Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Liwei owns and operates two shoe stores in San Jose, California. She travels to Las Vegas, Nevada to discuss acquiring a restaurant. Later in

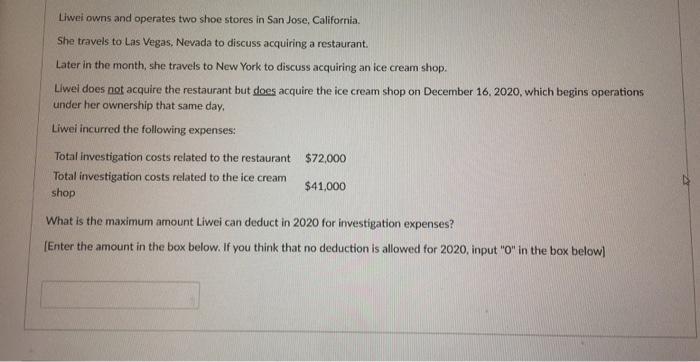

Liwei owns and operates two shoe stores in San Jose, California. She travels to Las Vegas, Nevada to discuss acquiring a restaurant. Later in the month, she travels to New York to discuss acquiring an ice cream shop. Liwel does not acquire the restaurant but does acquire the ice cream shop on December 16, 2020, which begins operations under her ownership that same day, Liwei incurred the following expenses: Total investigation costs related to the restaurant Total investigation costs related to the ice cream shop $72,000 $41,000 What is the maximum amount Liwei can deduct in 2020 for investigation expenses? [Enter the amount in the box below. If you think that no deduction is allowed for 2020, input "O" in the box below)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER In 2020 Liwel can deduct a maximum of 5000 for investigation expenses related to the ice c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started