Answered step by step

Verified Expert Solution

Question

1 Approved Answer

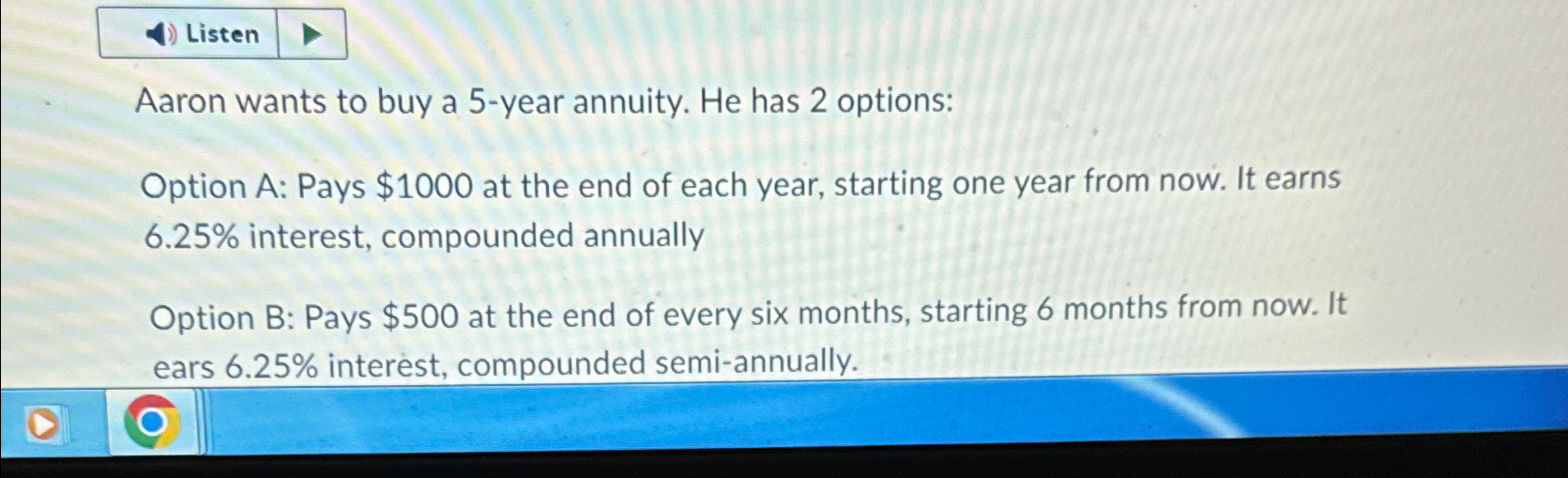

Listen Aaron wants to buy a 5 - year annuity. He has 2 options: Option A: Pays $ 1 0 0 0 at the end

Listen Aaron wants to buy a year annuity. He has options: Option A: Pays $ at the end of each year, starting one year from now. It earns interest, compounded annually Option B: Pays $ at the end of every six months, starting months from now. It ears interest, compounded semiannually.Which annuity should aaron choose? Write an explanation and use calculations to support your answer

Listen

Aaron wants to buy a year annuity. He has options:

Option A: Pays $ at the end of each year, starting one year from now. It earns interest, compounded annually

Option B: Pays $ at the end of every six months, starting months from now. It ears interest, compounded semiannually.Which annuity should aaron choose? Write an explanation and use calculations to support your answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started