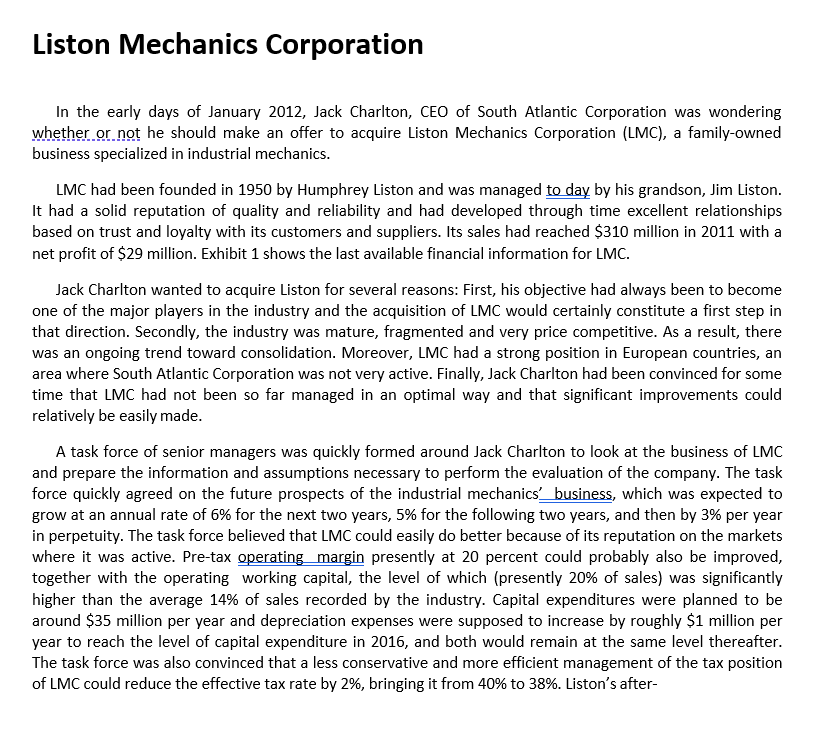

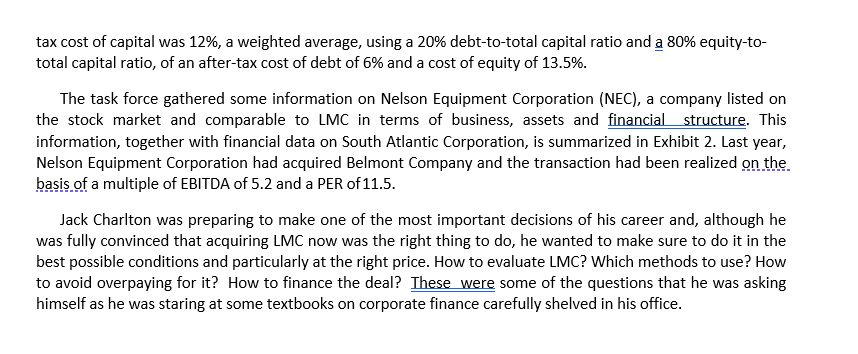

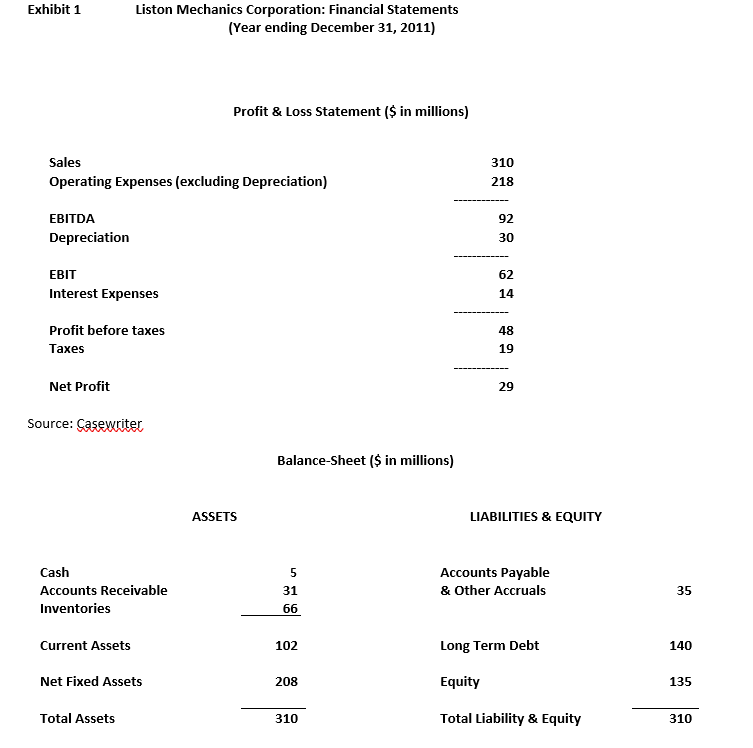

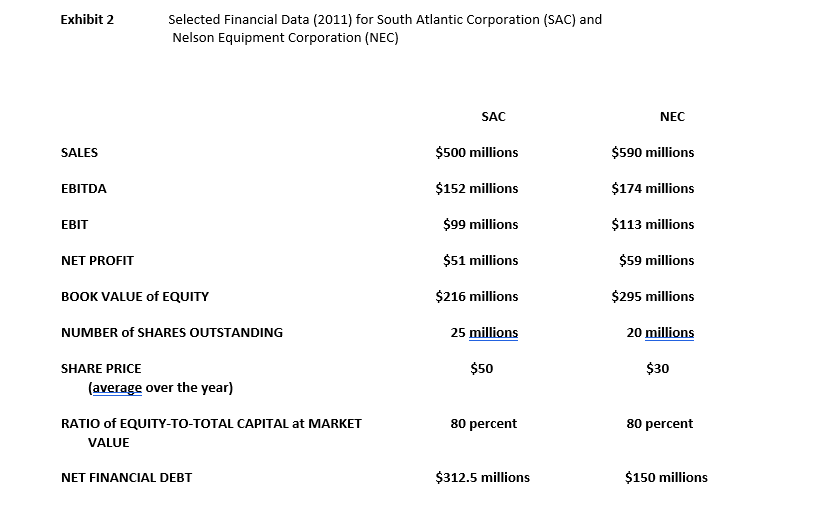

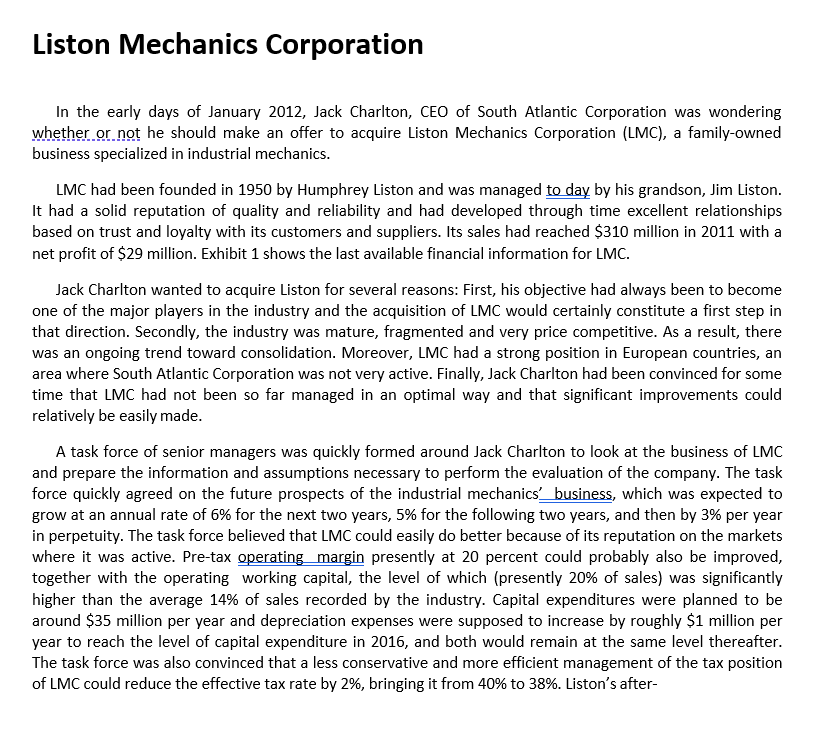

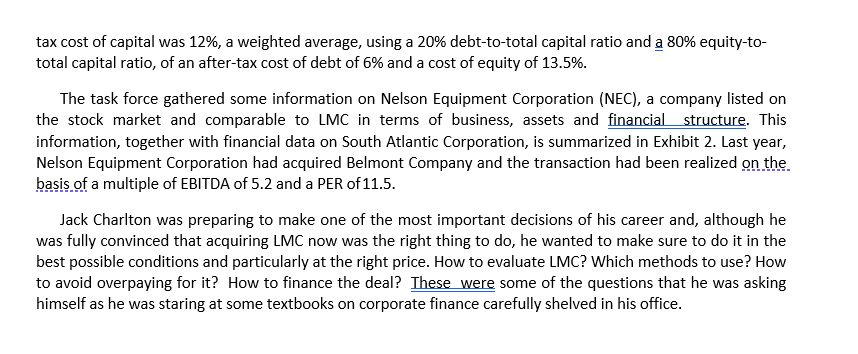

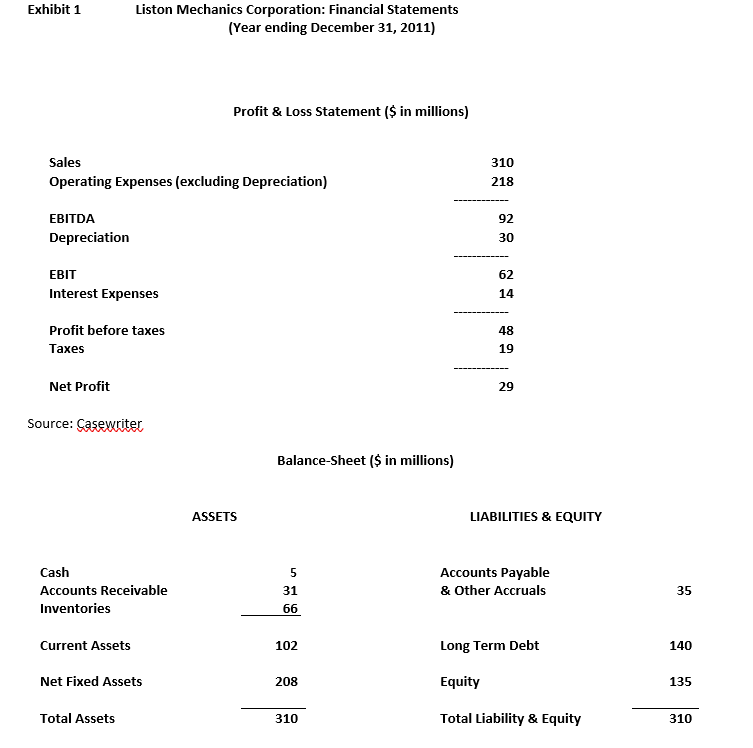

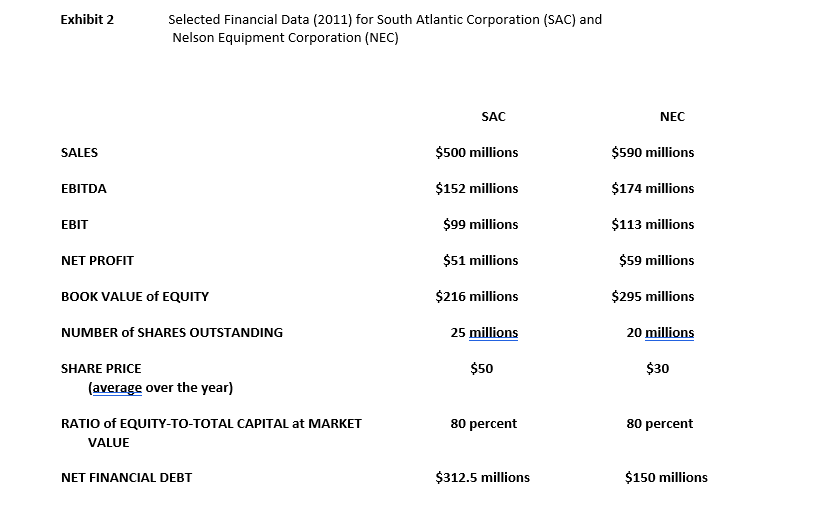

Liston Mechanics Corporation In the early days of January 2012, Jack Charlton, CEO of South Atlantic Corporation was wondering whether or not he should make an offer to acquire Liston Mechanics Corporation (LMC), a family-owned business specialized in industrial mechanics. LMC had been founded in 1950 by Humphrey Liston and was managed to day by his grandson, Jim Liston. It had a solid reputation of quality and reliability and had developed through time excellent relationships based on trust and loyalty with its customers and suppliers. Its sales had reached $310 million in 2011 with a net profit of $29 million. Exhibit 1 shows the last available financial information for LMC. Jack Charlton wanted to acquire Liston for several reasons: First, his objective had always been to become one of the major players in the industry and the acquisition of LMC would certainly constitute a first step in that direction. Secondly, the industry was mature, fragmented and very price competitive. As a result, there was an ongoing trend toward consolidation. Moreover, LMC had a strong position in European countries, an area where South Atlantic Corporation was not very active. Finally, Jack Charlton had been convinced for some time that LMC had not been so far managed in an optimal way and that significant improvements could relatively be easily made. A task force of senior managers was quickly formed around Jack Charlton to look at the business of LMC and prepare the information and assumptions necessary to perform the evaluation of the company. The task force quickly agreed on the future prospects of the industrial mechanics' business, which was expected to grow at an annual rate of 