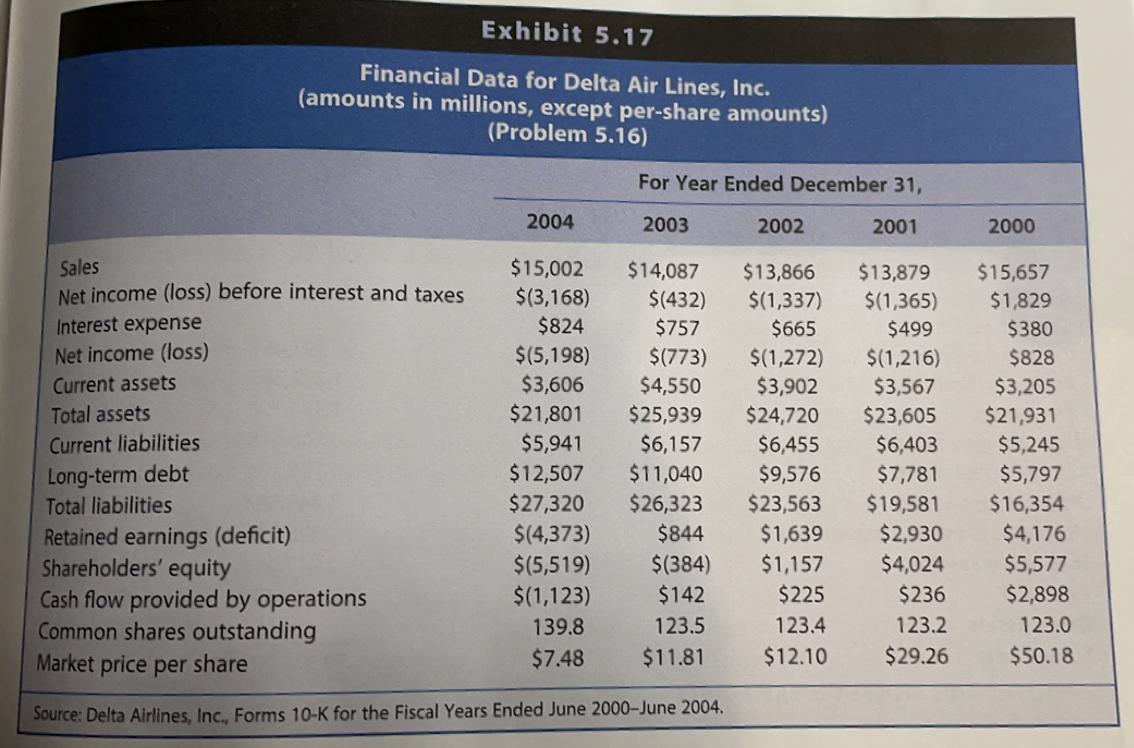

LO 5-6 5.16 Computing and Interpreting Risk and Bankruptcy Prediction Ratios for a Firm That Declared Bankruptcy. Delta Air Lines, Inc., is one of the largest airlines in the United States. It has operated on the verge of bankruptcy for sev- eral years. Exhibit 5.17 presents selected financial data for Delta Air Lines for each of the five years ending December 31, 2000, to December 31, 2004. Delta Air Lines filed for bankruptcy on September 14, 2005. We recommend that you create an Excel spreadsheet to compute the val- ues of the ratios and the Altman's Z-score in Requirements a and b, respectively. REQUIRED a. Compute the value of each the following risk ratios. (1) Current ratio (at the end of 2000-2004) (2) Operating cash flow to current liabilities ratio (for 2001-2004) (3) Liabilities to assets ratio (at the end of 2000-2004) (4) Long-term debt to long-term capital ratio (at the end of 20002004) (5) Operating cash flow to total liabilities ratio (for 2001-2004) (6) Interest coverage ratio (for 2000-2004) b. Compute the value of Altman's Z-score for Delta Air Lines for each year from 2000 to 2004. c. Using the analyses in Requirements a and b, discuss the most important factors that sig- naled the likelihood of bankruptcy of Delta Air Lines in 2005. Exhibit 5.17 Financial Data for Delta Air Lines, Inc. (amounts in millions, except per-share amounts) (Problem 5.16) For Year Ended December 31, 2004 2003 2002 2001 2000 Sales Net income (loss) before interest and taxes Interest expense Net income (loss) Current assets Total assets Current liabilities Long-term debt Total liabilities Retained earnings (deficit) Shareholders' equity Cash flow provided by operations Common shares outstanding Market price per share $15,002 $(3,168) $824 $(5,198) $3,606 $21,801 $5,941 $12,507 $27,320 $(4,373) $(5,519) $(1,123) 139.8 $7.48 $14,087 $(432) $757 $(773) $4,550 $25,939 $6,157 $11,040 $26,323 $844 $(384) $142 123.5 $11.81 $13,866 $(1,337) $665 $(1,272) $3,902 $24,720 $6,455 $9,576 $23,563 $1,639 $1,157 $225 123.4 $12.10 $13,879 $(1,365) $499 $(1,216) $3,567 $23,605 $6,403 $7,781 $19,581 $2,930 $4,024 $236 123.2 $29.26 $15,657 $1,829 $380 $828 $3,205 $21,931 $5,245 $5,797 $16,354 $4,176 $5,577 $2,898 123.0 $50.18 Source: Delta Airlines, Inc., Forms 10-K for the Fiscal Years Ended June 2000-June 2004