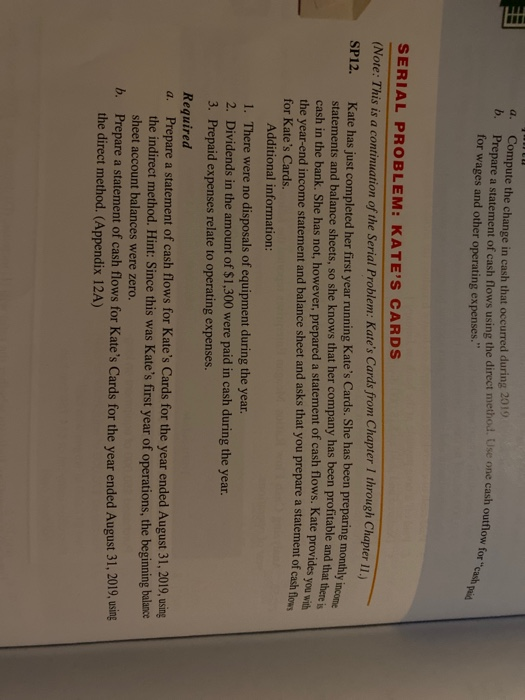

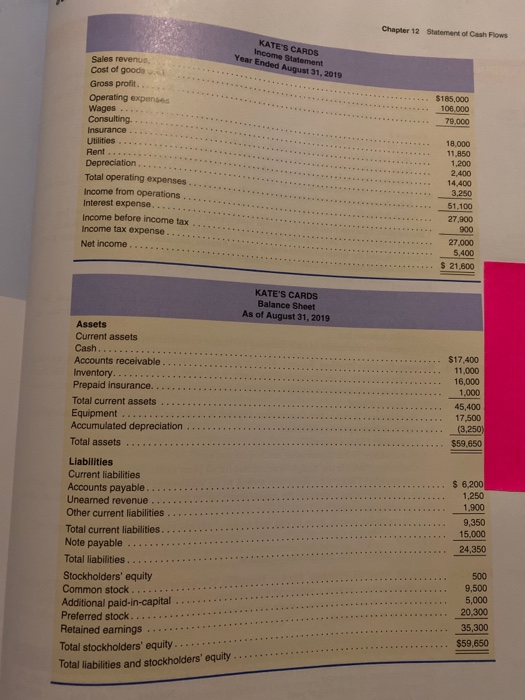

LLL Compute the change in cash that occurred during 2019 b. Prepare a statement of cash flows using the direct method. Use one cash outflow for "cash paid a. for wages and other operating expenses." SERIAL PROBLEM: KATE'S CARDS (Note: This is a continuation of the Serial Problem: Kate's Cards from Chapter I through Chapter 11. Kate has just completed her first year running Kate's Cards. She has been preparing monthly income statements and balance sheets, so she knows that her company has been profitable and that there i cash in the bank. She has not, however, prepared a statement of cash flows. Kate provides you with the year-end income statement and balance sheet and asks that you prepare a statement of cash flo SP12. for Kate's Cards. Additional information: 1. There were no disposals of equipment during the year. 2. Dividends in the amount of $1,300 were paid in cash during the year. 3. Prepaid expenses relate to operating expenses. Required Prepare a statement of cash flows for Kate's Cards for the year ended August 31, 2019, using the indirect method. Hint: Since this was Kate's first year of operations, the beginning balance sheet account balances were zero. b. Prepare a statement of cash flows for Kate's Cards for the year ended August 31, 2019, using the direct method. (Appendix 12A) a. Chapter 12 Statement of Cash Flows KATE'S CARDS Income Statement Year Ended August 31, 2019 Sales revenus. Cost of goods Gross profit.. Operating expenses Wages Consulting. $185,000 106.000 79,000 Insurance Utilities Rent... Depreciation. Total operating expenses Income from operations Interest expense... 18.000 11,850 1,200 2,400 14,400 3,250 51,100 27,900 900 Income before income tax Income tax expense 27,000 Net income. 5,400 S 21,600 KATE'S CARDS Balance Sheet As of August 31, 2019 Assets Current assets Cash.. Accounts receivable $17.400 11,000 Inventory. Prepaid insurance. 16,000 1,000 Total current assets 45,400 17,500 Equipment. Accumulated depreciation (3,250) $59,650 Total assets Liabilities Current liabilities Accounts payable. Unearned revenue Other current liabilities $ 6,200 1,250 1,900 9,350 15,000 Total current liabilities. Note payable 24,350 Total liabilities . 500 Stockholders' equity Common stock. Additional paid-in-capital Preferred stock. 9,500 5,000 20,300 35,300 Retained eanings $59,650 Total stockholders' equity. Total liabilities and stockholders' equity