6% for the next two years, 5% for the following two years, and then by 3% per year in perpetuity. The task force believed that LMC could easily do better because of its reputation on the markets where it was active. Pre-tax operating margin presently at 20 percent could probably also be improved, together with the operating working capital, the level of which (presently 20% of sales) was significantly higher than the average 14% of sales recorded by the industry. Capital expenditures were planned to be around $35 million per year and depreciation expenses were supposed to increase by roughly $1 million per year to reach the level of capital expenditure in 2016, and both would remain at the same level thereafter. The task force was also convinced that a less conservative and more efficient management of the tax position of LMC could reduce the effective tax rate by 2%, bringing it from 40% to 38%. Liston's after- tax cost of capital was 12%, a weighted average, using a 20% debt-to-total capital ratio and a 80% equity-to- total capital ratio, of an after-tax cost of debt of 6% and a cost of equity of 13.5%. The task force gathered some information on Nelson Equipment Corporation (NEC), a company listed on the stock market and comparable to LMC in terms of business, assets and financial structure. This information, together with financial data on South Atlantic Corporation, is summarized in Exhibit 2. Last year, Nelson Equipment Corporation had acquired Belmont Company and the transaction had been realized on the. basis of a multiple of EBITDA of 5.2 and a PER of 11.5. Jack Charlton was preparing to make one of the most important decisions of his career and, although he was fully convinced that acquiring LMC now was the right thing to do, he wanted to make sure to do it in the best possible conditions and particularly at the right price. How to evaluate LMC? Which methods to use? How to avoid overpaying for it? How to finance the deal? These were some of the questions that he was asking himself as