Answered step by step

Verified Expert Solution

Question

1 Approved Answer

LJTIUN 4 ears. Windhoek share? Windhoek share? a) Using the single period Dividend Discount Model estimate the value of Bank b) Using the Multi- period

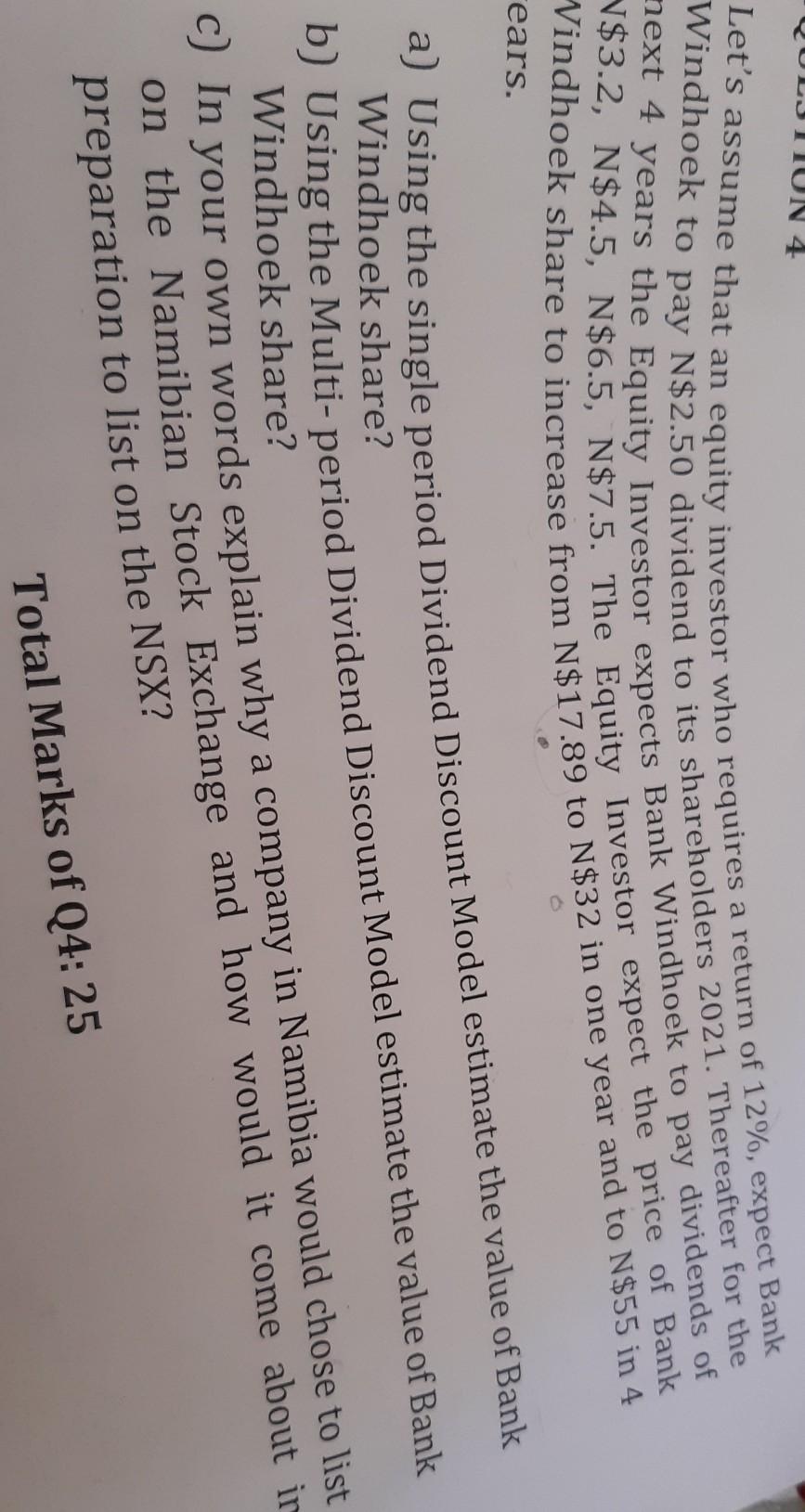

LJTIUN 4 ears. Windhoek share? Windhoek share? a) Using the single period Dividend Discount Model estimate the value of Bank b) Using the Multi- period Dividend Discount Model estimate the value of Bank C) In your own words explain why a company in Namibia would chose to list on the Namibian Stock Exchange and how would it come about ir preparation to list on the NSX? Total Marks of Q4: 25 Let's assume that an equity investor who requires a return of 12%, expect Bank Windhoek to pay N$2.50 dividend to its shareholders 2021. Thereafter for the next 4 years the Equity Investor expects Bank Windhoek to pay dividends of V$3.2, N$4.5, N$6.5, N$7.5. The Equity Investor expect the price of Bank Vindhoek share to increase from N$17.89 to N$32 in one year and to N$55 in 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started