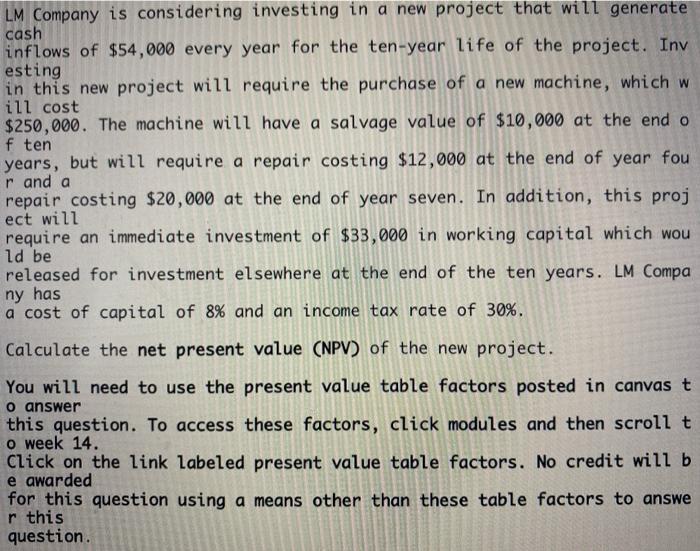

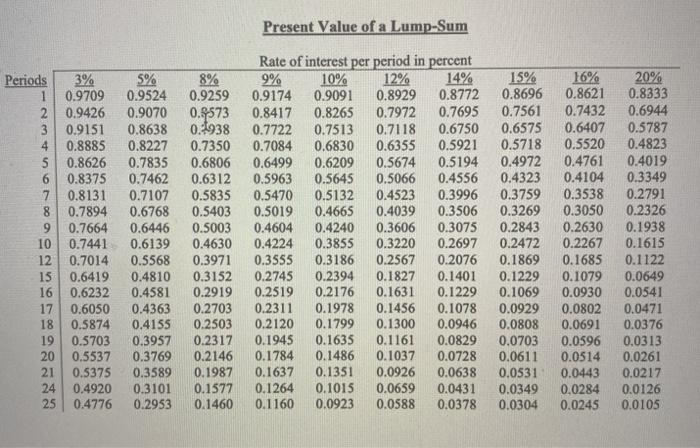

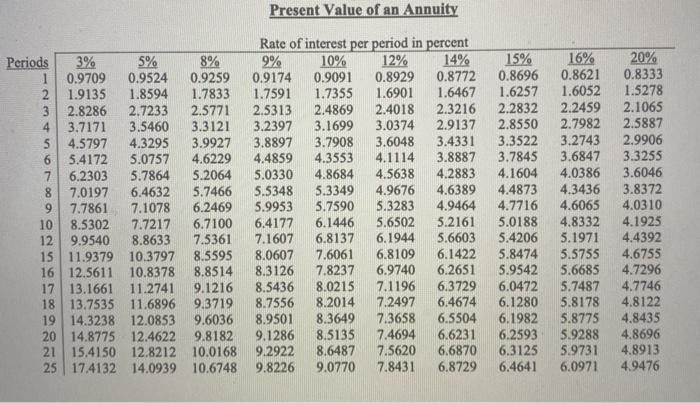

LM Company is considering investing in a new project that will generate cash inflows of $54,000 every year for the ten-year life of the project. Inv esting in this new project will require the purchase of a new machine, which w ill cost $250,000. The machine will have a salvage value of $10,000 at the end o f ten years, but will require a repair costing $12,000 at the end of year fou r and a repair costing $20,000 at the end of year seven. In addition, this proj ect will require an immediate investment of $33,000 in working capital which wou ld be released for investment elsewhere at the end of the ten years. LM Compa ny has a cost of capital of 8% and an income tax rate of 30%. Calculate the net present value (NPV) of the new project. You will need to use the present value table factors posted in canvas t o answer this question. To access these factors, click modules and then scroll t o week 14. Click on the link labeled present value table factors. No credit will b e awarded for this question using a means other than these table factors to answe r this question. Present Value of a Lump-Sum Periods 3% 5% 1 0.9709 0.9524 2 0.9426 0.9070 3 0.9151 0.8638 4 0.8885 0.8227 5 0.8626 0.7835 6 0.8375 0.7462 7 0.8131 0.7107 8 0.7894 0.6768 9 0.7664 0.6446 10 0.7441 0.6139 12 0.7014 0.5568 15 0.6419 0.4810 16 0.6232 0.4581 17 0.6050 0.4363 18 0.5874 0.4155 19 0.5703 0.3957 20 0.5537 0.3769 21 0.5375 0.3589 24 0.4920 0.3101 25 0.4776 0.2953 8% 0.9259 0.8573 0.1938 0.7350 0.6806 0.6312 0.5835 0.5403 0.5003 0.4630 0.3971 0.3152 0.2919 0.2703 0.2503 0.2317 0.2146 0.1987 0.1577 0.1460 Rate of interest per period in percent 9% 10% 12% 14% 15% 0.9174 0.9091 0.8929 0.8772 0.8696 0.8417 0.8265 0.7972 0.7695 0.7561 0.7722 0.7513 0.7118 0.6750 0.6575 0.7084 0.6830 0.6355 0.5921 0.5718 0.6499 0.6209 0.5674 0.5194 0.4972 0.5963 0.5645 0.5066 0.4556 0.4323 0.5470 0.5132 0.4523 0.3996 0.3759 0.5019 0.4665 0.4039 0.3506 0.3269 0.4604 0.4240 0.3606 0.3075 0.2843 0.4224 0.3855 0.3220 0.2697 0.2472 0.3555 