Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. Expense recognition principle. (c) Efforts (expenses) should be matched with ac- complishments (revenues). (d) Companies record revenues when they receive cash and record

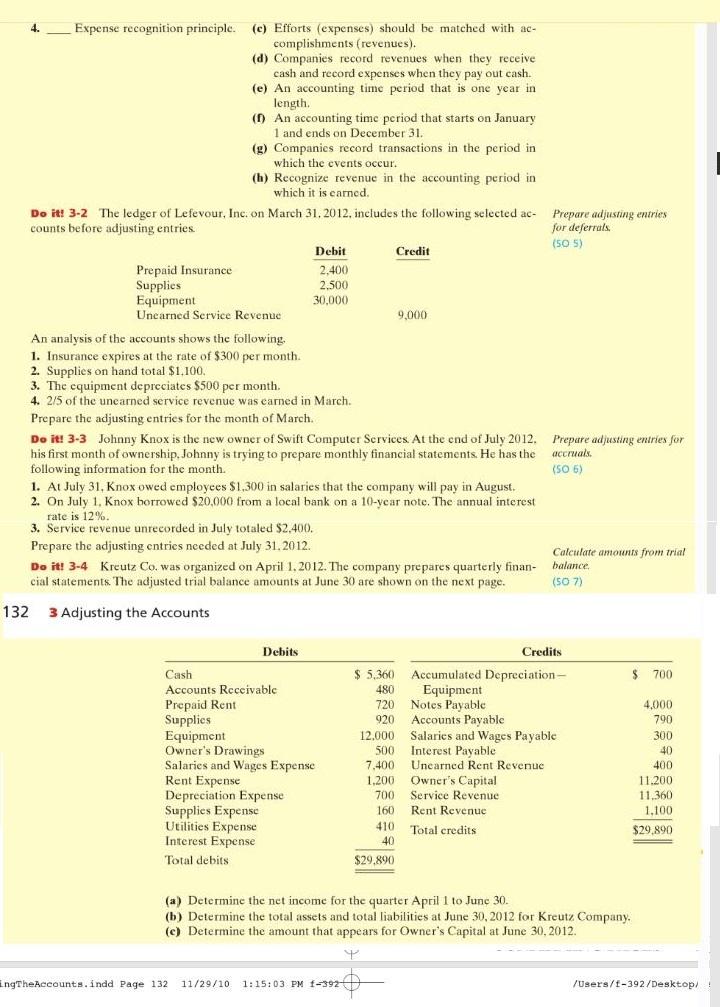

4. Expense recognition principle. (c) Efforts (expenses) should be matched with ac- complishments (revenues). (d) Companies record revenues when they receive cash and record expenses when they pay out cash. (e) An accounting time period that is one year in length. (f) An accounting time period that starts on January 1 and ends on December 31. (g) Companies record transactions in the period in which the events occur. (h) Recognize revenue in the accounting period in which it is earned. Do it! 3-2 The ledger of Lefevour, Inc. on March 31, 2012, includes the following selected ac- counts before adjusting entries. Prepaid Insurance Supplies Equipment Unearned Service Revenue An analysis of the accounts shows the following. 1. Insurance expires at the rate of $300 per month. 2. Supplies on hand total $1,100. 3. The equipment depreciates $500 per month. 4. 2/5 of the unearned service revenue was earned in March. Prepare the adjusting entries for the month of March. Debit 2,400 2.500 30,000 Debits Do it! 3-3 Johnny Knox is the new owner of Swift Computer Services. At the end of July 2012. Prepare adjusting entries for his first month of ownership, Johnny is trying to prepare monthly financial statements. He has the following information for the month. accruals. (50 6) 1. At July 31, Knox owed employees $1,300 in salaries that the company will pay in August. 2. On July 1, Knox borrowed $20,000 from a local bank on a 10-year note. The annual interest rate is 12%. 3. Service revenue unrecorded in July totaled $2,400. Prepare the adjusting entries needed at July 31,2012. Do it! 3-4 Kreutz Co. was organized on April 1, 2012. The company prepares quarterly finan- cial statements. The adjusted trial balance amounts at June 30 are shown on the next page. 132 3 Adjusting the Accounts Cash Accounts Receivable Prepaid Rent Supplies Equipment Owner's Drawings Salaries and Wages Expense Rent Expense Depreciation Expense Supplies Expense Utilities Expense Interest Expense Total debits Credit $ 5,360 480 720 920 ingTheAccounts.indd Page 132 11/29/10 1:15:03 PM 1-392 9,000 12,000 500 7,400 1,200 700 160 410 40 $29,890 Prepare adjusting entries for deferrals (505) Owner's Capital Service Revenue Rent Revenue Total credits Calculate amounts from trial balance. (507) Credits Accumulated Depreciation- Equipment Notes Payable Accounts Payable Salaries and Wages Payable Interest Payable Unearned Rent Revenue (a) Determine the net income for the quarter April 1 to June 30. (b) Determine the total assets and total liabilities at June 30, 2012 for Kreutz Company. (e) Determine the amount that appears for Owner's Capital at June 30, 2012. Y $ 700 4,000 790 300 40 400 11.200 11.360 1.100 $29,890 - /Users/1-392/Desktop/

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

4 The expense recognition principle also known as the matching principle is a fundamental accounting concept that guides the proper timing of recognizing expenses in the financial statements It states ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started