Answered step by step

Verified Expert Solution

Question

1 Approved Answer

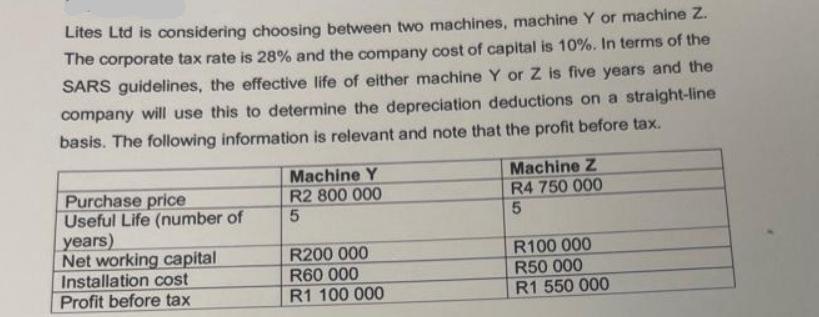

Lites Ltd is considering choosing between two machines, machine Y or machine Z. The corporate tax rate is 28% and the company cost of

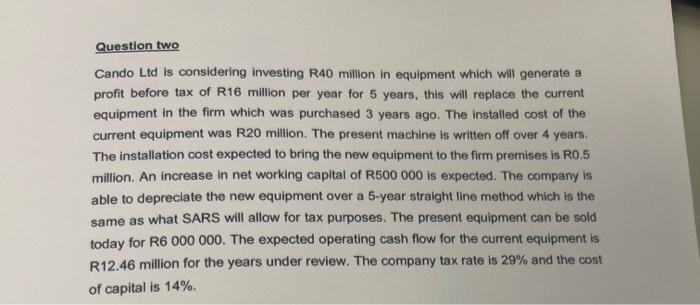

Lites Ltd is considering choosing between two machines, machine Y or machine Z. The corporate tax rate is 28% and the company cost of capital is 10%. In terms of the SARS guidelines, the effective life of either machine Y or Z is five years and the company will use this to determine the depreciation deductions on a straight-line basis. The following information is relevant and note that the profit before tax. Purchase price Useful Life (number of years) Net working capital Installation cost Profit before tax Machine Y R2 800 000 5 R200 000 R60 000 R1 100 000 Machine Z R4 750 000 5 R100 000 R50 000 R1 550 000 Question two Cando Ltd is considering investing R40 million in equipment which will generate a profit before tax of R16 million per year for 5 years, this will replace the current equipment in the firm which was purchased 3 years ago. The installed cost of the current equipment was R20 million. The present machine is written off over 4 years. The installation cost expected to bring the new equipment to the firm premises is R0.5 million. An increase in net working capital of R500 000 is expected. The company is able to depreciate the new equipment over a 5-year straight line method which is the same as what SARS will allow for tax purposes. The present equipment can be sold today for R6 000 000. The expected operating cash flow for the current equipment is R12.46 million for the years under review. The company tax rate is 29% and the cost of capital is 14%. Calculate the initial investment

Step by Step Solution

★★★★★

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

To evaluate the investment decisions for Lites Ltd and Cando Ltd we can calculate the net present value NPV and internal rate of return IRR for each project Lets perform the calculations 1 Lites Ltd M...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started