0.3186 0.2567 0.2076 0.1869 0.2745 0.2394 0.1827 0.1401 0.1229 0.2519 0.2176 0.1631 0.1229 0.1069 0.2311 0.1978 0.1456 0.1078 0.0929 0.2120 0.1799 0.1300 0.0946 0.0808 0.1945 0.1635 0.1161 0.0829 0.0703 0.1784 0.1486 0.1037 0.0728 0.0611 0.1637 0.1351 0.0926 0.0638 0.0531 0.1264 0.1015 0.0659 0.0431 0.0349 0.1160 0.0923 0.0588 0.0378 0.0304 16% 0.8621 0.7432 0.6407 0.5520 0.4761 0.4104 0.3538 0.3050 0.2630 0.2267 0.1685 0.1079 0.0930 0.0802 0.0691 0.0596 0.0514 0.0443 0.0284 0.0245 20% 0.8333 0.6944 0.5787 0.4823 0.4019 0.3349 0.2791 0.2326 0.1938 0.1615 0.1122 0.0649 0.0541 0.0471 0.0376 0.0313 0.0261 0.0217 0.0126 0.0105 Present Value of an Annuity Periods 3% 5% 8% 1 0.9709 0.9524 0.9259 2 1.9135 1.8594 1.7833 3 2.8286 2.7233 2.5771 4 3.7171 3.5460 3.3121 5 4.5797 4.3295 3.9927 6 5.4172 5.0757 4.6229 7 6.2303 5.7864 5.2064 8 7.0197 6.4632 5.7466 9 7.7861 7.1078 6.2469 10 8.5302 7.7217 6.7100 12 9.9540 8.8633 7.5361 15 11.9379 10.3797 8.5595 16 12.5611 10.8378 8.8514 17 13.1661 11.2741 9.1216 18 13.7535 11.6896 9.3719 19 14.3238 12.0853 9.6036 20 14.8775 12.4622 9.8182 21 15.4150 12.8212 10.0168 25 17.4132 14.0939 10.6748 Rate of interest per period in percent 9% 10% 12% 14% 0.9174 0.9091 0.8929 0.8772 1.7591 1.7355 1.6901 1.6467 2.5313 2.4869 2.4018 2.3216 3.2397 3.1699 3.0374 2.9137 3.8897 3.7908 3.6048 3.4331 4.4859 4.3553 4.1114 3.8887 5.0330 4.8684 4.5638 4.2883 5.5348 5.3349 4.9676 4.6389 5.9953 5.7590 5.3283 4.9464 6.4177 6.1446 5.6502 5.2161 7.1607 6.8137 6.1944 5.6603 8.0607 7.6061 6.8109 6.1422 8.3126 7.8237 6.9740 6.2651 8.5436 8.0215 7.1196 6.3729 8.7556 8.2014 7.2497 6.4674 8.9501 8.3649 7.3658 6.5504 9.1286 8.5135 7.4694 6.6231 9.2922 8.6487 7.5620 6.6870 9.8226 9.0770 7.8431 6.8729 15% 0.8696 1.6257 2.2832 2.8550 3.3522 3.7845 4.1604 4.4873 4.7716 5.0188 5.4206 5.8474 5.9542 6.0472 6.1280 6.1982 6.2593 6.3125 6.4641 16% 0.8621 1.6052 2.2459 2.7982 3.2743 3.6847 4.0386 4.3436 4.6065 4.8332 5.1971 5.5755 5.6685 5.7487 5.8178 5.8775 5.9288 5.9731 6.0971 20% 0.8333 1.5278 2.1065 2.5887 2.9906 3.3255 3.6046 3.8372 4.0310 4.1925 4.4392 4.6755 4.7296 4.7746 4.8122 4.8435 4.8696 4.8913 4.9476