Question

Lloyd, a life insurance salesman, earns a $400,000 salary in the current year. As he works only 30 hours per week in this job, he

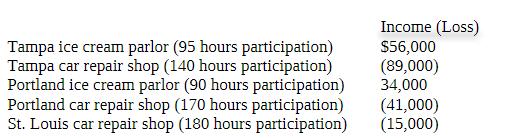

Lloyd, a life insurance salesman, earns a $400,000 salary in the current year. As he works only 30 hours per week in this job, he has time to participate in several other businesses. He owns an ice cream parlor and a car repair shop in Tampa. He also owns a nice cream parlor and a car repair shop in Portland and a car repair shop in St. Louis. A preliminary analysis on December 1 of the current year shows projected income and losses for the various businesses as follows:

Lloyd has full-time employees at each of the five businesses listed above. Review all possible groupings for Lloyd’s activities. Which grouping method and other strategies should Lloyd consider that will provide the greatest tax advantage?

Lloyd has full-time employees at each of the five businesses listed above. Review all possible groupings for Lloyd’s activities. Which grouping method and other strategies should Lloyd consider that will provide the greatest tax advantage?

Tampa ice cream parlor (95 hours participation) Tampa car repair shop (140 hours participation) Portland ice cream parlor (90 hours participation) Portland car repair shop (170 hours participation) St. Louis car repair shop (180 hours participation) Income (Loss) $56,000 (89,000) 34,000 (41,000) (15,000)

Step by Step Solution

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 One option for Lloyd would be to group his businesses by location so that his Tampa bus...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started