he was staring at some textbooks on corporate finance carefully shelved in his office. Exhibit 1 Liston Mechanics Corporation: Financial Statements (Year ending December 31, 2011) Profit & Loss Statement ($ in millions) 310 Sales Operating Expenses (excluding Depreciation) 218 92 EBITDA Depreciation 30 EBIT Interest Expenses 62 14 Profit before taxes Taxes 48 19 Net Profit 29 Source: Casewriter Balance Sheet ($ in millions) ASSETS LIABILITIES & EQUITY Cash Accounts Receivable Inventories 5 31 Accounts Payable & Other Accruals 35 66 Current Assets 102 Long Term Debt 140 Net Fixed Assets 208 Equity 135 Total Assets 310 Total Liability & Equity 310 Exhibit 2 Selected Financial Data (2011) for South Atlantic Corporation (SAC) and Nelson Equipment Corporation (NEC) SAC NEC SALES $500 millions $590 millions EBITDA $152 millions $174 millions EBIT $99 millions $113 millions NET PROFIT $51 millions $59 millions BOOK VALUE of EQUITY $216 millions $295 millions NUMBER of SHARES OUTSTANDING 25 millions 20 millions $50 $30 SHARE PRICE (average over the year) RATIO of EQUITY-TO-TOTAL CAPITAL at MARKET VALUE 80 percent 80 percent NET FINANCIAL DEBT $312.5 millions $150 millions Liston Mechanics Corporation In the early days of January 2012, Jack Charlton, CEO of South Atlantic Corporation was wondering whether or not he should make an offer to acquire Liston Mechanics Corporation (LMC), a family-owned business specialized in industrial mechanics. LMC had been founded in 1950 by Humphrey Liston and was managed to day by his grandson, Jim Liston. It had a solid reputation of quality and reliability and had developed through time excellent relationships based on trust and loyalty with its customers and suppliers. Its sales had reached $310 million in 2011 with a net profit of $29 million. Exhibit 1 shows the last available financial information for LMC. Jack Charlton wanted to acquire Liston for several reasons: First, his objective had always been to become one of the major players in the industry and the