Answered step by step

Verified Expert Solution

Question

1 Approved Answer

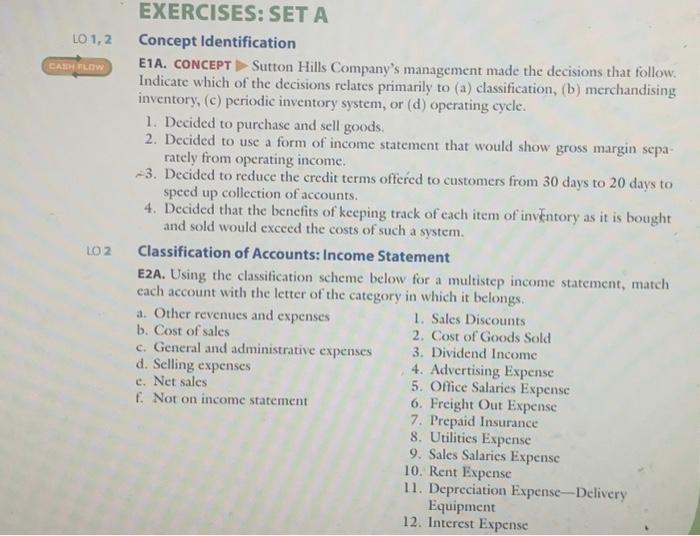

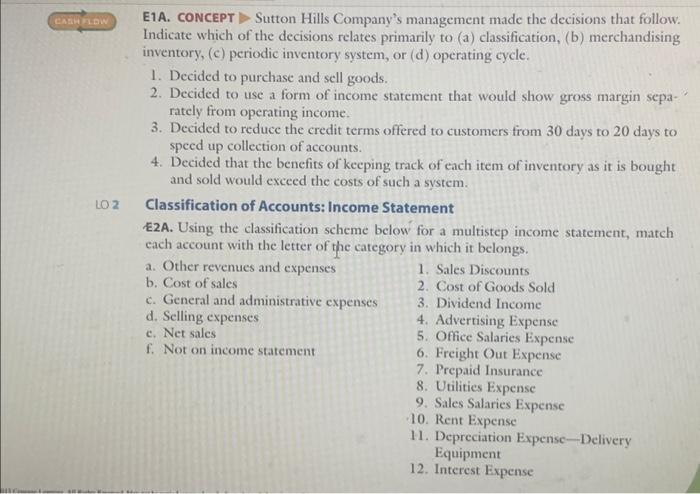

LO 1,2 CASH FLOW LO 2 EXERCISES: SET A Concept Identification E1A. CONCEPT Sutton Hills Company's management made the decisions that follow. Indicate which of

LO 1,2 CASH FLOW LO 2 EXERCISES: SET A Concept Identification E1A. CONCEPT Sutton Hills Company's management made the decisions that follow. Indicate which of the decisions relates primarily to (a) classification, (b) merchandising inventory, (c) periodic inventory system, or (d) operating cycle. 1. Decided to purchase and sell goods. 2. Decided to use a form of income statement that would show gross margin sepa- rately from operating income. 3. Decided to reduce the credit terms offered to customers from 30 days to 20 days to speed up collection of accounts. 4. Decided that the benefits of keeping track of each item of inventory as it is bought and sold would exceed the costs of such a system. Classification of Accounts: Income Statement E2A. Using the classification scheme below for a multistep income statement, match each account with the letter of the category in which it belongs. a. Other revenues and expenses b. Cost of sales c. General and administrative expenses d. Selling expenses e. Net sales f. Not on income statement 1. Sales Discounts 2. Cost of Goods Sold 3. Dividend Income 4. Advertising Expense 5. Office Salaries Expense 6. Freight Out Expense 7. Prepaid Insurance 8. Utilities Expense 9. Sales Salaries Expense 10. Rent Expense 11. Depreciation Expense-Delivery Equipment 12. Interest Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started