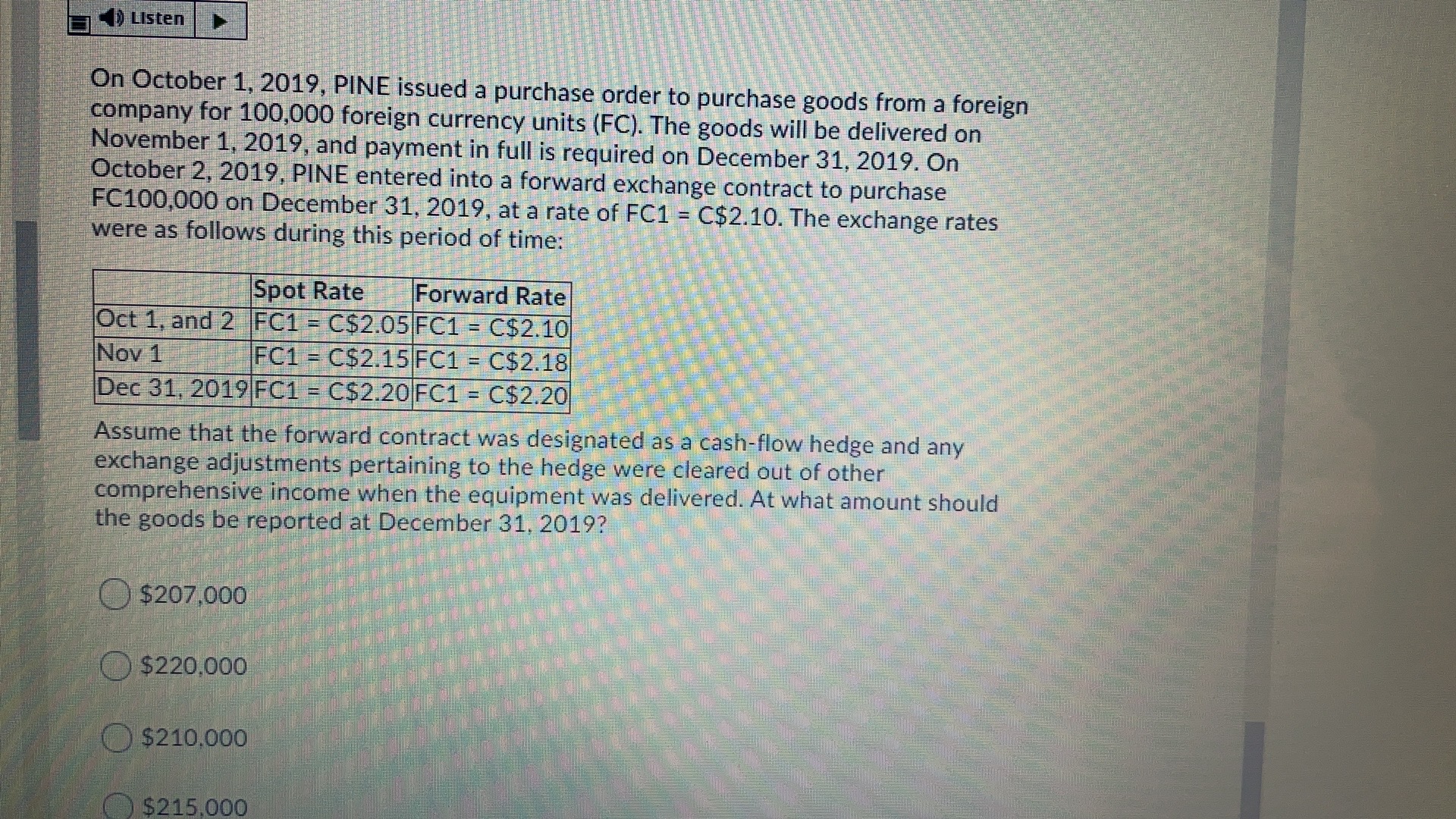

Listen Spa Ltd. has nine divisions. Although the B division had very low profits, it was determined to be a reportable segment on the basis of its total revenue of $1,600,000. What can be inferred based on this information? )The combined assets of the reportable operating segments total less than $16,000,000. ()The combined revenue of the reportable operating segments total less than $16,000,000. The greater of 10% of total profit and 10% of total loss is less than $1,600,000. The combined revenue of the reportable operating segments total greater than $16.000.000Listen P Co. owns 9,000 shares of S Co. On Dec 31, 2012, S's Co. common shares = $120,000 (total outstanding shares 10,000) and retained earnings = $150,000. On January 1, 2013, S Co. issued 1,800 new shares and P Co. did not purchase any of them. Assume S Co. received $60,000 for the new share issue. The balance in the investment in S Co. account was $280,000 (equity basis). Acquisition deferential was allocated as 30% to machinery (remaining life 10 yrs), 40% equipment (remaining life 5 yrs), and 30% to goodwill. S's Co. NI for 2013 was $100,000 and paid dividends of $40,000. There was a goodwill impairment loss of $592 in 2013. What is the balance of the NCI at Jan. 1, 2013? $72,900 $70,750 $79.200 None of theseListen On consolidation using the Canadian dollar presentation, the appropriate exchange rate for translating a plant asset in the balance sheet of a foreign subsidiary in which the functional currency is the Canadian dollar is the: O The average exchange rate for the current year. Forward rate. O Historical exchange rate in effect when the plant asset was acquired or the date of acquisition, whichever is later. Current exchange rate.Listen On October 1, 2019, PINE issued a purchase order to purchase goods from a foreign company for 100,000 foreign currency units (FC). The goods will be delivered on November 1, 2019, and payment in full is required on December 31, 2019. On October 2, 2019, PINE entered into a forward exchange contract to purchase FC100,000 on December 31, 2019, at a rate of FC1 = C$2.10. The exchange rates were as follows during this period of time: Spot Rate Forward Rate Oct 1, and 2 FC1 = C$2.05 FC1 = C$2.10 Nov 1 FC1 = C$2.15 FC1 = C$2.18 Dec 31, 2019 FC1 = C$2.20 FC1 = C$2.20 Assume that the forward contract was designated as a cash-flow hedge and any exchange adjustments pertaining to the hedge were cleared out of other comprehensive income when the equipment was delivered. At what amount should the goods be reported at December 31, 2019? $207,000 $220,000 $210,000 $215.000