acquisition of LMC would certainly constitute a first step in that direction. Secondly, the industry was mature, fragmented and very price competitive. As a result, there was an ongoing trend toward consolidation. Moreover, LMC had a strong position in European countries, an area where South Atlantic Corporation was not very active. Finally, Jack Charlton had been convinced for some time that LMC had not been so far managed in an optimal way and that significant improvements could relatively be easily made. A task force of senior managers was quickly formed around Jack Charlton to look at the business of LMC and prepare the information and assumptions necessary to perform the evaluation of the company. The task force quickly agreed on the future prospects of the industrial mechanics' business, which was expected to grow at an annual rate of 6% for the next two years, 5% for the following two years, and then by 3% per year in perpetuity. The task force believed that LMC could easily do better because of its reputation on the markets where it was active. Pre-tax operating margin presently at 20 percent could probably also be improved, together with the operating working capital, the level of which (presently 20% of sales) was significantly higher than the average 14% of sales recorded by the industry. Capital expenditures were planned to be around $35 million per year and depreciation expenses were supposed to increase by roughly $1 million per year to reach the level of capital expenditure in 2016, and both would remain at the same level thereafter. The task force was also convinced that a less conservative and more efficient management of the tax position of LMC could reduce the effective tax rate by 2%, bringing it from 40% to 38%. Liston's after- tax cost of capital was 12%, a weighted average, using a 20% debt-to-total capital ratio and a 80% equity-to- total capital ratio, of an after-tax cost of debt of 6% and a cost of equity of 13.5%. The task force gathered some information on Nelson Equipment