952 22,285 4,884 Inventories 27,260 5,509 Prepaid expenses Total current assets $ 107,562 $ 128,555 Property, plant, and equipment, at cost $ $ 136,117 (50,317) 84,699 (45,972) Less: Accumulated depreciation and amortization Net fixed assets $ 85,800 $ 38,727 Other assets $ 109,952 $ 56,422 Print Done