Corporation (NEC), a company listed on the stock market and comparable to LMC in terms of business, assets and financial structure. This information, together with financial data on South Atlantic Corporation, is summarized in Exhibit 2. Last year, Nelson Equipment Corporation had acquired Belmont Company and the transaction had been realized on the. basis of a multiple of EBITDA of 5.2 and a PER of 11.5. Jack Charlton was preparing to make one of the most important decisions of his career and, although he was fully convinced that acquiring LMC now was the right thing to do, he wanted to make sure to do it in the best possible conditions and particularly at the right price. How to evaluate LMC? Which methods to use? How to avoid overpaying for it? How to finance the deal? These were some of the questions that he was asking himself as he was staring at some textbooks on corporate finance carefully shelved in his office. Exhibit 1 Liston Mechanics Corporation: Financial Statements (Year ending December 31, 2011) Profit & Loss Statement ($ in millions) 310 Sales Operating Expenses (excluding Depreciation) 218 92 EBITDA Depreciation 30 EBIT Interest Expenses 62 14 Profit before taxes Taxes 48 19 Net Profit 29 Source: Casewriter Balance Sheet ($ in millions) ASSETS LIABILITIES & EQUITY Cash Accounts Receivable Inventories 5 31 Accounts Payable & Other Accruals 35 66 Current Assets 102 Long Term Debt 140 Net Fixed Assets 208 Equity 135 Total Assets 310 Total Liability & Equity 310 Exhibit 2 Selected Financial Data (2011) for South Atlantic Corporation (SAC) and Nelson Equipment Corporation (NEC) SAC NEC SALES $500 millions $590 millions EBITDA $152 millions $174 millions EBIT $99 millions $113 millions NET PROFIT $51 millions $59 millions BOOK VALUE of EQUITY $216 millions $295 millions NUMBER of SHARES OUTSTANDING 25 millions 20 millions $50 $30 SHARE PRICE (average over the year) RATIO of EQUITY-TO-TOTAL CAPITAL at MARKET VALUE 80 percent 80 percent NET FINANCIAL DEBT $312.5 millions $150 millions